“Before working with AMZDUDES, our products were on page 5. Within the first two months, their targeted keyword strategy and listing optimization pushed our main products to the top 3 spots. We saw an immediate 40% jump in organic traffic due to which our number of sales is also increasing. Highly recommended Amazon SEO services.”

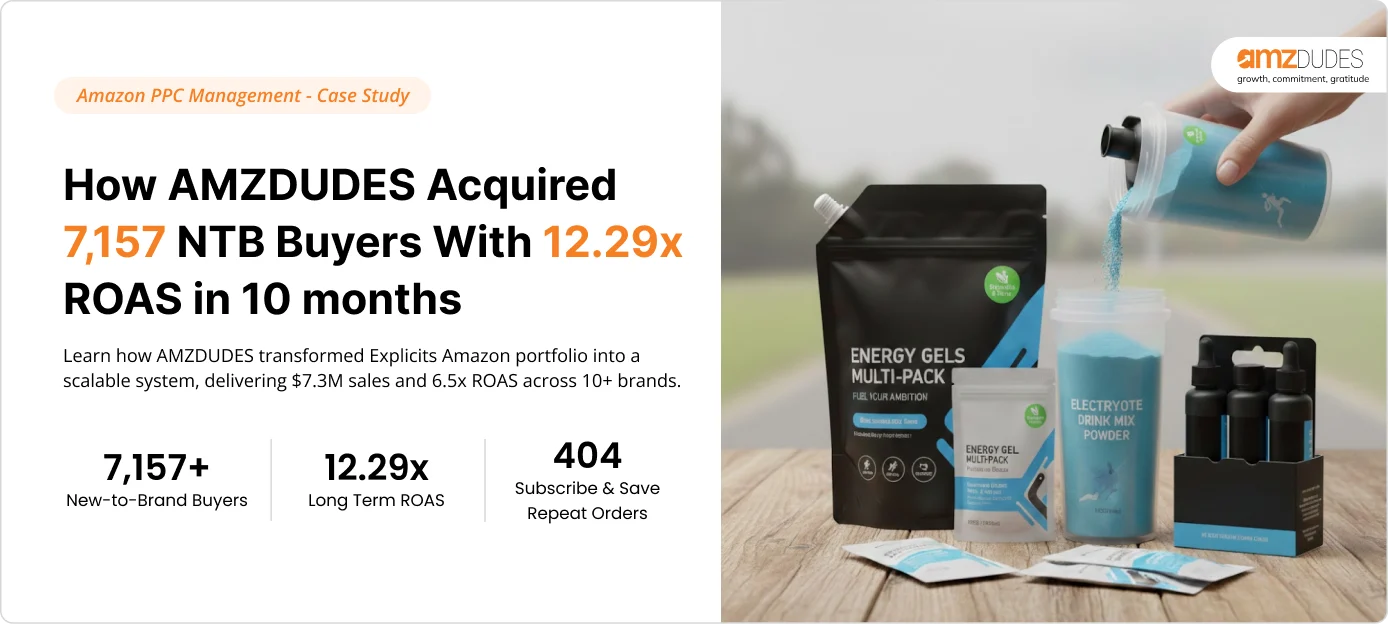

How AMZDUDES Acquired 7,157 New-to-Brand Buyers With 12.29x ROAS Using Amazon PPC & Subscribe & Save

Learn how AMZDUDES Acquired 7,157 New-to-Brand Buyers With 12.29x ROAS Using Amazon PPC & Subscribe & Save.

7,157 New-to-Brand Buyers | 12.29x ROAS | 404 Subscribe & Save Repeat OrdersClient Overview

This sports nutrition brand was already doing well in retail and on its own website, but Amazon hadn’t been built as a sales channel yet. Even though demand was growing for products like energy gels, electrolyte drink mixes, endurance bundles, and running refills, the brand had little visibility on Amazon, very few reviews, and no system to drive repeat purchases.

The objective was clear:

“Launch Amazon as a scalable growth channel, reach first-time buyers searching high-intent sports nutrition terms, turn those buyers into repeat customers using Subscribe & Save, and grow without wasting ad spend.”

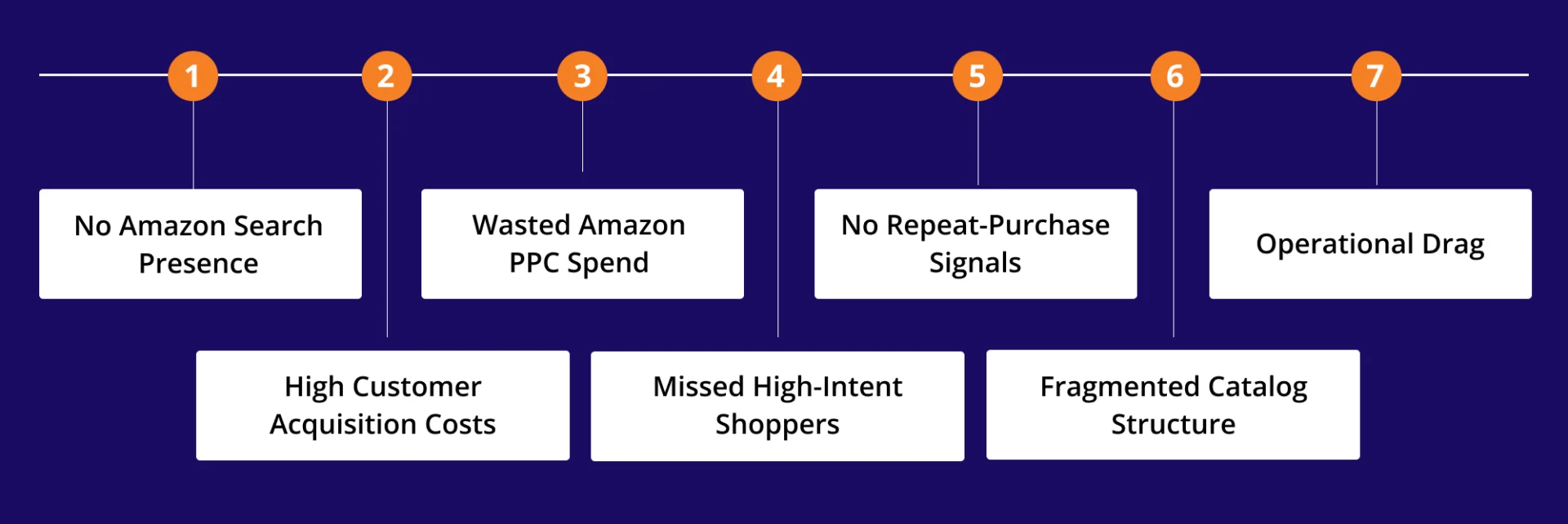

The Challenges

1. No Amazon Search Presence: The brand had no meaningful visibility for category searches. Shoppers actively searching for sports nutrition products could not find the brand organically or through ads.

2. High Customer Acquisition Costs: Competitors were bidding on branded terms, forcing the brand to overpay to win back its own demand once Amazon ads were turned on.

3. Wasted Amazon PPC Spend: Ads were running without clarity on which search terms actually drove profitable, long-term customers. Spend was leaking into clicks that didn’t convert or repeat.

4. Missed High-Intent Shoppers: Large numbers of shoppers viewed product pages or added items to cart but never completed purchases. There was no Amazon retargeting system in place to recover this demand.

5. No Repeat-Purchase Signals: Without Subscribe & Save adoption, Amazon treated the products as one-time purchases, limiting repeat order velocity and ranking potential.

6. Fragmented Catalog Structure: Products were split across separate listings with no parent-child structure, diluting reviews, sales history, and ranking strength for high-volume searches like bundles and refills.

7. Operational Drag: The internal team was stuck managing Seller Central daily instead of building a scalable Amazon growth engine.

Our Strategy

We treated Amazon as a search-driven, repeat-purchase platform, not a retail mirror. Here’s exactly what we have done for this brand.

1. Set Up Listings for Amazon Search

Before scaling ads, the catalog was rebuilt for Amazon indexing and conversion. Listings were optimized around how real shoppers search, including:

- Energy gels

- Electrolyte drink mix powder

- Endurance carb bundles

- Sports nutrition 2-packs

- Running nutrition refills

Parent-child variations were created to consolidate reviews and sales velocity, allowing Amazon to rank products correctly.

2. Launch Amazon PPC Campaigns

Sponsored Products and Sponsored Brands campaigns were launched to capture demand already present in the category.

Bids were intentionally increased where purchase intent was high and visibility was low, ensuring the brand appeared when shoppers were ready to buy — not just browse.

3. Grow Repeat Orders on Amazon

Subscribe & Save became the growth lever.

During Prime Day and holiday periods, discounts were increased up to 30%, encouraging customers to lock in recurring orders for consumable products they already buy regularly.

This shifted Amazon’s perception of the brand from one-time purchases to repeat-order products, strengthening ranking and retention signals.

4. Recovering Missed Demand With Amazon Marketing Cloud

Using Amazon Marketing Cloud, we identified shoppers who showed intent but didn’t convert:

- Product detail page viewers

- Cart abandoners

- Wishlist savers

- Ad clickers without purchases

Audiences were segmented into:

- Under-served (50% below optimal ad frequency, not converted)

- Over-saturated (50% above optimal frequency, not converted)

Spend was redirected toward incremental buyers Amazon already had but the brand wasn’t reaching yet, while reducing waste on overexposed audiences.

Results

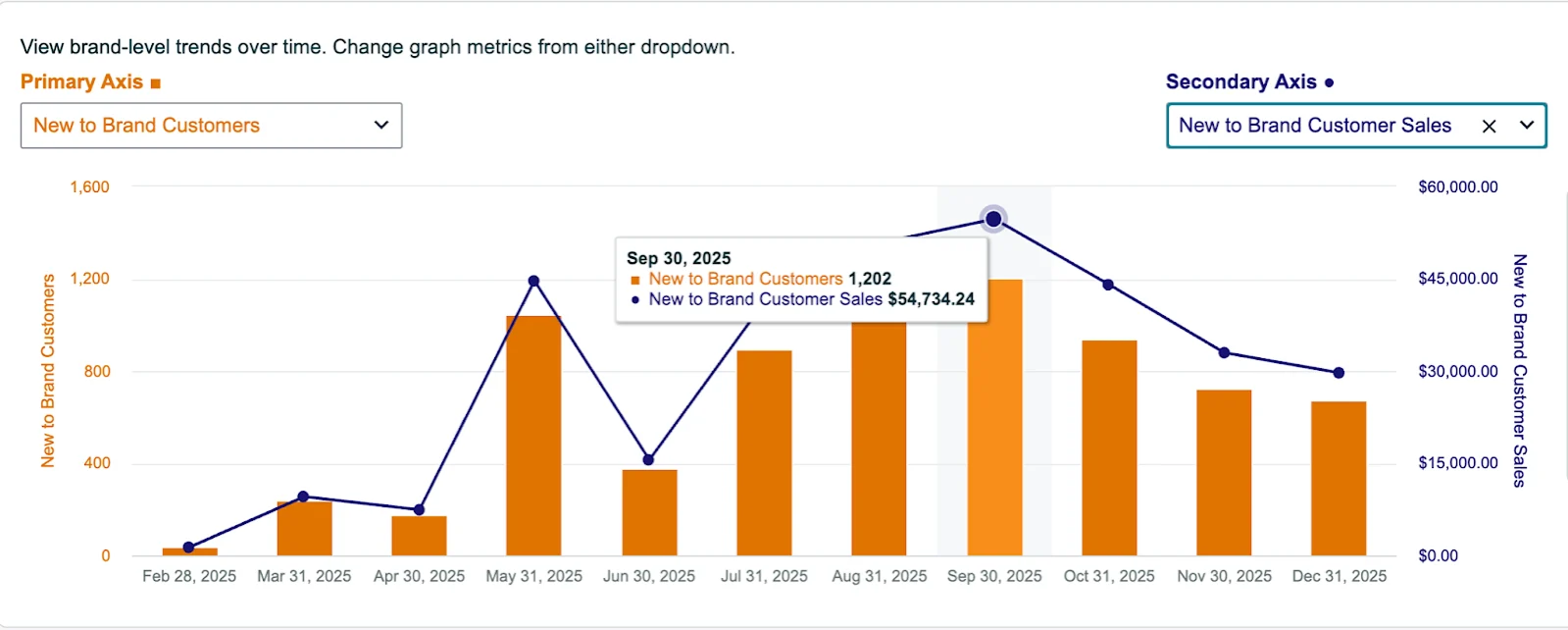

1. New-to-Brand Customer Acquisition

The biggest result was reaching customers who had never bought from the brand before. Instead of relying on brand searches, we focused on where real demand already existed.

- 7,157 new customers acquired in 10 months

- $324,544 in New-to-Brand sales from first-time buyers

This showed that when the products appeared in the right searches: like energy gels, electrolyte drink mix powder, endurance bundles, and running nutrition refills, shoppers were willing to buy without prior brand awareness.

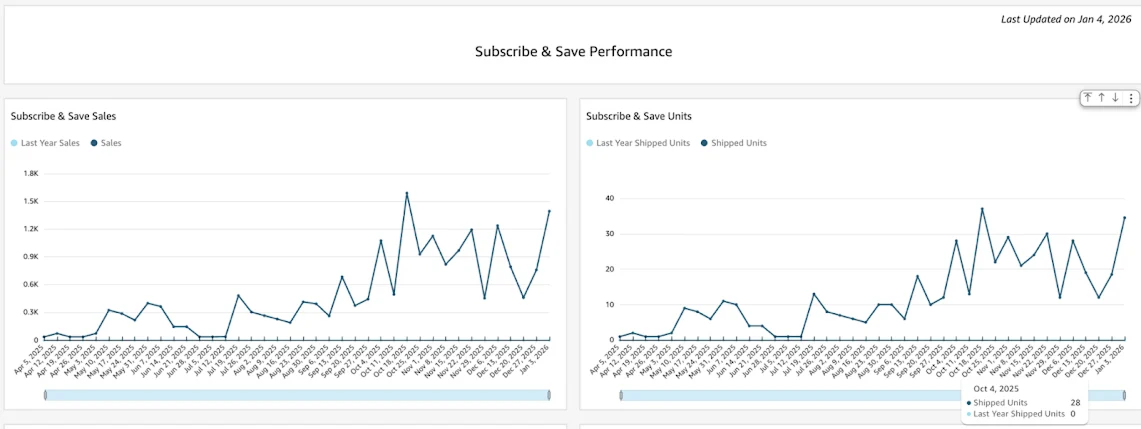

2. Repeat Revenue Through Subscribe & Save

We didn’t stop after the first purchase. By using Subscribe & Save discounts during Prime Day and holiday shopping periods, we made it easy for first-time buyers to set up automatic reorders for products they already search on Amazon, including energy gels, electrolyte drink mix powder, endurance carb bundles, and running nutrition refills.

In 7 months, Subscribe & Save signups grew from 0 to 107 active subscribers, delivering 404 repeat orders and $41,029 in recurring revenue. These are real Amazon customers who continue buying on a schedule, helping the brand grow naturally in Amazon search rankings while adding predictable revenue every month.

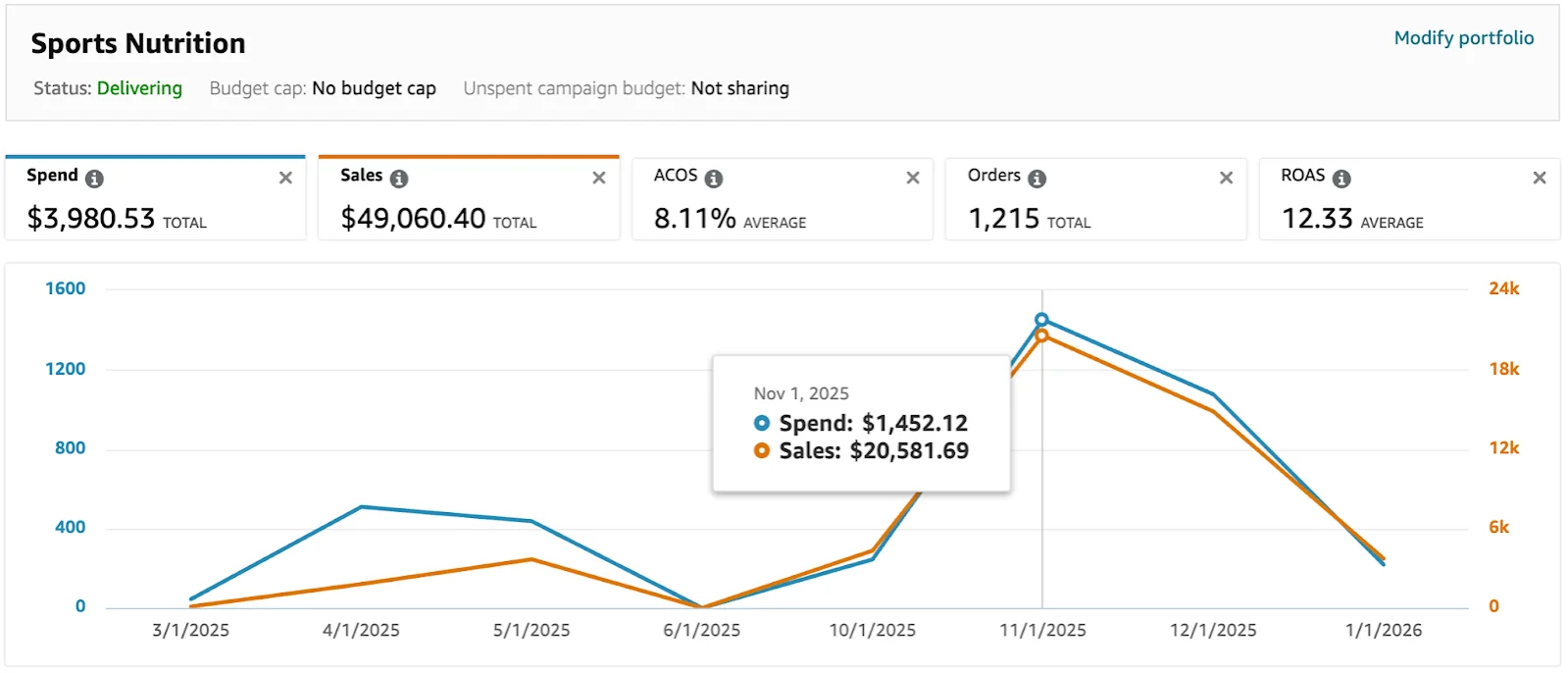

3. Strong Returns from Amazon Ads

Even while scaling, the brand maintained strong ad performance by focusing on searches shoppers already trust, such as sports nutrition refills, hydration powder 2-packs, endurance fuel bundles, and energy gels multi-packs.

With 12.29x return on ad spend and 8.13% average advertising cost of sales, the brand generated $48,908.60 in Amazon PPC ad-driven sales from only $3,977.93 in spend.

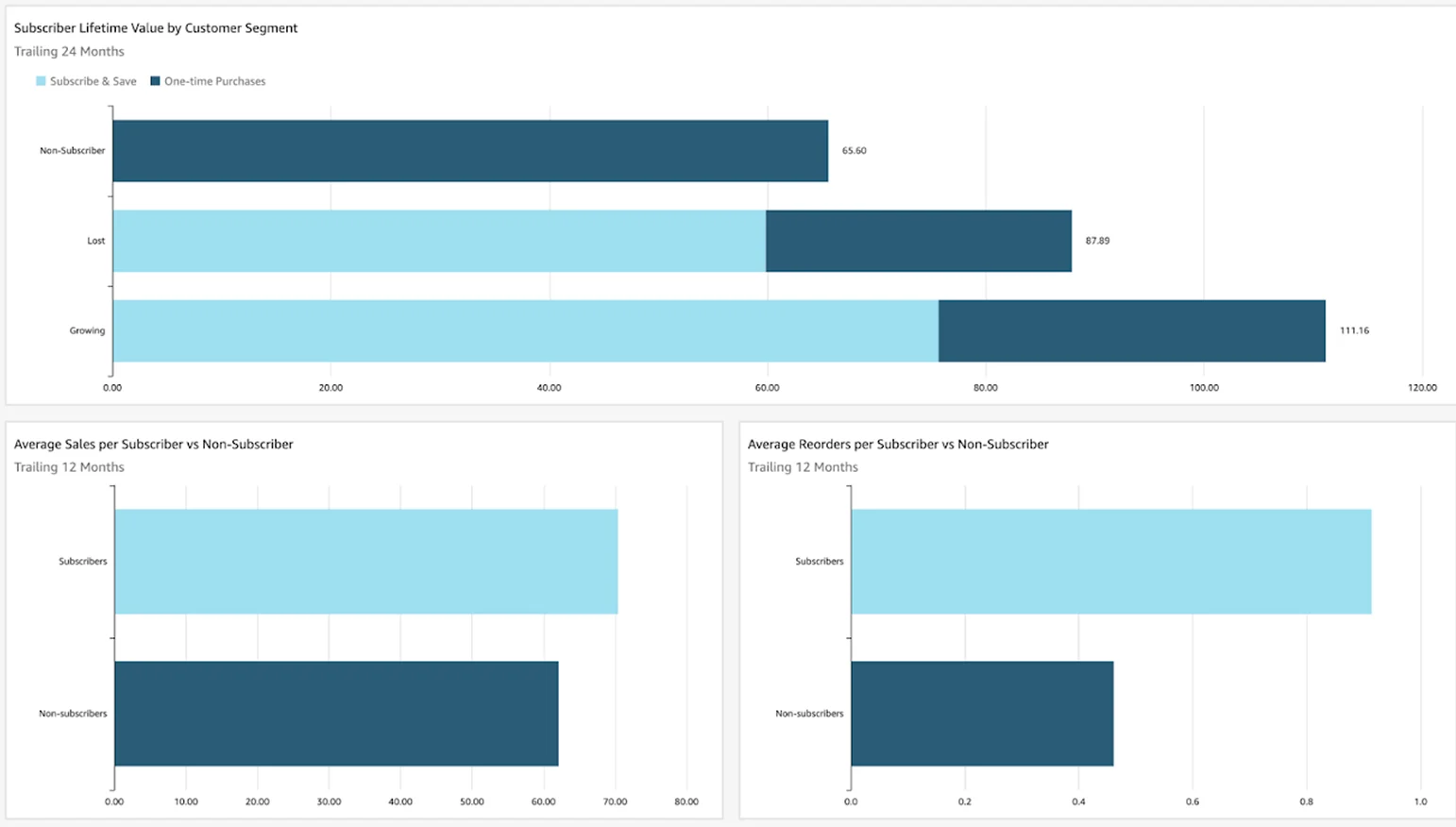

4. Faster Reorders and Better Retention

As more first-time buyers returned to purchase again, Amazon began receiving stronger repeat order signals. The brand recorded a repeat purchase rate of 11.7%, meaning nearly 1 in every 8 new buyers reordered.

At the same time, the average reorder time dropped to 6.2 weeks, showing that customers were not just buying again, they were buying sooner, which is a major advantage for consumable nutrition products like electrolyte drink mix powder, energy gels, carb refill packs, and running nutrition bundles. Faster reorders signaled improving product stickiness, higher customer loyalty, and better long-term sales stability.

5. Smarter Use of Amazon Data

Amazon Marketing Cloud insights ensured ads focused on real buyers, not guesswork. The result: controlled spend, higher conversion rates, and scalable performance Amazon could reward.

What This Case Study Proves?

This case study shows what happens when Amazon PPC management, listing optimization, and customer lifecycle strategy are executed as one system, not as disconnected tasks.

Instead of relying on organic sales or short-term ad spikes, this brand built a repeatable Amazon sales system rooted in how real shoppers buy Sports Nutrition products. By fixing ad eligibility, strengthening subcategory-based listings, and using Amazon Marketing Cloud insights to engage high-intent audiences, Amazon could finally recognize, classify, and scale demand correctly.

The result wasn’t just higher sales, it was measurable New-to-Brand acquisition, growing Subscribe & Save adoption, shorter reorder cycles, and predictable recurring revenue. Every dollar spent on Amazon Ads supported long-term visibility, not one-time clicks.

Amazon PPC and Subscribe & Save worked together to build real growth Amazon can track. Traffic became steady. Orders became repeatable. New customers kept increasing. Subscribe & Save became a normal part of sales, not just a one-time boost.

At AMZDUDES, we don’t just manage Amazon ads. We improve how products show up in Amazon search, lower Amazon PPC costs, bring new buyers, and increase repeat orders through Subscribe & Save for consumable products.

Ready to Scale Your Amazon Portfolio?

AMZDUDES helps brands:

- Optimize Amazon listings for SEO and conversion

- Scale PPC with controlled ACoS and strong ROAS

- Acquire verifiable New-to-Brand customers

- Grow Subscribe & Save for recurring revenue

- Use Amazon Marketing Cloud to reduce wasted spend

- Turn first-time buyers into loyal customers

We apply the same framework used in this case study, built for brands that want sustainable Amazon growth, not short-term ad spikes.

Book a Free Amazon Growth Strategy Call

Let’s turn your Amazon channel into a predictable, high-performing sales asset.