Key Takeaways

- Google ads for Amazon listings are now essential. They capture early-funnel buyers on Google, drive sales velocity, and improve Amazon organic rankings.

- Amazon’s own ad strategy shapes the market When Amazon paused Google Shopping Ads in 2025, CPCs dropped by up to 40 percent, proving that sellers must adapt quickly to auction volatility.

- Profitability depends on benchmarks Sustainable campaigns aim for ~3:1 ROAS, with higher returns possible for niche or premium products, while commodity categories often settle closer to break-even.

- Success requires alignment across the funnel. Strong listings, clear ad-to-page messaging, and attribution tools like Amazon Attribution are critical for converting paid traffic into profitable sales.

- Scaling works best with discipline Start lean, protect brand keywords, refine negatives, and expand gradually with automation and remarketing to maximize ROI without wasted spend.

Google ads for Amazon listings has become one of the most important external traffic strategies for sellers in 2025. The idea is simple but highly effective: use Google Ads across search, shopping, display, and video to guide buyers directly to Amazon product listings.

This approach connects two powerful ecosystems. On one side is Google, the largest search engine where billions of purchase-intent queries begin. On the other is Amazon, the marketplace where those searches often convert into purchases. By linking the two, sellers can capture new customers while also boosting sales velocity that strengthens their organic ranking inside Amazon’s algorithm.

In this guide, you will find benchmarks, insights into Amazon’s own ad use, proven campaign structures, and common pitfalls, that show how to make Google Ads profitable for Amazon products.

Current Landscape & Key Changes

The year 2025 has been turbulent for anyone running Amazon ads on Google. To understand today’s strategies, you must first know what shifted.

Amazon’s Retreat and Return

For years, Amazon was Google’s #1 advertiser, with an estimated spend of $22 million per month in 2022, dwarfing Walmart’s $3 million. Much of this went into Amazon Google Shopping Ads, where Amazon often held 30%+ of impressions in the U.S.

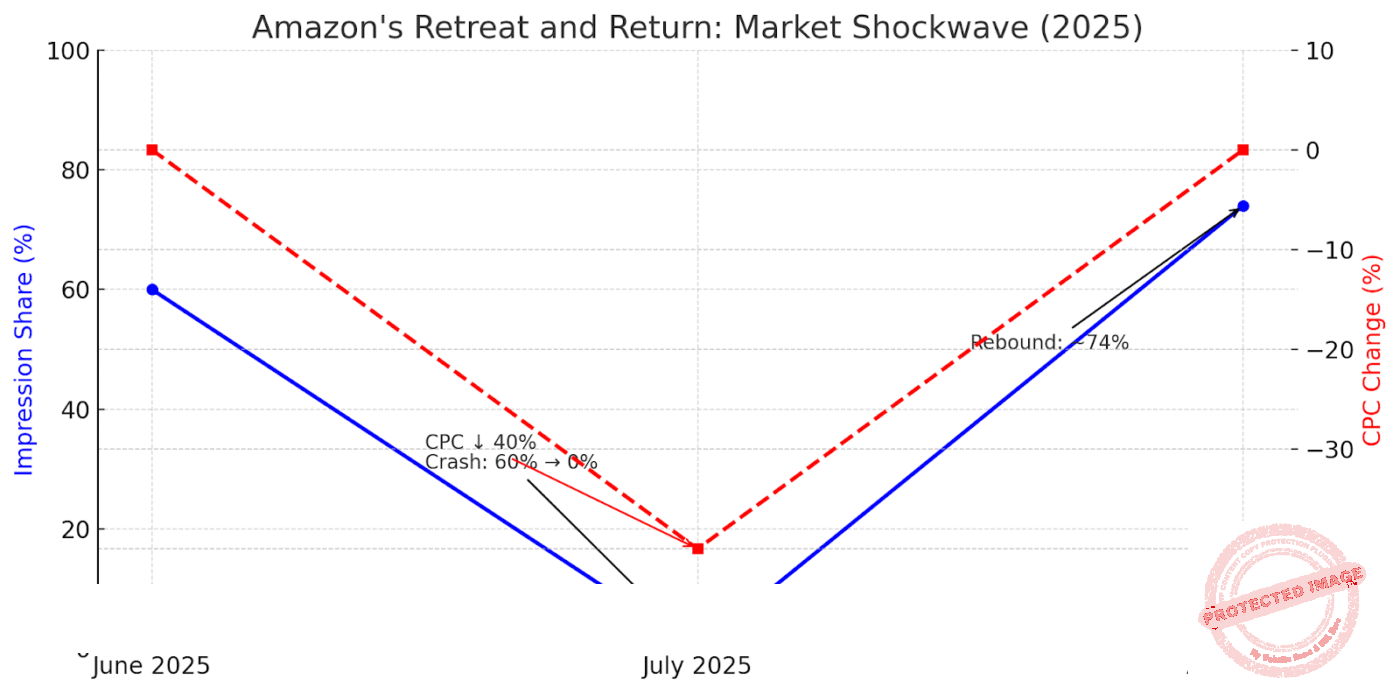

In July 2025, Amazon stunned the industry by pulling the plug:

- Impression share collapsed from 60% to 0% virtually overnight in the U.S. and ~55% to 0% in the U.K.

- Both paid Shopping ads and free product listings from Amazon disappeared from Google Merchant Center feeds.

- Analysts speculated Amazon was testing incrementality (would buyers find Amazon anyway without ads?) or margin optimization during a post–Prime Day.

But within a month, Amazon reversed course. By late August, its impression share rebounded to ~74% in Europe, restoring auction pressure. The whiplash proved one thing: Amazon has the power to move the market at will.

Implications for Sellers

- CPC pressure: Amazon’s presence inflates Google Ads auctions. When Amazon paused, CPCs dropped 25–40% in some categories; when it returned, they spiked back. For smaller sellers, this volatility means careful margin monitoring.

- Competition shifts: Walmart, Target, and Home Depot surged into the gap Amazon left. Sellers should note: when a giant steps back, opportunistic retailers expand quickly.

- Ad strategy as negotiation: Amazon’s pullback wasn’t just about costs. It signaled to Google: “We can walk away.” Sellers should expect more tactical retreats and returns as Amazon tests the market.

Broader Trends in Google Ads for Amazon Listings

- Google ads vs Amazon ads: This isn’t a binary choice. The platforms are converging. Amazon’s own DSP mimics Google Display, while Google is improving product feeds. Sellers must learn how to orchestrate both, not pick sides.

- Attribution demand: With more external traffic in play, tools like Amazon Attribution are no longer optional. Without them, sellers risk losing sight of ROAS.

- Policy shifts: Compliance rules on direct linking and trademark use have tightened. What worked in 2023 may trigger ad disapproval in 2025.

Why Use Google Ads for Amazon Products

Many sellers still ask whether it makes sense to invest in Google ads for Amazon products when Amazon PPC itself is already costly. The answer in 2025 is yes, but with conditions.

Benefits that Matter Today

- Visibility Beyond Amazon:

Millions of buyers begin their journey on Google. By running Amazon ads on Google, sellers capture purchase intent at the earliest stage instead of letting competitors take that click.

- Boost to Internal Ranking:

External traffic increases sales velocity, which feeds Amazon’s A10 algorithm. More orders from Google ads Amazon campaigns can lift organic keyword placement and improve Sponsored Products performance.

- Brand Protection:

If you do not occupy those Google Shopping or search slots, rivals will. Competitors, resellers, or even counterfeiters may buy those keywords and redirect demand.

- High-margin Leverage:

Products with solid margins, strong reviews, and optimized listings tend to see the best return. For these categories, digital marketing on Amazon integrated with Google Ads provides measurable lift.

When It May Not Work

Not every product is a fit. Thin margins, weak listings with poor reviews, or hyper-competitive categories often turn external campaigns into wasted spend. Before investing in digital marketing of Amazon through Google, sellers should audit their listings to ensure conversion readiness.

Benchmarks & Metrics You Should Know

Understanding benchmarks is critical before scaling Google ads for Amazon listings. Without reference points, it’s easy to overspend or misinterpret performance. Below are the key metrics sellers should monitor in 2025.

ROAS and ACoS Expectations

Return on ad spend (ROAS) and advertising cost of sales (ACoS) are the foundation for measuring profitability. The right targets vary by product type and margin structure.

| Product Type | ROAS Target | Equivalent ACoS |

| General Categories | 3:1 | ~33% |

| High-ticket or Niche | 4:1 or more | ~25% |

| Commodity Categories | 2:1 | ~50% |

Conversion Rates and CTR

Performance benchmarks vary by campaign type. Search traffic usually converts strongest, while Display and Video serve better for awareness.

| Campaign Type | CTR Range | Conversion Rate |

| Google Search | 5–10% | 5–10% |

| Shopping Ads | 8–12% | Varies widely |

| Display/ Video | 0.5–1% | Lower |

CPC Ranges in 2025

Cost per click (CPC) remains volatile due to Amazon’s shifting presence in auctions. Sellers should expect these ranges in the U.S. market:

| Keyword Type | CPC Range |

| Non-Branded | $1.20–$2.50 |

| Branded | $0.40–$0.80 |

Break-Even Calculation

Sellers must calculate their maximum bid before launching campaigns.

- Start with product margin after Amazon fees.

- Divide by target CPC and conversion rate.

- The result is the maximum CPC you can afford.

Example:

If your net margin is $15, conversion rate is 8%, and average CPC is $1.50, then:

1. $15 ÷ (0.08 × $1.50) ≈ 1.25 ROAS.

This means you either need higher conversion (optimize listings) or lower CPC to remain profitable.

Setting Up Google Ads for Amazon Listings (Step-by-Step Guide)

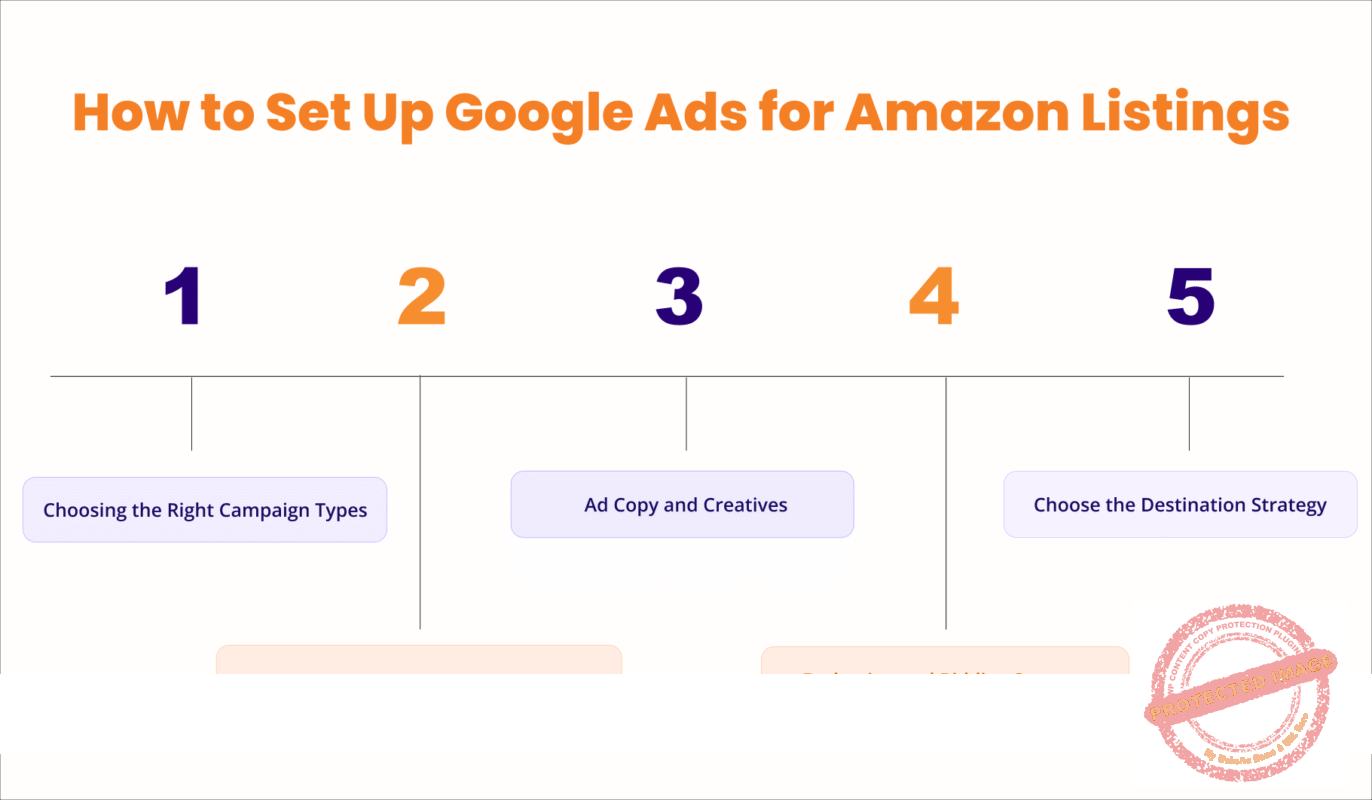

Launching Google ads for Amazon listings that drive buyers from Google to Amazon requires deliberate planning. Each step should reduce waste and align with both Google’s ad auction mechanics and Amazon’s conversion environment.

Step 1: Choosing the Right Campaign Types

Not every campaign type inside Google Ads is suited for Amazon sellers. The key is matching your goal with the format. Search and Shopping campaigns work best for direct sales, while Display and Video play a supporting role for awareness and remarketing. Performance Max can help scale but requires careful oversight. The below table will help you decide which campaign type is most suited for you:

| Campaign Type | Best Use Case | Strengths | Limitations |

| Search | High-intent queries like “buy wireless headphones Amazon” | Strong ROAS, clear buyer intent | Limited scale compared to Shopping |

| Shopping | Product-focused visibility in Google Shopping results | Visual ads, strong CTR, trusted by buyers | Requires Merchant Center feed and policy compliance |

| Display and Video | Awareness and retargeting campaigns | Expands reach, supports remarketing | Lower CTR and conversion vs Search/Shopping |

| Performance Max | Scaling across multiple Google placements | Automated reach across Search, Shopping, Display, YouTube | Limited control, spend may scatter |

Step 2: Keyword Research and Targeting

Keyword strategy is the backbone of Google ads for Amazon listings. Start by focusing on purchase-intent terms such as “best protein powder Amazon” or “cheap phone cases online.” These indicate readiness to buy. At the same time, layer negative keywords like “free,” “review,” or “DIY,” which tend to attract non-buyers.

Using both branded and non-branded keywords is critical: branded terms protect your presence when customers search for your brand name, while non-branded keywords capture incremental market share. Tools such as Google Keyword Planner, Helium 10, and Amazon’s Search Term Reports help align campaigns with real buyer behavior.

Step 3: Ad Copy and Creatives

Strong ad copy ensures clicks turn into conversions. Your ads should reflect the promise of the Amazon listing. For instance, if your product page highlights “BPA-free” or “eco-certified,” those claims should appear in the ad headline or description. Consistency reassures buyers and prevents confusion.

Calls to action like “Shop on Amazon Today” or “See Thousands of Reviews” increase click-through rates by leveraging Amazon’s trust factor. For Display and Video formats, emphasize benefits quickly and use visuals that match your target audience’s lifestyle. These details improve both CTR and on-page engagement.

Step 4: Budgeting and Bidding Strategy

Budgets and bids determine whether your Google ads for Amazon listings have gathered enough data to optimize. A small daily budget often stalls campaigns, while sudden budget spikes confuse Google’s algorithm. A gradual, structured approach works best.

| Budget Aspect | Recommendation | Rationale |

| Starting Budgets | $30–50 per day minimum | Ensures enough clicks for meaningful data |

| Bidding Models | Begin with Manual CPC, test Target ROAS once stable | Manual gives control; automation works after data collection |

| Scaling | Increase 15–20% per week | Prevents overspending and avoids resetting Google’s learning phase |

Step 5: Choose the Destination Strategy

Where you send traffic matters just as much as how you set up the ad. A strong campaign can fail if the destination does not match user expectations. Sellers using Amazon ads on Google must decide whether to send traffic straight to an Amazon listing or use a custom landing page first. Each option has its strengths and trade-offs.

- Direct to Amazon Listing

Sending buyers directly to the Amazon product page shortens the journey. It works best for high-intent search traffic because there are fewer steps before purchase. This approach benefits from Amazon’s trust factor, Prime shipping, and existing reviews. The downside is limited tracking, since sellers cannot access full analytics or retargeting options once buyers are inside Amazon’s ecosystem.

- Landing Page First

A landing page gives more control. You can highlight key features, add social proof, collect emails, and even install tracking pixels. This makes remarketing possible and allows you to segment audiences before sending them to Amazon. However, the extra click adds friction. Some buyers may drop off before reaching the product page, which reduces conversion rates if the page is not optimized.

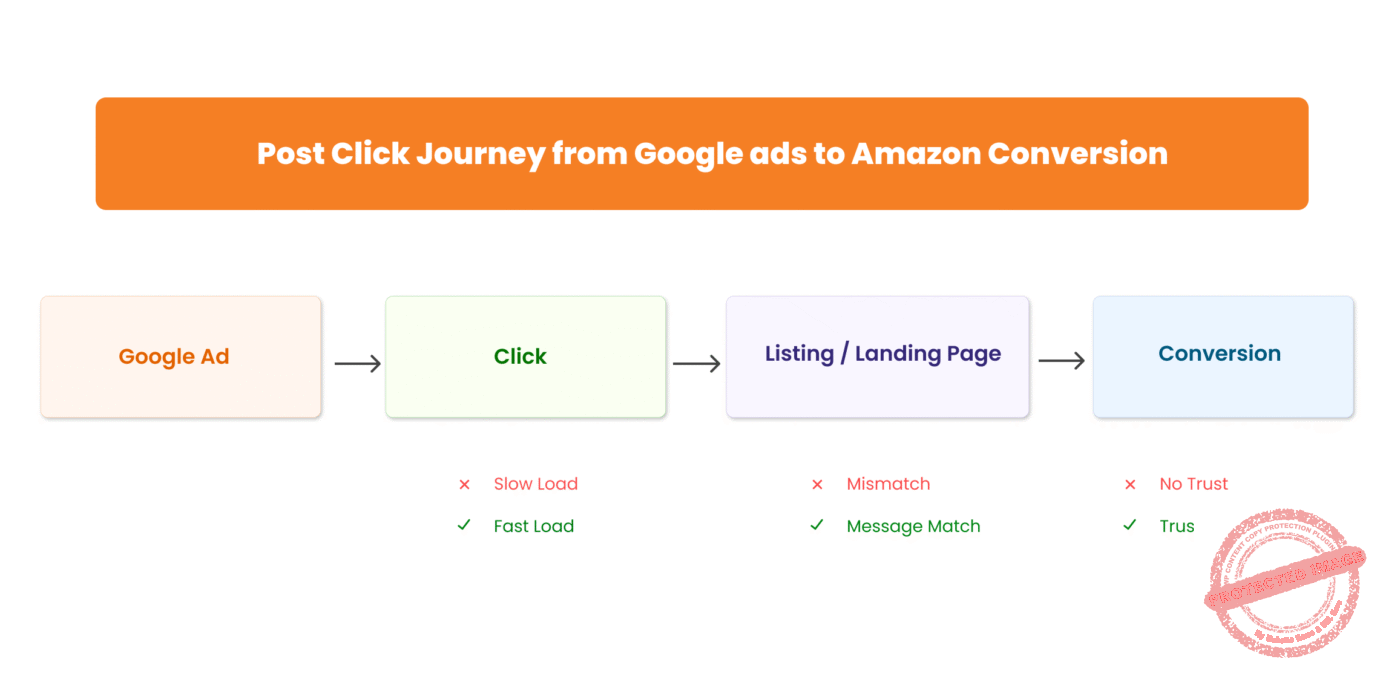

Post-Click: Conversion Optimization & Listing Readiness

Driving traffic through Google ads for Amazon listings only delivers results if the product page converts. External clicks are costly, so every element on your Amazon listing must support a seamless purchase journey.

Amazon Listing Quality Checklist

Before scaling digital marketing with Amazon, review your product detail page against these essentials:

- High-resolution images: Include multiple angles, lifestyle shots, and infographics that highlight features.

- Compelling bullet points: Focus on benefits, not just specs. Buyers need to understand why your product solves their problem.

- Reviews and ratings: Aim for at least 4 stars and a healthy review count. Weak social proof erodes the trust you build with ads.

- Price competitiveness: External ads cannot fix overpriced offers. Benchmark against top sellers in your category.

- A+ Content and Brand Story: Rich visuals and brand modules increase dwell time and lift conversion rates.

Using Landing Pages Strategically

In some cases, routing traffic through a landing page before Amazon creates additional leverage:

- Email capture: Collect addresses for future remarketing or product launches.

- Audience filtering: Pre-sell the benefits, answer FAQs, and send only qualified leads to Amazon.

- Attribution clarity: Adding UTM tags and pixels helps track user paths, something not possible with direct Amazon traffic.

When used this way, landing pages act as a bridge. They warm cold traffic from display or video campaigns while preserving high-intent search clicks for direct listing routes.

Reducing Friction After the Click

Whether traffic from Google ads for Amazon listings goes to a listing or a landing page, the experience must feel consistent with the ad that attracted the click:

- Mobile-first optimization: More than 70 percent of Google-to-Amazon traffic happens on mobile. Images and bullet points should load quickly and be scannable.

- Message match: If the ad promised “BPA-free” or “fast charging,” the same phrase should appear above the fold on the listing.

- Trust signals: Badges such as “Amazon’s Choice” or “Prime Eligible” increase buyer confidence and reduce hesitation.

- Fast load times: Poor performance kills conversions. Ensure both landing pages and Amazon media assets are optimized for speed.

Tracking, Attribution, & Analytics

Without reliable tracking, you cannot know if your spend on Amazon ads on Google is producing incremental sales or just noise. The challenge lies in Amazon’s closed ecosystem, where traditional Google Ads conversion tags cannot be placed on product pages. Sellers must combine Amazon’s own tools with external analytics to build a clear picture.

Tools You Must Use

1. Amazon Attribution

Amazon’s native solution for external traffic tracking. It lets you tag Google Ads campaigns and measure resulting detail page views, add-to-carts, and purchases. For example, if $500 of Google traffic generates $1,800 in attributed sales, you know your ROAS is 3.6. Attribution data is not instant but provides granular insights over time.

2. Google Analytics + UTM tags

If you use a landing page before Amazon, always add UTM parameters. This shows where clicks originate and how users behave before heading into Amazon. It bridges the gap between Google Ads reporting and Amazon sales data.

3. Google Ads conversion tracking

Works only when a landing page is in play. It records on-page actions such as button clicks, email sign-ups, or outbound link clicks to Amazon. These micro-conversions help optimize campaigns even before final sales data is visible.

Tracking Delayed and Multi-touch Conversions

Shoppers often do not buy immediately. A user may click a Google ads Amazon campaign today, browse, and purchase three days later on Amazon. Attribution models need to account for this. Amazon Attribution captures delayed conversions, but sellers should also track trends such as repeat orders and rising brand search volume as secondary signals of success.

Key KPIs to Monitor

- CTR (Click-Through Rate): Indicates ad relevance. A healthy CTR is 5–10 percent on Search and 0.5–1 percent on Display.

- CPC (Cost Per Click): Benchmarked at $1.20–$2.50 for non-branded terms in 2025, with branded clicks lower.

- Conversion Rate: Amazon listings with optimized images and reviews often see 8–10 percent from search-driven clicks.

- ROAS and ACoS: Core profitability measures. Track both at campaign and product level.

- Add-to-Cart Rate: A strong leading indicator of conversion potential.

- Profit Margin and CLV: Beyond single transactions, monitor whether campaigns help acquire repeat buyers or Prime subscribers.

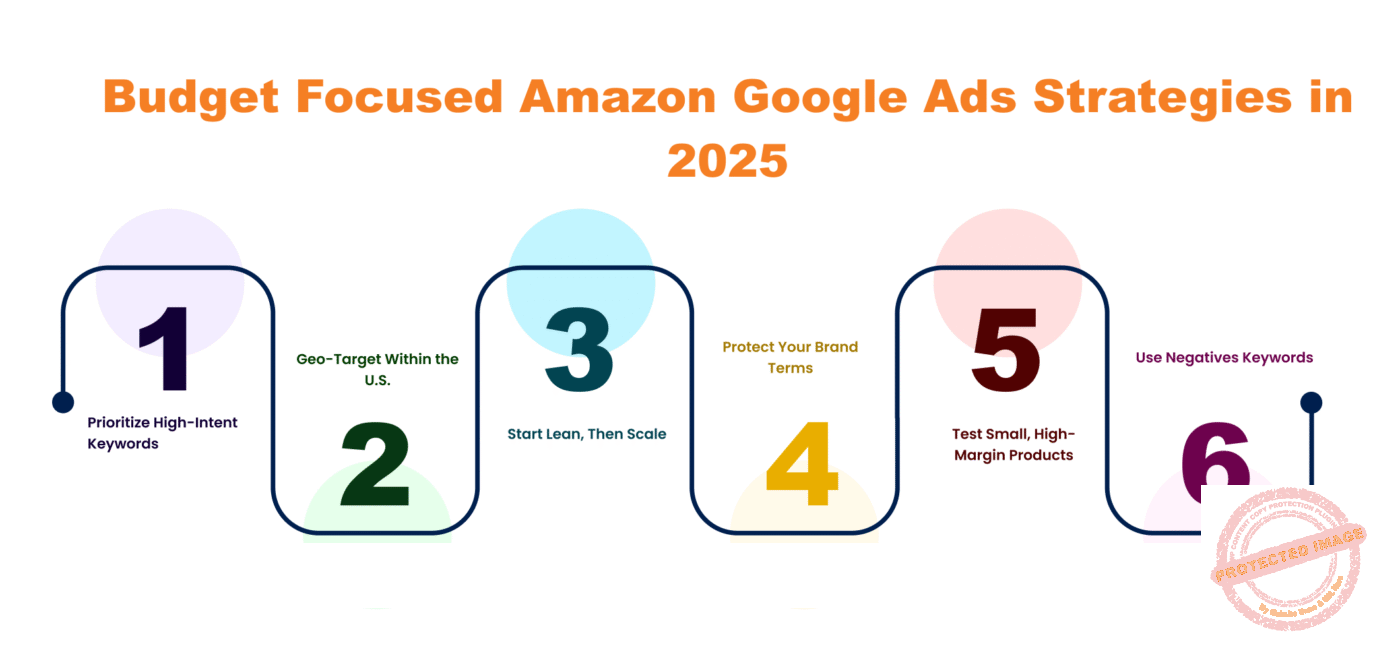

Budget-Focused Strategies (U.S. Market)

Running Google ads for Amazon listings in the U.S. can quickly become expensive, especially with Amazon itself bidding aggressively on high-volume keywords. Sellers with limited budgets need to prioritize efficiency over scale. The following approaches help maximize ROI while controlling spend.

1. Prioritize High-Intent Keywords

In the U.S. market, generic non-branded terms often command CPCs above $2.00. Instead of spreading spend thin, focus on keywords that signal strong buying intent. Examples include “buy organic coffee Amazon” or “best electric shaver Amazon Prime.” These clicks cost more but convert at higher rates, producing stronger ROAS.

2. Geo-Target Within the U.S.

National targeting is default, but smaller brands can save budget by focusing on regions with stronger conversion rates. For instance, products tied to lifestyle categories (outdoor gear, wellness, specialty foods) often convert better in states like California, Texas, and Florida where consumer adoption is higher. Testing state-level targeting in Google Ads can reveal pockets of efficiency.

3. Start Lean, Then Scale

Begin with a $30–$50 daily budget per campaign. Use manual CPC bidding to control costs until you collect enough data. Once profitable, scale budgets gradually by 15–20 percent per week. Jumping too fast resets Google’s learning phase and drains efficiency.

4. Protect Your Brand Terms

Competitors often bid on your brand keywords to intercept customers searching for your product name. Running Amazon ads on Google against your own brand terms is usually cheap (CPCs often $0.40–$0.80). This ensures customers intending to buy from you are not poached by rivals.

5. Test Small, High-Margin Products

With limited spend, prioritize SKUs with higher profit margins and proven reviews. A $5 margin product cannot absorb a $2 CPC, but a $25 margin SKU can. Early wins with premium products build the budget confidence needed to expand.

6. Use Negatives Keywords

Wasted spend is the fastest way to kill small budgets. Apply negatives like “free,” “manual,” “parts,” “review,” and unrelated modifiers to cut irrelevant clicks. Constantly refine based on search term reports.

Scaling & Automation Tools

Once campaigns for Google ads for Amazon listings are profitable at a small scale, the challenge becomes expanding reach without losing efficiency. Scaling too quickly often inflates CPCs and reduces ROAS. The right mix of automation and disciplined testing allows U.S. sellers to grow sustainably.

Tools that Support Scaling

- Feed management software: Tools like DataFeedWatch or GoDataFeed ensure product data stays optimized for Google Shopping campaigns. Clean titles, attributes, and images directly improve CTR and quality score.

- Bid automation platforms: Solutions such as Kenshoo, Marin, or even Google’s built-in Smart Bidding help adjust bids in real time based on device, location, and time-of-day performance. Use cautiously, starting only after campaigns have solid data.

- Remarketing audiences: Collect visitors through landing pages or Amazon Attribution tags. Retarget them with Display or YouTube ads. This keeps your brand visible and increases conversion rates over time.

Principles for Scaling Without Losing ROI

- Incremental budget increases: Raise budgets by no more than 15–20 percent weekly to avoid algorithmic resets.

- Expand keyword sets carefully: Start with proven high-intent queries, then layer mid-funnel terms like “top rated” or “best under $50.”

- Iterative ad testing: Rotate ad copy and creative in small batches. Test one change at a time so you know what drives performance.

- Cross-campaign learnings: Apply insights from profitable campaigns (winning keywords, effective ad angles) across Search, Shopping, and Display.

Common Challenges & Pitfalls to Watch Out For

Even well-structured campaigns can fail if sellers overlook hidden risks. The following pitfalls frequently erode ROI for U.S. advertisers running Amazon ads on Google.

1. Weak Product Listings

Sending external traffic to an Amazon page with poor reviews, unclear bullet points, or low-quality images is one of the fastest ways to burn a budget. A high CPC paired with a weak conversion rate can double your ACoS. Always ensure your listing is optimized before scaling Google ads for Amazon products.

2. Policy and Compliance Issues

Google has tightened its rules on direct linking to Amazon. Ads that use restricted trademarks or misleading claims often get disapproved. In 2025, many sellers will also see stricter enforcement on product feed quality for Shopping campaigns. Without compliance, campaigns never reach full potential.

3. Wasteful Spend from Poor Keyword Control

Broad match without negatives invites irrelevant clicks. For example, targeting “wireless headphones” without negatives might trigger queries like “wireless headphones repair manual,” which never convert. Constant review of search term reports is essential.

4. Attribution Mismatches

External campaigns often face delayed or multi-touch conversions. A shopper may click today and buy three days later. Without Amazon Attribution, this sale may not appear tied to the ad, leading to false assumptions about underperformance. Sellers who fail to integrate attribution tools often scale down profitable campaigns by mistake.

5. Over-Scaling Too Soon

Once a campaign shows promise, the temptation is to double budgets overnight. This resets Google’s learning phase, inflates CPCs, and erodes efficiency. Incremental scaling remains the safest approach.

6. Competition from Amazon Itself

When Amazon re-entered Google Shopping auctions in August 2025, CPCs across categories jumped back up. Sellers need to accept that competing with Amazon means higher auction pressure. The key is focusing on niches where you can differentiate with product features, reviews, or bundles.

Alternative or Complementary Channels

Relying only on Amazon ads on Google can be limiting. Costs rise when competition intensifies, and attribution gaps sometimes mask real ROI. Sellers who diversify into complementary channels often see steadier performance and more efficient scaling.

1. Balancing Google Ads with Amazon PPC

Running Google ads for Amazon products should never replace Sponsored Products, Sponsored Brands, or Sponsored Display campaigns. Instead, it complements them. Google captures buyers earlier in the funnel, while Amazon PPC closes the sale. Sellers who orchestrate both channels often see higher organic rank, stronger brand visibility, and better protection against competitors bidding on their product keywords.

2. Social Media Ads

Meta (Facebook/Instagram) and TikTok ads provide discovery-level traffic that can later convert on Amazon. While conversion rates are lower than Google Search, these channels excel at building remarketing pools. Sellers can retarget this traffic through Google Display or bring them back with digital marketing on Amazon offers like coupons or limited-time discounts.

3. Influencer Marketing and Affiliates

Influencers on YouTube, Instagram, and TikTok often generate trust faster than ads alone. Pairing influencer content with Google ads Amazon campaigns reinforces messaging across multiple touchpoints. Amazon’s Affiliate Program also incentivizes third parties to drive external traffic, diversifying acquisition channels.

4. Content and SEO

Building blog content, product guides, or comparison articles creates organic pathways into Amazon. For example, an article ranking for “best organic coffee for Amazon Prime” can funnel free clicks while reducing dependency on paid Google campaigns. This strengthens long-term visibility and complements paid traffic sources.

5. Email and Remarketing

Capturing emails through a pre-sell landing page extends lifetime value. A buyer acquired from a Google ads Amazon campaign can later be remarketed via email with complementary product bundles or replenishment reminders, multiplying the value of one paid click.

Conclusion

In 2025, Google ads for Amazon listings have shifted from a nice-to-have to a competitive necessity. They help sellers capture buyers before they reach Amazon, fuel sales velocity that boosts organic rank, and defend against rivals bidding for visibility. Success depends on three pillars: optimized listings, precise keyword targeting, and disciplined tracking with Amazon Attribution.

However, if building a digital marketing strategy for your Amazon brand is a hard-to-do task for you, let us handle it with the guaranteed results. At AMZDUDESs, our team ensures that every dollar spent on ads translates into measurable growth on Amazon. If you are ready to scale smarter, book a free consultation call with us today.

FAQs

Q1. Can you run Google Ads for Amazon product listings?

Yes. Sellers can use Google Ads across Search, Shopping, Display, and Video to send buyers directly to Amazon listings.

Q2. Is it allowed by Amazon / Google Terms of Service to send Google Ads traffic directly to Amazon?

Yes. Both platforms allow it as long as ad copy, feeds, and listings comply with Google Ads and Amazon policies.

Q3. Can you use Google Shopping Ads for Amazon products?

Yes. Shopping Ads can work if you have an approved Google Merchant Center feed, though not all sellers qualify.

Q4. How can I track conversions when I use Google Ads to send traffic to Amazon?

Use Amazon Attribution for sales and add-to-cart tracking. If you run traffic through a landing page, you can also track micro-conversions with UTM tags and Google Analytics.Q5. How much budget do I need to start Google Ads to Amazon campaigns?

At least $30–$50 per day per campaign is recommended to gather enough data for optimization.