There’s More Money in Your Data Than You Think

Every established brand has blind spots. Even the optimized Amazon PPC campaign strategy, including the one you review weekly, adjust bids on, and feed with solid creative, leave money on the table.

Why? Because you’re optimizing the visible. But growth doesn’t come from what’s obvious. It comes from spotting what others miss.

If you’re a mid-market brand running Amazon ads, chances are you’re under-leveraging the data you already have. That’s where the hidden opportunities are.

What Does “Uncovering Hidden Opportunities” Actually Mean?

This isn’t about running more Amazon PPC campaigns or spending more money. It’s about extracting profitable insights from overlooked signals in your account.

Think of your Amazon PPC account like a warehouse. You know where the best-selling SKUs are stacked, but in the back? There’s inventory that could move, if you just knew how to position it.

In PPC terms, hidden opportunities look like:

- Search terms converting under one Amazon PPC campaign but ignored in others

- Overlapping ASIN targets wasting budget

- Keywords with high click-throughs but low ACoS, buried in auto

- Products with great ROAS but zero cross-sell exposure

- Timing gaps where bids aren’t optimized for buying windows

You’re already sitting on this data. The opportunity is to read it differently.

Why Brands Miss These Signals

The usual culprits:

- Too much reliance on bulk sheets without zooming into pattern-level insights

- Lack of segmentation in data views i.e., SKU vs. campaign vs. keyword

- Weekly reporting habits that prioritize urgent over valuable

- Disconnected PPC and catalog teams i.e., no SKU-level feedback loop

The consequence? Decisions are made in silos. You cut bids without realizing the keyword is supporting another product. You scale campaigns without validating inventory flow. You pause what looked inefficient, without knowing it was feeding Brand Analytics rank.

This isn’t just inefficient. It’s expensive.

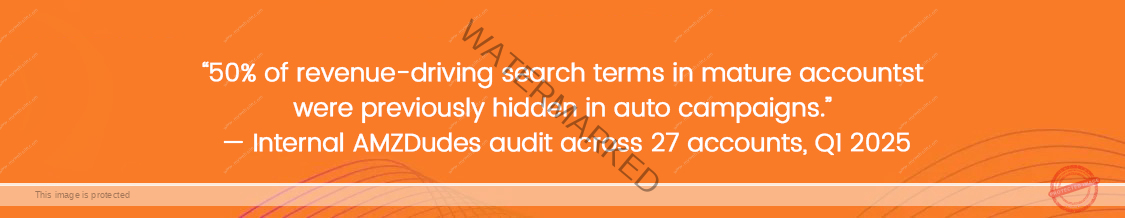

1. How Search Term Mapping Reveals Keyword Gaps

You’re probably already using keyword research tools. But the best-performing keywords often come from your own search term reports, not from external tools.

Here’s what to do:

- Pull 60 days of search term data from Sponsored Products

- Sort by orders, then ACoS, then conversion rate

- Highlight keywords that are:

- High-performing in auto campaigns but not added to manual

- Repeating across SKUs, showing intent overlap

- Generating sales but missing from branded search coverage

- High-performing in auto campaigns but not added to manual

2. Ad Scheduling Isn’t Just for Budget Control

If you’re running 24/7 campaigns without checking hourly performance, you’re missing a major efficiency lever.

Tools like Perpetua, Adtomic, and PACUVE show time-of-day performance trends. But even without tools, you can start with:

- Pulling hourly data via Amazon’s report scheduler

- Identifying when click volume spikes without converting

- Adjusting bids or applying dayparting rules for manual campaigns

This simple adjustment can reduce ACoS by 10–20% in some cases, without cutting spend.

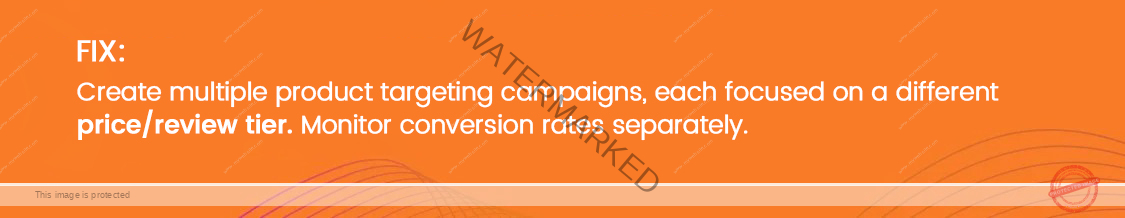

3. Product-Targeting Campaigns Are Often Misdirected

Let’s be honest: many product targeting campaigns run on autopilot. Brands will throw a few ASINs into the mix and call it “competitive conquesting.”

But if you’re not segmenting by:

- Price point (yours vs. competitor)

- Star rating (4.2+ performs better for conquesting)

- Bundle vs. single-unit positioning

- Review count (social proof delta)

…then you’re likely spending inefficiently.

4. ASIN-Level Budget Misalignment Is Quietly Hurting You

Most brands assign budgets by campaign type, not by ASIN performance.

With advanced Amazon PPC strategies, we shift the focus to what matters:

Not all ASINs contribute equally to your TACoS. Some are margin leaders, others are volume pushers. And some have rank sensitivity that’s bid-dependent.

Here’s a better framework:

- Identify your hero ASINs (highest profit per conversion)

- Allocate higher budgets and tighter ROAS targets to them

- Assign discovery or test campaigns to your newer listings

- Keep tight watch on underperformers, don’t overfeed them

Have I reviewed each ASIN’s profitability post-ad spend?

Are discovery campaigns supporting future bestsellers?

Are budget caps preventing growth for high-ROAS SKUs?

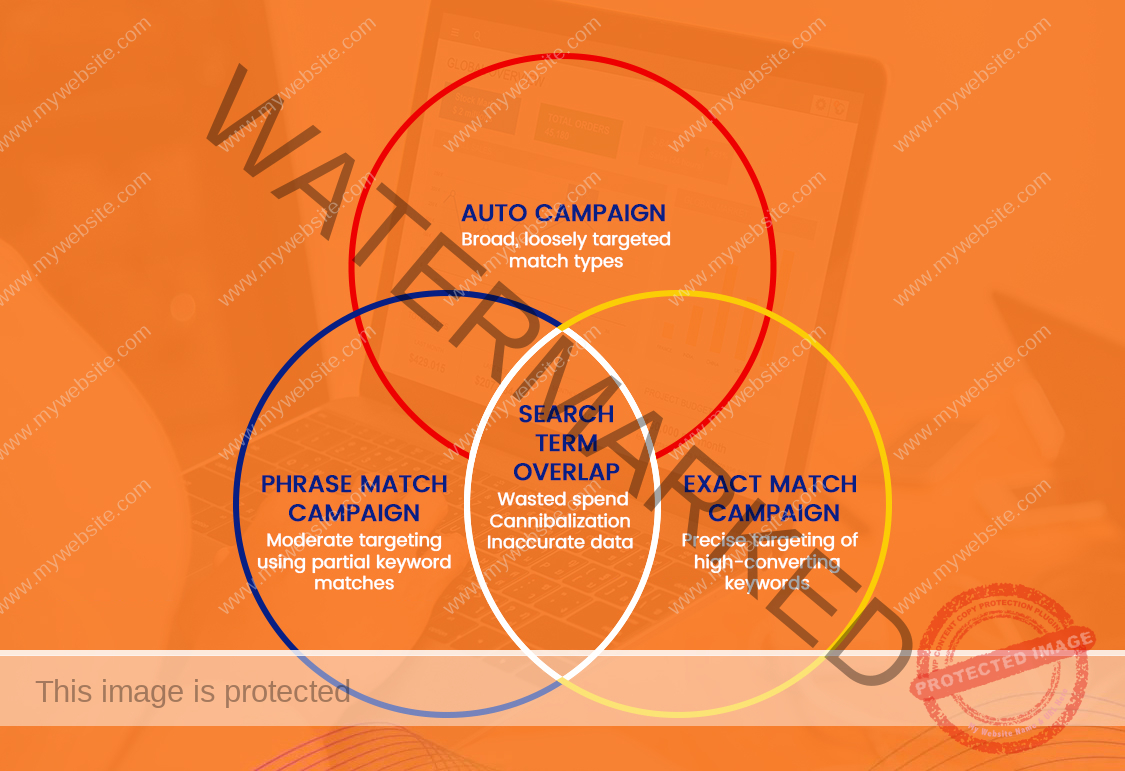

5. Overlapping Target Types Can Skew Results

Running broad match, phrase match, auto, and category targeting (without exclusions) is like running Amazon PPC advertising in a room full of mirrors.

You’ll:

- Compete against yourself

- Skew attribution

- Waste spend through duplicated exposure

Fix this with:

- Search term isolation: Add exact matches to negative phrase

- ASIN exclusions in category targeting: Prevent overlapping exposure

- Separate campaigns by match type: It makes performance easier to measure

6. The Buy Box Factor Is Often Ignored in Ad Performance

Ads won’t convert well without the Buy Box. But many brands still run Sponsored Products for listings that are price-checked or Buy Box suppressed.

Here’s how to fix it, right from your Amazon PPC campaign structure:

- Pull a Buy Box report

- Cross-reference with active ad ASINs

- Pause ads for SKUs that are frequently losing the Buy Box

- Alternatively: reduce bids during periods of loss

7. Use DSP and Brand Analytics to Find Hidden Audiences

If you’re only using Sponsored Products and Brands, you’re leaving retargeting money untouched.

Brand Analytics gives you:

- Demographics of converting customers

- Market basket analysis

- Top-of-search click share data

DSP allows you to:

- Retarget customers who viewed your product but didn’t buy

- Build lookalike segments based on in-cart behavior

- Re-engage lapsed customers through off-Amazon placements

Final Takeaway: Data First. Spend Second.

The most successful brands on Amazon aren’t the ones with the biggest budgets. They’re the ones who know where to look.

They measure at the ASIN level.

They track behavior over attribution.

They fix what matters instead of chasing what’s visible.

That’s where AMZDudes comes in.

We go beyond Amazon PPC campaign management. We uncover what’s missing across your search terms, ASIN performance, inventory flow, and audience timing, then turn those insights into action.

From full account management to product launches, from listing optimization and storefront design to Amazon FBA prep and inventory management, we help you build a business that scales profitably, not just one that spends more.

If you’re ready to turn Amazon into your most strategic sales channel, we’re ready to lead the way. Schedule a free consultation today.

![How To Achieve Amazon Listing Optimization For Better Results [2024]](https://amzdudes.com/wp-content/uploads/2024/01/How-To-Achieve-Amazon-Listing-Optimization-For-Better-Results-2024-1-1-796x400.webp)