Key Takeaways

- Seller Central shows surface metrics; AMC reveals hidden drivers. Seller Central reports what happened (ACOS, clicks, sales), while AMC explains why it happened through multi-touch attribution and journey analysis.

- AMC connects channels; Seller Central keeps them siloed. AMC links DSP, Sponsored Products, and Sponsored Brands to measure combined impact — something Seller Central cannot do.

- AMC detects audience overlap and cannibalization. Seller Central can’t show if campaigns compete for the same shoppers, but AMC highlights redundancy and enables clean exclusions for efficient spend.

- AMC supports custom logic and metrics. Instead of being locked into fixed KPIs, advertisers can create metrics like lifetime value, incremental ROAS, or repeat purchase contribution.

- AMC turns reporting into optimization. Insights from AMC directly inform budget reallocation, audience refinement, creative sequencing, and incrementality testing — actionable levers unavailable in Seller Central.

Many advertisers rely almost entirely on Seller Central reports to guide their decisions. These reports provide surface-level metrics such as impressions, clicks, spend, sales, ACOS, and ROAS but they stop short of showing how shoppers actually move through the funnel. Critical insights such as multi-touch attribution, cross-channel impact, or whether campaigns are cannibalizing each other remain hidden.

This post will show how Amazon Marketing Cloud (AMC) fills that gap. By moving beyond basic Seller Central dashboards, AMC gives advertisers the ability to see the full customer journey, measure the incremental impact of different ad types, and optimize campaigns with data-backed precision.

And unlike in the past, AMC is now accessible to all advertisers. This shift opens the door for every brand, from emerging sellers to enterprise-level advertisers, to move beyond surface reporting and start optimizing campaigns with advanced, actionable insights.

Seller Central Reporting: What It Shows vs. What It Misses

Most advertisers begin their analytics journey inside Seller Central. And for day-to-day tracking, it does its job well. Seller Central reporting gives you the basics: impressions, clicks, spend, sales, ACOS, and ROAS at the campaign or SKU level. If you want to know how much you spent last week, which keywords converted, or whether ACOS improved, these reports give you a quick snapshot.

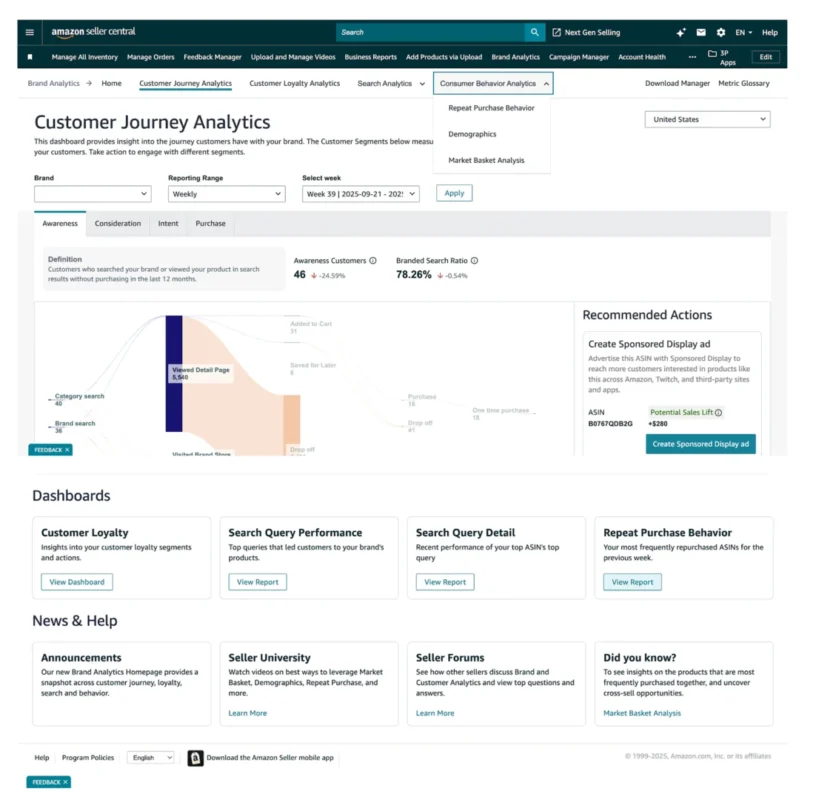

Amazon has also added Brand Analytics modules that extend reporting a step further:

- Search Query Performance (SQP): visibility into which queries drove impressions and clicks for your products.

- Top Search Terms: competitive benchmarking to see how your share of voice compares.

- Market Basket Analysis (MBA): product pairing insights to understand what else buyers purchase alongside your items.

- Demographics: breakdowns by age, gender, and income group.

- Repeat Purchase Behavior: data on how often customers come back for a second order.

These tools provide useful benchmarks, especially when you’re trying to measure keyword competitiveness or understand who your customers are.

But here’s the critical limitation: Seller Central and Brand Analytics still describe performance in isolation. They answer what happened, not why it happened.

- Attribution limits: Seller Central metrics are almost always last-click based. If a shopper saw a Sponsored Brand ad on Monday, clicked a DSP retargeting ad on Wednesday, and finally converted on a Sponsored Product ad Friday, only the final touch gets credit. Every other influence is invisible.

- No cross-channel measurement: Brand Analytics doesn’t connect Sponsored Products, Sponsored Brands, and DSP into a single picture. You see silos of data, not the full journey.

- No audience overlap detection: If multiple campaigns are hitting the same shoppers, you can’t see cannibalization or wasted impressions. You don’t know whether the budget is being spent efficiently.

- No custom logic: You’re locked into the metrics Amazon provides. Want to score audiences by predicted lifetime value? Or run a time-decay attribution model? You can’t.

- Lagging granularity: Brand Analytics aggregates at the query or audience level. You never see the underlying event-level interactions that reveal true behavior patterns.

And that’s the gap. Seller Central + Brand Analytics are solid for surface-level and competitive metrics but they leave advertisers blind to the deeper drivers of performance. If you want to answer questions like:

- Which audiences are being hit redundantly across campaigns?

- How do different ad types work together to drive a sale?

- Where is my incremental lift actually coming from?

…then you need Amazon Marketing Cloud (AMC).

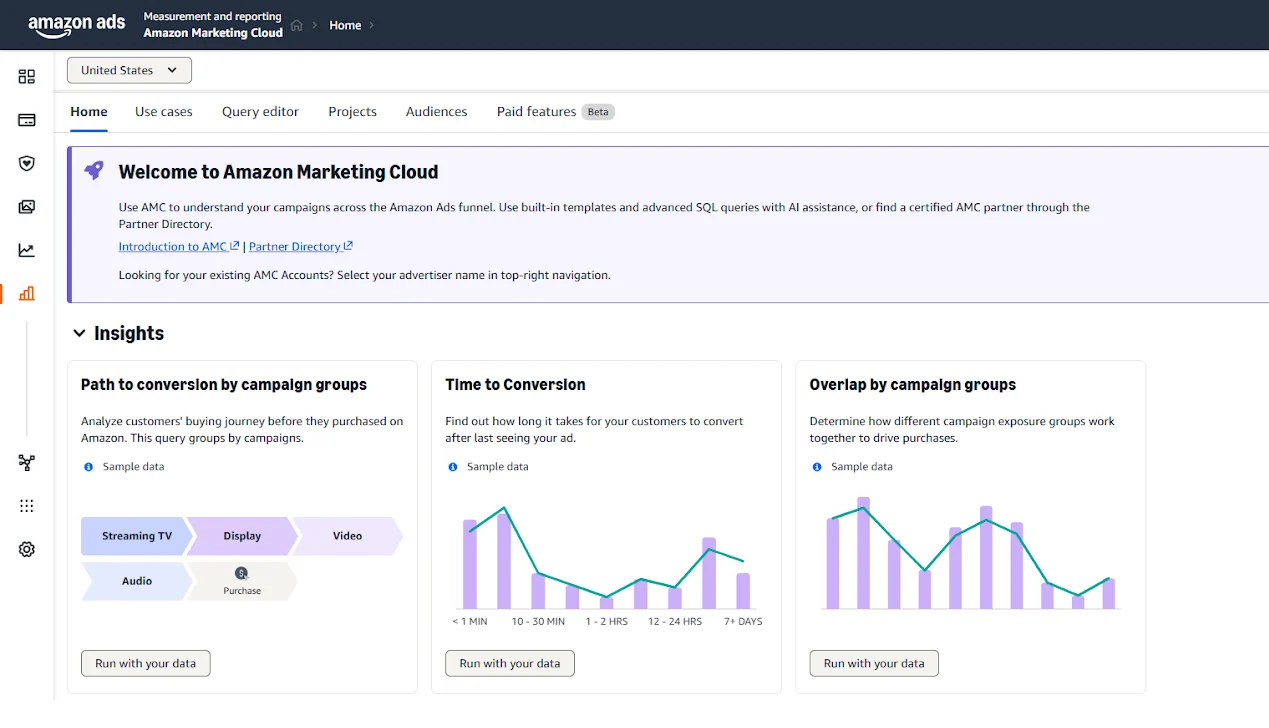

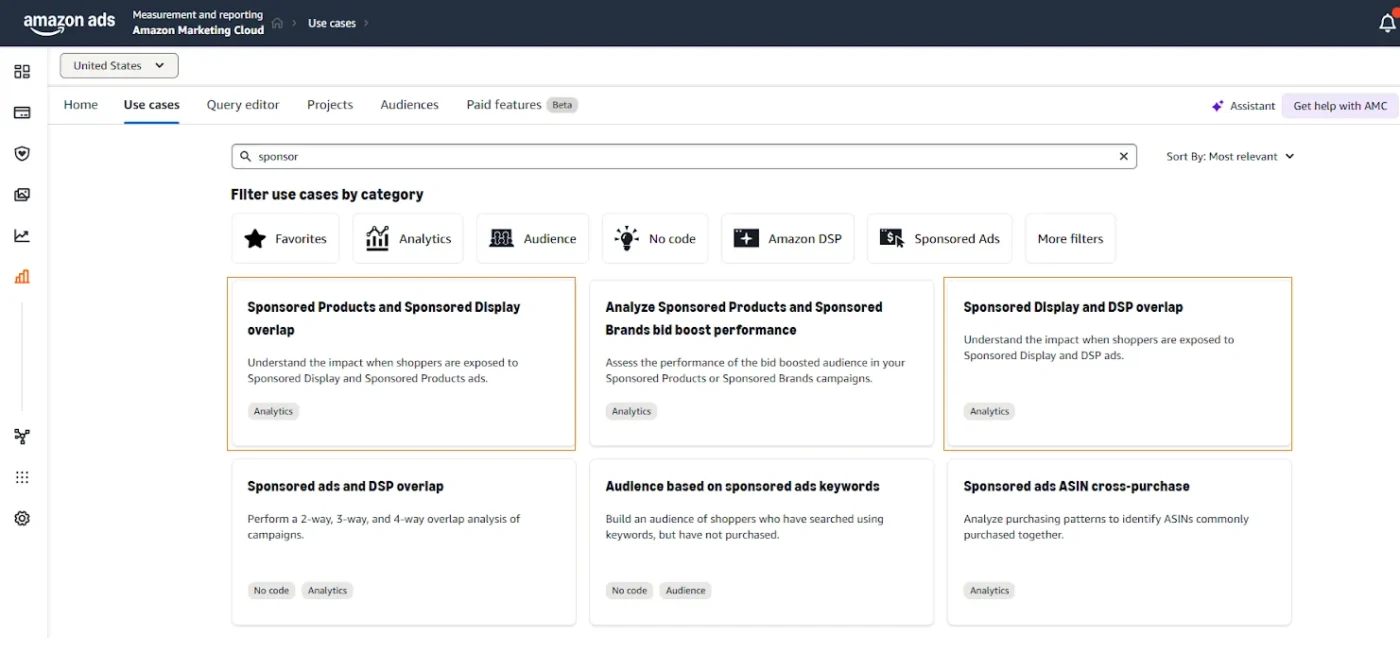

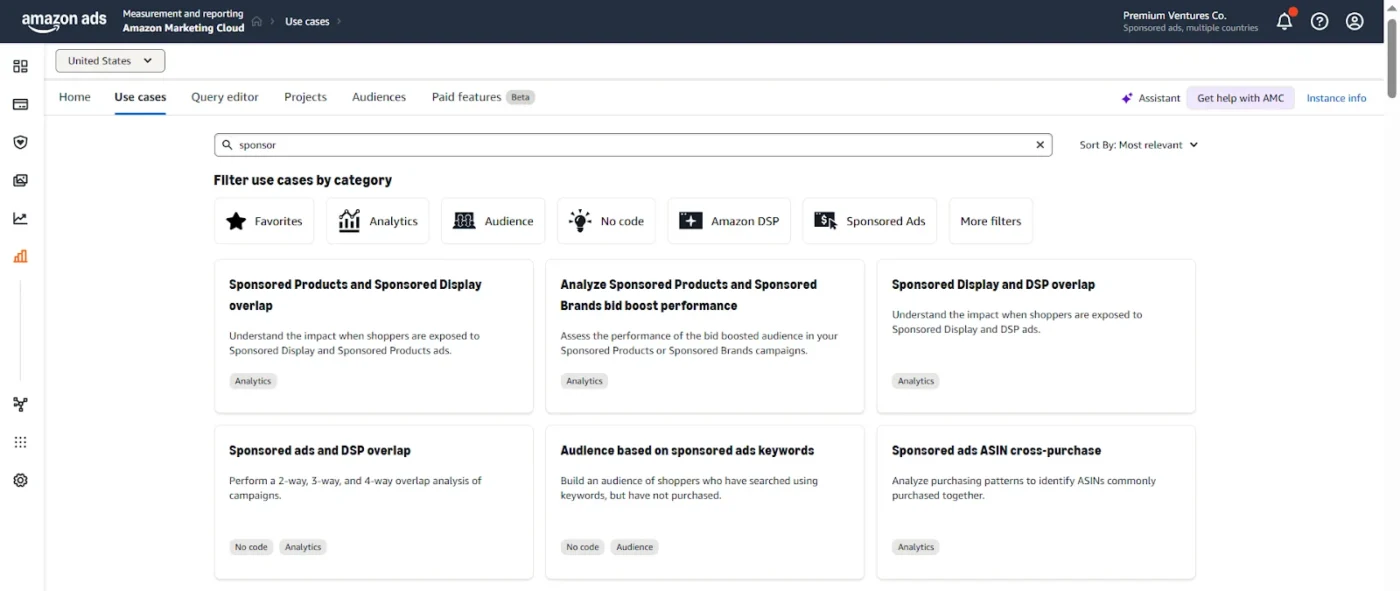

What is Amazon Marketing Cloud (AMC)?

Amazon Marketing Cloud, or AMC, is Amazon’s advanced analytics environment built for advertisers who want to move beyond surface reporting. It’s a privacy-safe, cloud-based clean room that gives access to event-level advertising data such as impressions, clicks, and conversions and allows you to analyze it in ways Seller Central and Brand Analytics simply can’t.

Built for Advanced Optimization

Where Seller Central locks you into pre-set dashboards, AMC is designed for flexibility and depth. Advertisers can query raw event data and stitch together cross-channel insights that reveal the real story of how ads drive conversions. It’s not about replacing Seller Central, but about layering strategic intelligence on top of operational reports.

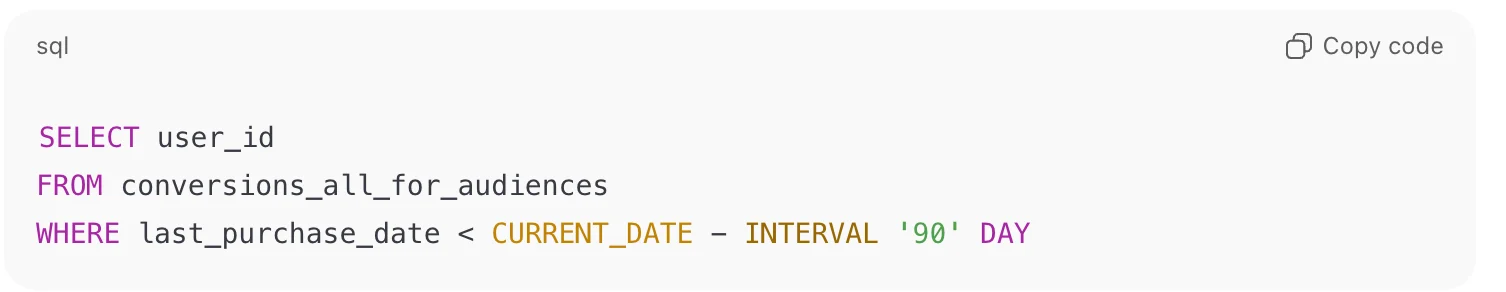

SQL-Driven Flexibility

Instead of fixed, one-size-fits-all reports, AMC uses a SQL-based query environment. This means you can ask highly specific questions about campaign performance like which ad types appear earliest in the conversion path, or how many times a shopper saw a DSP ad before clicking on Sponsored Products. The outputs are anonymized and aggregated, but the level of control you have over the analysis is far greater than anything inside Seller Central.

Why AMC Matters for Campaign Optimization

This flexibility tells about the deeper insights advertisers need to optimize campaigns more effectively:

- Cross-channel measurement: See how DSP and Sponsored Ads interact, rather than analyzing them in silos. For example, you might learn that Sponsored Brand impressions are more valuable when paired with DSP retargeting.

- Multi-touch attribution: Move beyond last-click reporting. AMC shows how each touchpoint contributes along the journey, helping you allocate spend based on incremental impact rather than surface-level credit.

- Custom audience creation and activation: Build custom audience segments directly from AMC queries, such as “cart abandoners in the last 7 days” or “repeat purchasers of premium SKUs” and activate them in DSP for precision targeting.

- Custom metrics and logic: Define KPIs that matter to your business. Want to measure lifetime value, frequency of exposure before purchase, or incremental ROAS? AMC gives you the tools to model it.

Why This Matters Compared to Seller Central

The key difference is shifting from reporting outcomes to understanding causes. Seller Central can tell you your ACOS or which keywords drove conversions, but it stops there. AMC goes further by showing why those results occurred, highlighting the touchpoints, audience segments, and campaign sequences that shaped the outcome. This shift transforms data from a static report into a roadmap for optimization.

How AMC Do Optimization Beyond Seller Central

Seller Central and Brand Analytics can help you track performance, but they don’t explain how different channels, touchpoints, and audiences actually drive conversions. This is where AMC becomes a true optimization tool which turns disconnected metrics into a connected view of the customer journey.

Cross-Channel Measurement

In Seller Central, Sponsored Products, Sponsored Brands, and DSP exist in silos. You know how each performs individually, but you can’t see how they work together. AMC solves this by linking data across channels.

For example, you can measure whether Sponsored Brand ads are more effective when followed by DSP retargeting, or how Sponsored Products perform after shoppers have been exposed to display ads. This gives you a complete view of the media mix instead of separate snapshots.

Comprehensive Data Analysis

AMC pulls event-level data on impressions, clicks, and conversions from across Amazon Ads. Advertisers can also incorporate their own inputs like CRM segments or offline purchase data to create richer, more customized analyses. The result is a single environment where you can ask complex questions that Seller Central dashboards can’t answer.

Advanced Use Cases That Drive Optimization

- Performance Deep Dives: Instead of just knowing ACOS, you can analyze how different campaigns contribute to conversions at various stages of the funnel.

- Audience Insights: Identify correlations between actions and attributes, such as whether repeat purchasers respond better to DSP than new-to-brand shoppers.

- Shopping Journey Analysis: Map the sequence of touchpoints that lead to a sale, so you can optimize ad timing and creative sequencing.

- Media Mix Modeling: Reallocate budget across Sponsored Products, Sponsored Brands, and DSP based on their combined incremental impact rather than siloed ACOS.

- Omnichannel Impact Assessment: Measure how Amazon Ads influence not only Amazon purchases but also sales in physical stores or other online channels.

- Custom Attribution Logic: Move past last-click attribution by applying models like time decay or engagement-weighted credit, giving a more accurate picture of ROI.

Custom Metrics Creation

Seller Central locks you into fixed KPIs like ACOS and ROAS. AMC allows you to build your own metrics that reflect business priorities such as new-to-brand lifetime value, repeat purchase contribution, or customer acquisition cost across touchpoints. This flexibility ensures your reporting matches strategy, not the other way around.

Audience Creation & Activation

One of AMC’s most powerful features is the ability to create custom audiences based on query logic. For instance, you can define “cart abandoners in the last 7 days” or “shoppers who viewed premium SKUs but didn’t convert.”

These audiences can then be pushed directly into Amazon DSP for precision targeting and that’s a level of activation Seller Central simply doesn’t support.

SQL-Based Insights for Strategic Questions

At the core of AMC is its SQL-driven environment. While Seller Central gives you fixed dashboards, AMC lets you frame questions in the language of data. Want to know how many ad exposures it takes before a conversion? Or which combination of DSP + SP ads delivers the highest incremental ROAS? AMC gives you the flexibility to build those queries and uncover answers specific to your business.

Solving Overlap & Cannibalization: A Key AMC Advantage

One of the biggest blind spots in Seller Central reporting is audience overlap. When you run multiple campaigns, it’s common for them to target many of the same shoppers often without realizing it. This overlap leads to two major problems:

- Budget cannibalization: You’re paying multiple times to reach the same people, inflating spend without increasing reach.

- Ad fatigue: Shoppers repeatedly see your ads across campaigns, which lowers engagement and reduces campaign effectiveness.

Seller Central reports can show performance metrics for each campaign in isolation, but they provide no visibility into whether those audiences intersect. This makes it impossible to know if you’re spending efficiently or cannibalizing your own budget.

How AMC Solves It

With Amazon Marketing Cloud, you can run overlap analysis using tools like Persona Builder.

This allows you to measure exactly how much redundancy exists between different campaign audiences. For example, you might find that 40% of the shoppers targeted by one Sponsored Products campaign are also being hit by a DSP retargeting campaign.

By uncovering this overlap, AMC provides a path to optimization:

- Apply exclusions: Separate segments cleanly so that one campaign focuses on new-to-brand customers, while another targets high-value repeat purchasers. This ensures every dollar is incremental rather than wasted on duplication.

- Enhanced scoring with Persona Builder API: AMC doesn’t just show overlap; it can also score and rank overlapping audiences based on value. For instance, some overlap might be worth keeping if those shoppers have a high repeat purchase rate. Scoring lets you prioritize which audiences to focus on and which to exclude, balancing efficiency with impact.

Why This Matters

This capability is critical because audience overlap is invisible in Seller Central and Brand Analytics. You can track clicks, impressions, or sales, but you cannot see if multiple campaigns are competing for the same eyeballs. AMC brings transparency, helping advertisers shift from spending broadly to spending intelligently.

The Optimization Payoff

By removing redundancy and focusing on high-value cohorts, advertisers can:

- Reduce wasted spend on duplicate impressions.

- Minimize ad fatigue for shoppers, improving engagement.

- Reallocate budget to audiences and channels that truly expand reach.

- Drive higher incremental ROAS by ensuring campaigns complement, not compete with, each other.

The Bottom Line: Seller Central can tell you how each campaign performed in a silo. AMC reveals how those campaigns interact with one another and gives you the tools to eliminate overlap and maximize efficiency.

Concrete Comparisons: AMC vs. Seller Central

The easiest way to see AMC’s value is to look at the kinds of questions each platform can answer. Seller Central and Brand Analytics give you operational and competitive data, but the view is siloed and surface-level. AMC, by contrast, connects those silos and reveals what’s happening underneath.

Here are some direct comparisons:

| In Seller Central / Brand Analytics | In Amazon Marketing Cloud (AMC) | Why It Matters |

| CTR by campaign → You can see which campaigns drove higher click-through rates. | Conversion paths across DSP + Sponsored Products + Sponsored Brands → Understand the sequence of touchpoints that led to a sale. | Instead of just knowing a campaign’s CTR, you can see how ad types work together and optimize sequencing. |

| ACOS by SKU → Surface-level efficiency at the product level. | Incremental ROAS by channel and time decay attribution → Measure the true contribution of each ad type across the journey. | You move from “which SKU is profitable?” to “which ad strategy delivers incremental growth?” |

| Top Search Terms report → Benchmark keywords and share of voice. | Budget cannibalization across overlapping audience segments → Detect redundant impressions and wasted spend. | Keyword share tells you where you rank, but overlap analysis tells you whether you’re wasting money competing against yourself. |

| Market Basket Analysis (MBA) → See what products are purchased together. | Audience-level insights (e.g., repeat purchasers vs. NTB) → Learn which audience types respond to different ads and tailor campaigns accordingly. | BA tells you what’s in the cart; AMC tells you who the shopper is and how they respond to ads. |

| Repeat Purchase Behavior report → Shows reorder rates. | Omnichannel impact assessment → See how Amazon ads influence purchases across Amazon and offline/other channels. | Seller Central tracks Amazon-only behavior; AMC shows how your ads ripple into total business impact. |

The Critical Difference

Seller Central tells you how individual campaigns or products performed in isolation. AMC shows you how channels, campaigns, and audiences interact with each other to produce results. That distinction is what unlocks optimization: shifting budgets, refining targeting, and preventing cannibalization

From Insight to Action: Campaign Optimization in Practice

The real power of AMC isn’t just in uncovering deeper insights, it’s in turning those insights into measurable performance improvements. Seller Central shows you what happened, but AMC gives you the levers to act on why it happened.

Budget Efficiency

In Seller Central, budget decisions often hinge on ACOS or ROAS at the campaign or SKU level. The problem is, those numbers don’t account for overlap or incremental lift. AMC changes that by showing where dollars are being wasted such as redundant impressions across campaigns and where they’re truly driving incremental conversions. This allows you to reallocate spend away from low-lift or overlapping channels and into the placements that actually expand reach.

Example: AMC reveals that 30% of DSP impressions are hitting the same audience already targeted by Sponsored Products. By excluding that overlap, budget can be shifted into DSP audiences that add new reach, improving incremental ROAS.

Audience Precision

Seller Central can tell you who clicked or purchased, but it can’t tell you if the same shopper is being targeted by multiple campaigns. With AMC, you can run overlap analysis, then apply audience exclusions to separate segments cleanly. This prevents cannibalization and ensures that each campaign is focused on distinct, high-value cohorts.

Impact: Instead of paying twice to show ads to the same audience, you spend once and use the savings to target untapped audiences.

Creative Sequencing

Another area where AMC unlocks optimization is creative timing. Seller Central doesn’t track when a shopper was exposed to different ad types, only that they eventually converted. AMC, however, lets you analyze paths to conversion, showing which ad types are most effective at the start, middle, or end of the journey.

Optimization move: You might learn that Sponsored Brands work best as a top-of-funnel touchpoint, while Sponsored Products convert more effectively when shown later. This insight helps you structure campaigns in sequence rather than treating them as standalone efforts.

Experimentation & Incrementality Testing

One of AMC’s most advanced capabilities is running controlled experiments. Seller Central can report on campaign results, but it can’t separate incremental lift from baseline performance. AMC allows you to set up incrementality tests, apply custom attribution models (such as time decay), and measure how much additional value ads are generating.

Example: By testing DSP retargeting against a control group, you can quantify whether those ads are actually adding conversions or simply capturing sales that would have happened anyway.

The Critical Difference: Seller Central can track performance, but it leaves you guessing on what actions to take. AMC closes that gap by connecting insights directly to optimization moves — from smarter budget allocation to cleaner audience targeting and data-driven creative sequencing.

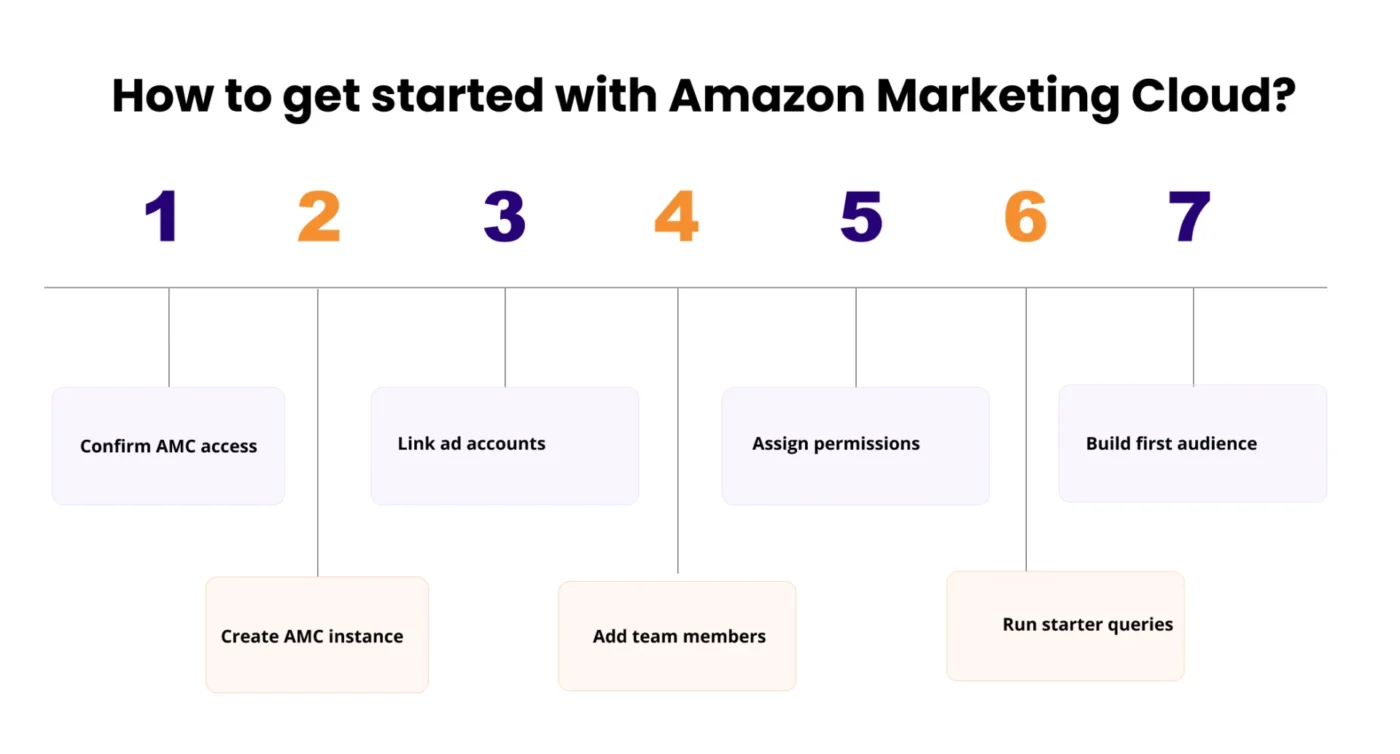

Getting Started with AMC

Moving from Seller Central reporting to AMC can feel like a leap, but with the right setup, the transition is straightforward. Here’s what advertisers need to know:

Eligibility and Access

The good news: AMC is now accessible to all advertisers, not just those with DSP contracts or agency partnerships. This makes advanced analytics available whether you’re a small brand or a large enterprise.

Setup and Permissions

Access to AMC requires the correct user permissions in Amazon Ads. Make sure your team has the right roles assigned (e.g., analyst or admin). You’ll also want to align with your internal teams on data governance since AMC allows integration with your own advertiser-provided inputs.

Common Pitfalls to Avoid

- Aggregation thresholds: To protect shopper privacy, AMC only returns aggregated results. Queries must meet minimum thresholds (e.g., at least 100 users per row), so results may not always be as granular as you expect.

- SQL learning curve: AMC uses a custom SQL dialect. If your team hasn’t worked with SQL before, start with Amazon’s query library or prebuilt templates.

- 48-hour data latency: Unlike Seller Central’s near-real-time reports, AMC data has a ~48-hour lag. It’s not meant for daily monitoring but for deeper, strategic analysis.

Best Practices for Success

- Start simple: Use template queries to answer foundational questions like new-to-brand orders or path-to-conversion.

- Validate results: Cross-check AMC outputs against Seller Central reports to ensure consistency.

- Document insights: Keep a record of queries, results, and business actions taken. This builds a knowledge base your team can scale.

- Iterate: Once comfortable, progress to advanced use cases like overlap detection, custom attribution, and incrementality testing.

Critical takeaway: While Seller Central is plug-and-play, AMC requires setup and learning. But that investment pays off as AMC unlocks optimization levers you can’t access with surface-level reporting

When to Use AMC vs. Seller Central

Understanding when to use each tool is key to building a complete reporting and optimization workflow.

Seller Central: Daily Operational Monitoring

- Best for tracking live campaign health: impressions, spend, ACOS/ROAS.

- Useful for keyword management and quick checks on product-level performance.

- Provides fast visibility but only at a surface level.

AMC: Strategic Analysis and Optimization

- Best for deep dives into campaign performance across channels.

- Critical for audience overlap detection, multi-touch attribution, and incrementality testing.

- Provides the “why” behind results, helping you decide how to reallocate budget, refine targeting, and build smarter audiences.

Using Both Together: Tactical + Strategic Optimization

The most effective advertisers use both tools in tandem:

- Seller Central for day-to-day monitoring.

- AMC for weekly or monthly strategy reviews that inform long-term optimizations.

Conclusion

AMC is not a replacement for Seller Central, it’s an upgrade layer. Seller Central will always be the go-to for daily campaign checks and operational reporting. But if you want to understand why performance looks the way it does and how to optimize it, Seller Central alone won’t cut it.

The key message is simple: AMC provides the depth that Seller Central lacks. It connects channels, reveals audience overlap, shows multi-touch attribution, and allows you to create custom metrics and audiences.

So, advertisers, all you need to do is audit your reporting gap, run one AMC use case, and integrate AMC into your optimization process. Use its insights to reallocate spend, refine targeting, and run incrementality tests on a recurring basis. Book a free consultation call now to see how we have transformed the advertising game of Amazon by incorporating Amazon Marketing Cloud into our processes.