Key Takeaways

- Looking at Amazon PPC metrics one by one can mislead you. Real insight comes from seeing how visibility, sales, and profit connect across your Amazon PPC management.

- Only a few Amazon PPC metrics show real performance. CVR, DPVR, TACoS, and contribution margin tell you more than clicks or impressions.

- Amazon ads dashboards don’t explain why results change. Strong Amazon PPC management reads metrics alongside keyword intent, listing quality, competition, and category trends.

- Amazon PPC metrics drives better profit. When you see how each number affects the full chain, decisions get faster and wasted spend drops.

- Not every Amazon PPC service tracks the same numbers. Fast-growing and margin-tight brands should focus on profit and conversion metrics, while early brands may focus more on visibility and learning.

Amazon PPC data looks straightforward at first glance, but most metrics reveal only part of the story. The Amazon Ads Console focuses on activity, not on the factors that drive efficiency or profitability. This gap leads many brands to misread performance and make decisions that slow down growth.

The challenge is simple. Amazon provides a lot of data, but not all of it reflects performance. Brands often make decisions from surface-level signals. That leads to wasted spend, stalled scalability, and a constant sense of uncertainty.

Clarity changes everything. When you know which metrics highlight true visibility, conversion strength, and long-term profitability, your decisions become sharper and more confident. You understand where growth is coming from. You see where efficiency breaks and regain control.

This guide helps you reach that point. You will learn how to identify the Amazon PPC metrics that matter, how to interpret them with precision, and how to use them to support consistent, scalable growth.

Why Amazon PPC Metrics Are Often Misleading

Most performance dashboards look clear at first, but the metrics inside them reveal only fragments of the real picture. The Amazon Ads Console highlights activity, not the underlying factors that influence visibility, conversion, or profitability. This limited view causes many brands to interpret signals incorrectly and make decisions that hold back growth.

Surface Metrics Create False Confidence

A metric can look positive while the system underneath weakens. This is where many sellers lose clarity. Surface-level wins often mask deeper issues in targeting, listing strength, or category pressure.

Examples that look strong but rarely translate into real growth include:

- High CTR generated by the wrong audience

- Low ACoS during periods of flat overall sales

- Cheap CPC because competitors temporarily reduced bids

These movements feel reassuring, yet they tell only a fraction of the story. Without understanding what caused the shift, it is easy to scale the wrong terms, protect the wrong campaigns, or make adjustments that interrupt momentum.

Metrics Shift for Reasons Unrelated to Performance

Amazon PPC data often moves even when your campaigns stay the same. The marketplace around you changes constantly, and those shifts influence your numbers long before your strategy does. Visibility may climb during Amazon’s placement tests. Costs can rise when more brands enter the auction. Conversion may soften when demand dips or shoppers compare multiple options before buying.

These movements can appear sudden, but they follow the natural rhythm of category dynamics and shopper behavior. When you understand that context, you avoid reacting to noise and keep your decisions grounded in clear insight and genuine performance signals.

Reading Metrics in Isolation Leads to Wrong Decisions

Many sellers evaluate Amazon PPC by looking at one metric at a time. That approach removes the context that explains shopper intent, competitive pressure, listing strength, and margin requirements. A number on its own cannot tell you why performance shifted or what decision will strengthen the campaign.

Common patterns that lead to incorrect conclusions include:

- Checking impressions without confirming the keywords driving them

- Reviewing conversion without assessing the clarity of the product page

- Judging ACoS without understanding margin or FBA inventory management

When metrics are reviewed individually, sellers often cut bids, pause campaigns, or shift spend in ways that disrupt momentum. This reactive approach creates risks that could have been avoided with a more connected reading of the data.

True Insight Comes From How Metrics Connect

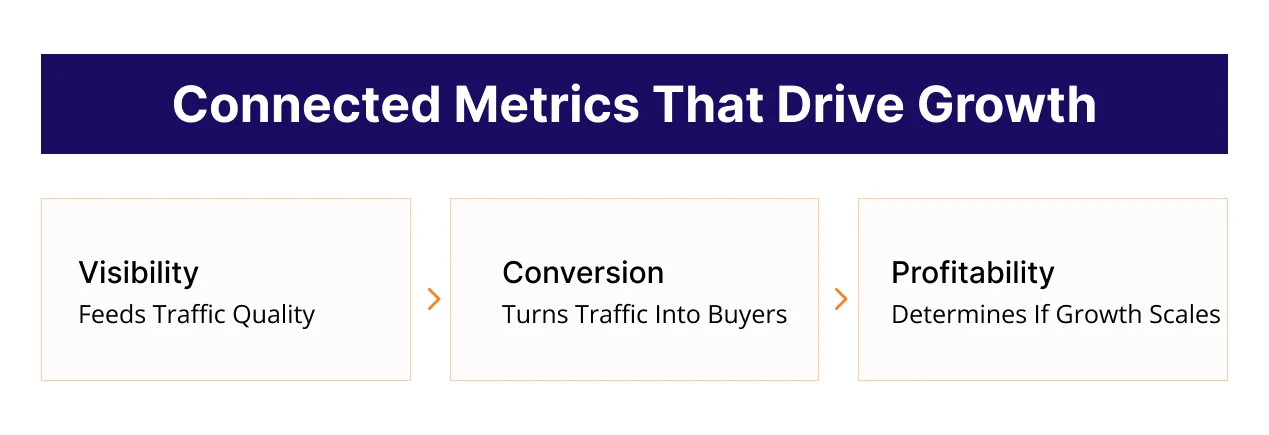

Clarity appears when you follow how one signal influences the next. Each metric sits inside a broader chain of shopper behavior. When one part shifts, another explains the reason. Reading these relationships reveals the true performance drivers and highlights opportunities in your Amazon PPC campaigns.

Examples that show accurate interpretation include:

- High CTR paired with low CVR, which signals a mismatch between shopper expectations and listing clarity

- Low ACoS and flat sales, which indicates efficiency without growth

- Rising CPC during stable intent signals, which usually reflects increased category aggression rather than campaign inefficiency

When you read metrics as a sequence instead of individual events, every decision becomes more deliberate and every adjustment supports long-term performance.

The Key Amazon PPC Metrics That Actually Reflect Performance

Strong Amazon PPC management relies on a small set of metrics that show whether your setup is really working. These metrics show if the right shoppers can see you, if they take action, and if your spend is moving toward profitability. Understanding Amazon PPC metrics helps you grasp the real health of your advertising system.

Visibility Metrics (Are the Right Shoppers Seeing You?)

Visibility metrics show how Amazon interprets your relevance and competitiveness. They help you understand whether your campaigns qualify for placements that matter.

Impressions

Impressions show how often Amazon chooses your ads as eligible for the auction. They reveal category movement as much as campaign strength. When impressions rise but clicks remain flat, shoppers normally see your ads but do not find the visual or title aligned with their intent.

CTR

CTR reflects how accurately your creative and listing match the query. High CTR signals strong alignment. Lower CTR usually means targeting drift or unclear visual cues. It is common to see CTR increase during broad match testing even when conversions drop, which usually means the campaign is capturing interest without attracting true buying intent.

CPC

CPC shows the level of competitive pressure in your category. Strong ads can still face rising CPC when demand increases or when competitors scale aggressively. A higher CPC does not automatically signal inefficiency. It often reflects market shifts rather than mistakes within the campaign.

Conversion Metrics (Are Shoppers Taking Action?)

Conversion metrics show whether your listing and offer resonate with the traffic you attract. They reveal how well your product experience supports the intent that brought shoppers in the first place.

CVR (Conversion Rate)

CVR is the clearest indicator of Amazon product listing strength. It exposes whether shoppers find enough value to commit. Across multiple audits, conversion rate often reveals listing issues long before ACoS or ROAS change, especially when a product sits beside stronger alternatives.

Detail Page View Rate (DPVR)

DPVR helps you understand traffic quality before conversion becomes part of the equation. When impressions stay healthy but DPVR falls, shoppers typically recognize that the ad does not match their search intent. That pattern usually signals that your keyword mix has shifted into lower quality searches.

Add-to-Cart Rate

Add-to-cart rate shows early purchase intent. It is often the first metric to improve after listing enhancements. When add-to-cart rate rises before conversion increases, it signals that shoppers see stronger value but have not yet completed the final step.

Profitability Metrics (Is Growth Sustainable and Worth the Spend?)

Profitability metrics shape decisions about scaling. They reveal whether increased visibility and conversion can support long-term growth.

ACoS

ACoS shows the direct cost of generating revenue through ads. It is helpful for immediate efficiency checks but should not be used to judge long-term Amazon PPC strategy on its own.

TACoS

TACoS shows how ads influence organic sales. It becomes meaningful when you evaluate it alongside organic movement. When TACoS drops during a sales increase, campaigns usually strengthen your organic rank. Many brands overlook this connection and misread a stable TACoS as poor performance when the real story is flattening organic contribution.

ROAS

ROAS shows revenue returned per advertising dollar. It gains value when viewed beside your margin structure. A campaign may show excellent ROAS yet remain unscalable if category CPCs grow faster than your margin can support.

Contribution Margin

Contribution margin shows how much profit remains after fees and advertising. Brands with stable margin trends often maintain consistent inventory flow and strong buy box control. When either of these weakens, profitability collapses even if campaign-level metrics still look stable.

How These Amazon PPC Benchmark Metrics Work Together

Amazon PPC performance makes sense only when you read the most important Amazon PPC metrics in sequence. Each stage influences the next. When one link weakens, the entire system shifts. This is why strong decisions come from understanding the chain rather than reacting to a single number.

Visibility Leads Into Conversion

Visibility metrics confirm whether shoppers can actually reach your offer. But visibility without action offers little value. When campaigns earn reach but fail to move shoppers forward, the issue is rarely traffic volume. There is usually a gap between what shoppers expect and what they see when they arrive. We often find situations where CTR looks healthy, yet conversion stays muted because the product story does not build enough confidence in the next step.

Conversion Shapes Profitability

Conversion metrics show whether the traffic you earned can translate into revenue. When conversions remain weak, acquisition costs climb and long-term return becomes fragile. Even strong conversion performance can struggle if the product positioning does not support efficient scaling. In many accounts we review, sellers attempt to control ACoS by lowering bids, which slows momentum and raises the cost of recovery later.

Profitability Determines Scalability

Profitability metrics reveal whether campaigns can grow without damaging the business. A campaign may look efficient today but fail to support long-term visibility if organic strength stagnates. TACoS paired with stable organic ranking on Amazon is often the signal that scaling is possible. ROAS alone cannot confirm this, especially in categories where rising CPC outpaces margin capacity. When profitability cracks, growth stalls regardless of how the upper metrics look.

Practical Ways to Use Metrics For Better Amazon PPC Decisions

Metrics only create value when they drive the right adjustments. These principles help you act with precision instead of reacting to noise.

Validate Keywords With Intent Signals

A keyword earns more budget when shoppers move through the funnel with consistency. Look for a pattern where clicks lead to meaningful actions. If the pattern stalls, keyword refinement produces better outcomes than scaling. Many stalled campaigns improve simply by reallocating spend toward terms that show predictable user movement.

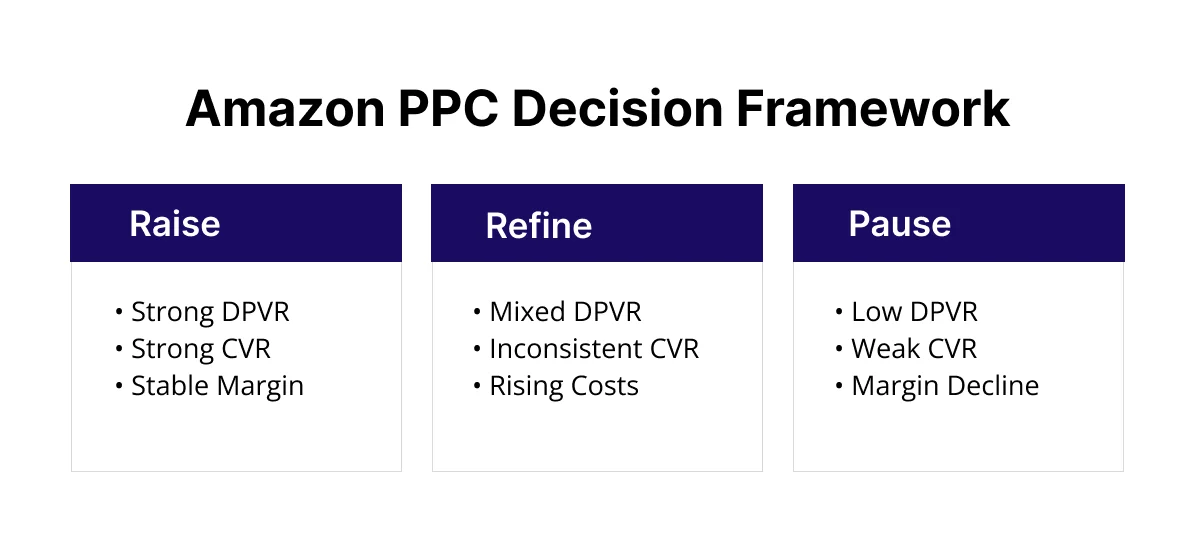

Choose When to Raise, Refine, or Pause

Raise bids when a keyword already demonstrates proven intent. Refine targeting when you see shallow engagement. Pause only when signals remain flat after changes. Most accounts lose momentum because bids are cut before the system finishes learning.

Spot Listing Issues Through CVR

When your conversion rate starts to soften, it is often the first sign of trouble. Especially when you have not changed campaigns or bids. This usually means shoppers are hesitating on your listing. Maybe the message is unclear. Maybe the flow does not answer their questions. That hesitation shows up in CVR before revenue drops. By improving Amazon listing quality, you help buyers feel confident again. And you often restore performance faster than chasing bid changes.

Interpret TACoS Through Trend Behavior

TACoS rises for different reasons. If sales increase at the same time, the rise often indicates expanding visibility. If sales stay flat, the increase usually reflects wasted spend. Reading these trends correctly prevents unnecessary cutbacks during periods of healthy growth.

Recognize Market Pressure Before Changing Structure

Performance can dip even when the setup is sound. When competitors scale aggressively, costs rise before your campaigns adjust. If your strongest Amazon PPC keywords remain steady while CPC increases, the shift normally comes from the market, not your strategy. Correcting structure in these moments creates setbacks.

Follow a Weekly Review Sequence

Start with visibility to confirm reach. Check intent signals to verify that traffic remains aligned with your offer. Review profitability last to understand whether momentum can scale. This sequence keeps decisions grounded in progression, not isolated numbers.

Conclusion

The right metrics reveal what’s really happening inside your campaigns. When you read visibility, conversion, and profitability together, decisions become clearer and spend stays under control.

Your next step is to review these signals as one performance chain. Validate intent, check listing quality, and adjust bids only when core metrics align.

AMZDUDES delivers Amazon PPC services built around this metrics-first approach. Our team reads data the way Amazon rewards it, so performance improves without added risk.

If you want a clearer view of your Amazon PPC performance, book a strategy call with our experts today.

Frequently Asked Questions about Top Amazon PPC Metrics for Amazon

What Amazon PPC metrics are there?

Amazon PPC performance revolves around visibility, intent, and profitability metrics. The core metrics include impressions, CTR, CPC, DPVR, CVR, add-to-cart rate, ACoS, TACoS, ROAS, and contribution margin.

Which Amazon PPC metrics are positively or negatively correlated?

CTR and CVR often rise together when targeting and listing clarity are aligned. CPC and margin efficiency often move in opposite directions in competitive categories. TACoS and organic sales normally move in sync when rank improves.

What metrics indicate a strong Amazon PPC campaign?

A healthy campaign shows stable visibility, consistent intent signals, and predictable profitability. Strong DPVR and CVR confirm that the right shoppers are reaching your listing. TACoS stability indicates that ads support organic performance.

Which metric matters more for Amazon PPC: bounce or time?

For Amazon PPC, bounce and time on page carry less weight than DPVR and CVR. Amazon prioritizes signals that show whether shoppers explored the listing and moved closer to purchase.