What is Changing on Amazon’s Reimbursement Policy Update?

Amazon has recently announced a delay in the implementation of its cost-based reimbursement policy update, creating some confusion among third-party (3P) sellers. The update, set for March 31, 2025 previously set for March 10, 2025, is supposed to change the way sellers could receive reimbursement for Amazon items damaged or lost. Instead of an average selling price upon which reimbursement was based, sellers would now be reimbursed based on their costs, a change that could severely affect profitability.

By delaying the implementation of the cost-based approach for reimbursement, Amazon has provided some immediate relief for FBA sellers on Amazon, but familiarizing themselves with those changes is critical for preparedness once the policy kicks in.

How Does the Amazon Reimbursement Policy Work?

Amazon’s reimbursement policy decides how sellers will get reimbursed for inventory that went missing or was damaged, or disposed of within the FBA network. Currently, the reimbursements are done based on Amazon appraising an item’s fair market value, using often recent sales data. The change is that the policy will now adopt a cost approach, wherein sellers themselves will provide proof of purchase costs to sustain a fair reimbursement level.

Key Terms You Need to Know

- FBA Reimbursement Policy – Guidelines that dictate how Amazon compensates sellers for lost or damaged inventory.

- FBA Reimbursement Report – A report in Seller Central that details reimbursements for damaged or lost inventory.

- Cost-Based Reimbursement – The new model plans to implement, which will require sellers to submit cost data for Amazon reimbursement claims.

Why Amazon Delayed the Reimbursement Policy Update?

There is no clear public explanation from Amazon regarding the postponement. According to seller feedback on various forums and industry discussion spaces, Amazon probably still needs some time to streamline the implementation process. One of the many complaints that some sellers raised is the difficulty in reporting an accurate cost, particularly involved with information on how long inventory has resided in the seller’s storage.

As per EcommerceBytes, there were many sellers disgruntled over the ambiguity on “what counts to provide as valid cost documentation“. While the delay is longer for sellers to get used to changes, it further extends the uncertainty of reimbursement calculations.

What the Delay Means for the 3P Sellers?

1. The Current Model Is in Effect for the Time Being

Right now, Amazon continues with the prevailing model for determining reimbursements, thereby giving a little element of predictability in monetary planning. Sellers still need to monitor their Amazon quantity limits via FBA Reimbursement Report in Seller Central so they can know that the money they are receiving is fair.

2. Preparing for More Time for Cost Documentation

Once the policy takes hold, a proof of cost such as invoices and receipts will have to be submitted by sellers – so right now is the time to begin putting together purchase records and making sure that your accounting easily can pull cost data.

3. Changes in Reimbursement Amount

Under a cost-based model, it’s likely that the reimbursement amount will be lower for sellers with who had purchased inventory at a lower cost but priced more on Amazon. On the contrary, the sellers with high-cost inventory will receive their reimbursements more accurately.

| Current Reimbursement Model | Cost-Based Reimbursement Model |

| Based on Amazon’s estimate of fair market value, considering recent sales data. | Based on seller-submitted cost documentation (e.g., invoices, receipts). |

| May reflect an average selling price, which can be higher or lower than actual costs. | Directly tied to the seller’s reported product cost, potentially reducing reimbursement amounts. |

| None required; Amazon determines value automatically. | Sellers must provide proof of product cost, increasing administrative tasks. |

| Higher reimbursements for those selling at premium prices but potentially inconsistent valuations. | More predictable but may result in lower reimbursements if purchase costs are low. |

| Currently in use. | Delayed, expected to roll out later. |

Steps to Take Before the Policy Goes Live

#1 Audit Your Inventory Costs

Commence cost examination for selling items on Amazon, and ensure that all records are updated, thus preparing you for tomorrow’s quick response in case Amazon starts asking for cost documentation.

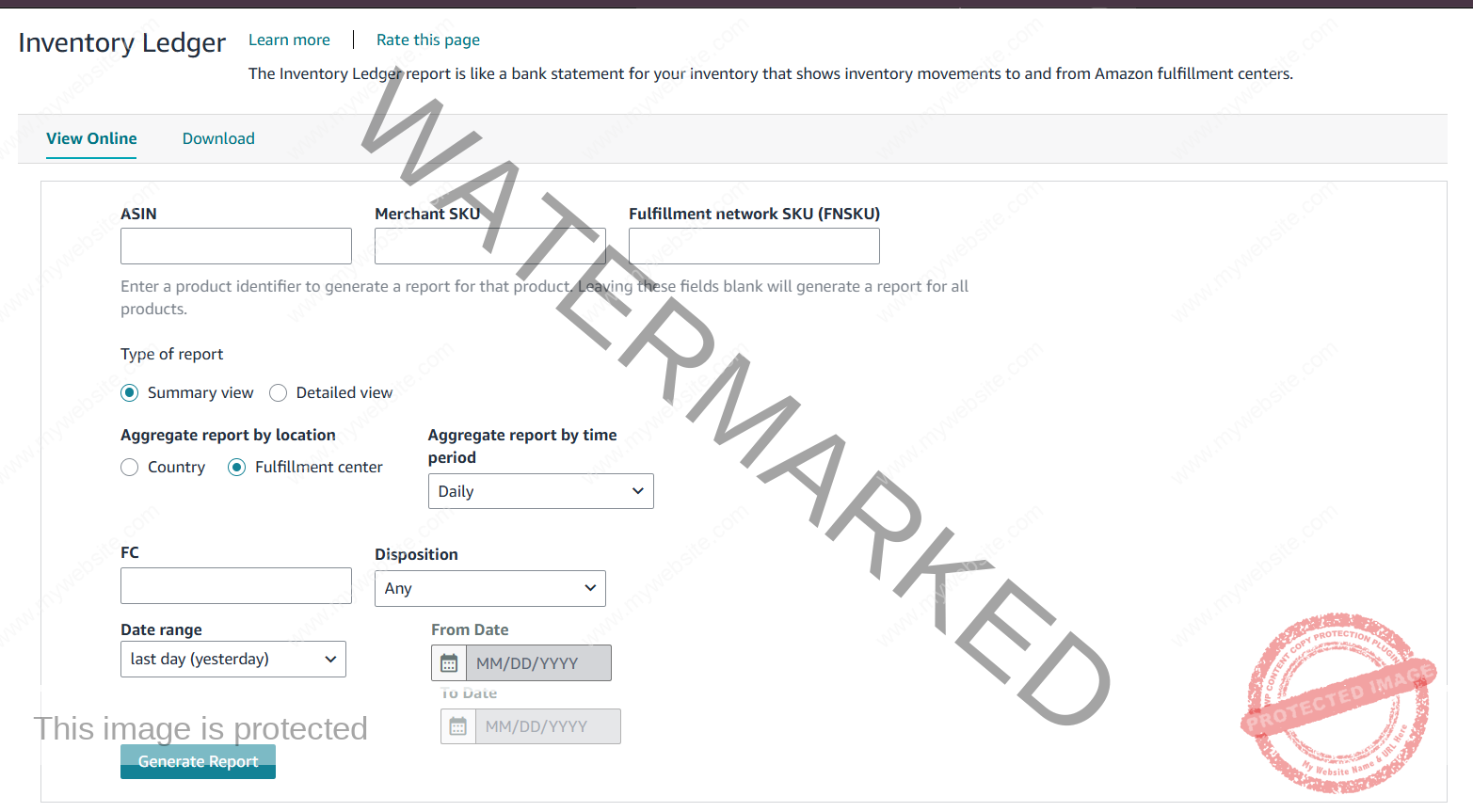

#2 Download & Analyze Your Inventory Ledger report

You can find your Amazon report via Seller Central, in Reports > Fulfilment > Inventory Ledger report. Focus on patterns of lost or damaged inventory, and check for fairness in Amazon seller reimbursement.

#3 Prepare Valid Cost Documents

Amazon might ask for invoices, receipts, or other proof of purchase. Make sure all your suppliers provide documentation to avoid slowing down any reimbursement claims.

#4 Stay Updated on Policy Announcements

Since Amazon could initiate all updates any time, monitor Seller Central notifications, Amazon Seller Discussion, Seller Central Help, as well as industry news sites like Carbon6 for updates.

Potential Challenges for 3P Sellers

While the delay offers short-term relief, sellers should be aware of potential challenges when the policy goes live:

- Smaller sellers may struggle with cost documentation. Some resellers and arbitrage sellers buy inventory from retailers rather than suppliers, making it difficult to provide formal invoices.

- Increased administrative burden. Sellers will need to spend more time tracking and submitting cost data, potentially slowing down the reimbursement process.

- Risk of underpayment. If Amazon disputes cost submissions, some sellers might receive lower reimbursements than expected.

What 3P Sellers Can Do to Protect Their Profits

- Amazon Reimbursement Services – Professional Agencies for Amazon sellers provide FBA reimbursement services to ensure that you get the maximum compensation for lost or damaged inventory.

- Automate Cost Tracking – Use accounting software to create accurate cost records. This will help provide documentation when needed.

- Negotiate for Better Supplier Invoices – Ask wholesale suppliers for clear itemized invoices to facilitate cost reporting.

- File Claims Promptly – Keep a close watch on inventory adjustments and file a claim when discrepancies arise on Seller Central.

FAQs

How to change Amazon phone number?

To change phone numbers on amazon, go to Your Account > Login & Security. Click Edit next to your phone number, enter the new number, and verify it with the OTP Amazon sends.

How to close an Amazon seller account?

To close your Amazon seller account, go to Seller Central > Settings > Account Info, then scroll down and select Close Account. Make sure you have no Amazon package delays or unresolved issues before submitting the request.

How much does it cost to start an Amazon FBA?

Starting costs vary but typically include inventory purchase, Amazon fulfillment costs, and the $39.99/month professional seller subscription. Additional costs include storage, shipping, and advertising.

How to calculate sell price from cost and margin?

Use this formula: Selling Price = Cost Price ÷ (1 – Profit Margin %). For example, if your cost is $10 and you want a 30% margin, the selling price would be: $10 ÷ (1 – 0.30) = $14.29.

Will Amazon do price adjustments?

Amazon generally does not offer price adjustments after purchase. However, third-party sellers can update their pricing based on market trends, and buyers may request refunds under specific return policies.

Does selling on amazon cost money?

Yes, selling on Amazon costs money. Sellers can choose between an Individual Plan (paying $0.99 per item sold) or a Professional Plan ($39.99/month). Additional costs include referral fees, FBA fees (if using Fulfillment by Amazon), storage fees, and advertising expenses.

Final Thoughts

Amazon’s delay in rolling out the cost-based reimbursement policy gives 3P sellers room for Amazon price adjustments, but the change is inevitable. By preparing in advance, sellers can ensure they continue receiving fair compensation for lost or damaged inventory. Now is the time to review cost records, strengthen documentation processes, and stay informed on policy updates.

For expert account management, Amazon advertising and listing optimization visit AMZDudes. Contact us today!