“Before working with AMZDUDES, our products were on page 5. Within the first two months, their targeted keyword strategy and listing optimization pushed our main products to the top 3 spots. We saw an immediate 40% jump in organic traffic due to which our number of sales is also increasing. Highly recommended Amazon SEO services.”

Amazon PPC Case Study: Scaling a Health & Household Brand Beyond In-House Limits

Client Background

The client is a Health & Household brand on Amazon, selling everyday wellness products with proven product-market fit. The listings had strong customer reviews and generated consistent baseline Amazon sales.

Amazon PPC was managed in-house. The internal team handled daily Amazon Advertising tasks, including keyword targeting, bid adjustments, and budget management. While the product performed well, advertising execution relied heavily on manual optimizations inside Seller Central.

Over time, Amazon sales growth plateaued. Monthly revenue stopped increasing, and attempts to scale ad spend resulted in a sharp increase in ACOS, putting pressure on margins. Despite spending more time managing campaigns, performance gains became smaller and less predictable.

At this stage, the brand partnered with AMZDUDES to review its Amazon PPC setup, restructure campaign architecture, fix structural issues, and scale advertising through a more controlled and repeatable approach.

The Challenge: Scaling Amazon PPC Without Losing Profit

The brand had a proven product and consistent demand in the Health & Household category, but Amazon sales had plateaued.

Amazon PPC was managed in-house. Campaigns were active, budgets were being adjusted, and ads were driving sales but scaling spend no longer translated into scalable growth. Any increase in budget led to higher ACOS and tighter margins, making growth feel risky instead of repeatable.

Several issues became clear over time:

- Unpredictable Amazon PPC performance: Small bid or budget changes caused large swings in results, making it difficult to scale with confidence.

- High manual workload: The team spent significant time inside Seller Central adjusting bids, pulling reports, and reacting to performance instead of focusing on growth decisions.

- Dependence on ads for visibility: Reducing ad spend led to drops in organic ranking, creating pressure to keep spending just to maintain sales.

- Rising CPCs and competition: Larger brands with higher budgets increased cost-per-click, making it harder to stay profitable at scale.

- No clear scaling framework: Campaigns were running, but they were not structured to support long-term growth, keyword expansion, or ranking improvement.

At this stage, continuing to manage PPC in-house meant more effort for diminishing returns. The brand needed a way to increase Amazon sales while keeping ACOS, margins, and rankings under control.

Our Strategic Approach: Scaling Amazon PPC With Control and Profitability

When we partnered with brand, campaigns were built around large, catch-all keyword groups, where broad, generic searches and high-intent buyer terms were mixed together. This made it impossible to control spend, isolate what was actually driving sales, or scale winning searches profitably.

We corrected this by applying a structured, step-by-step Amazon PPC framework focused on tighter campaign control, clearer search intent targeting, and disciplined scaling only after profitability and efficiency were restored.

Phase 1: Fixing Campaign Structure and Budget Allocation

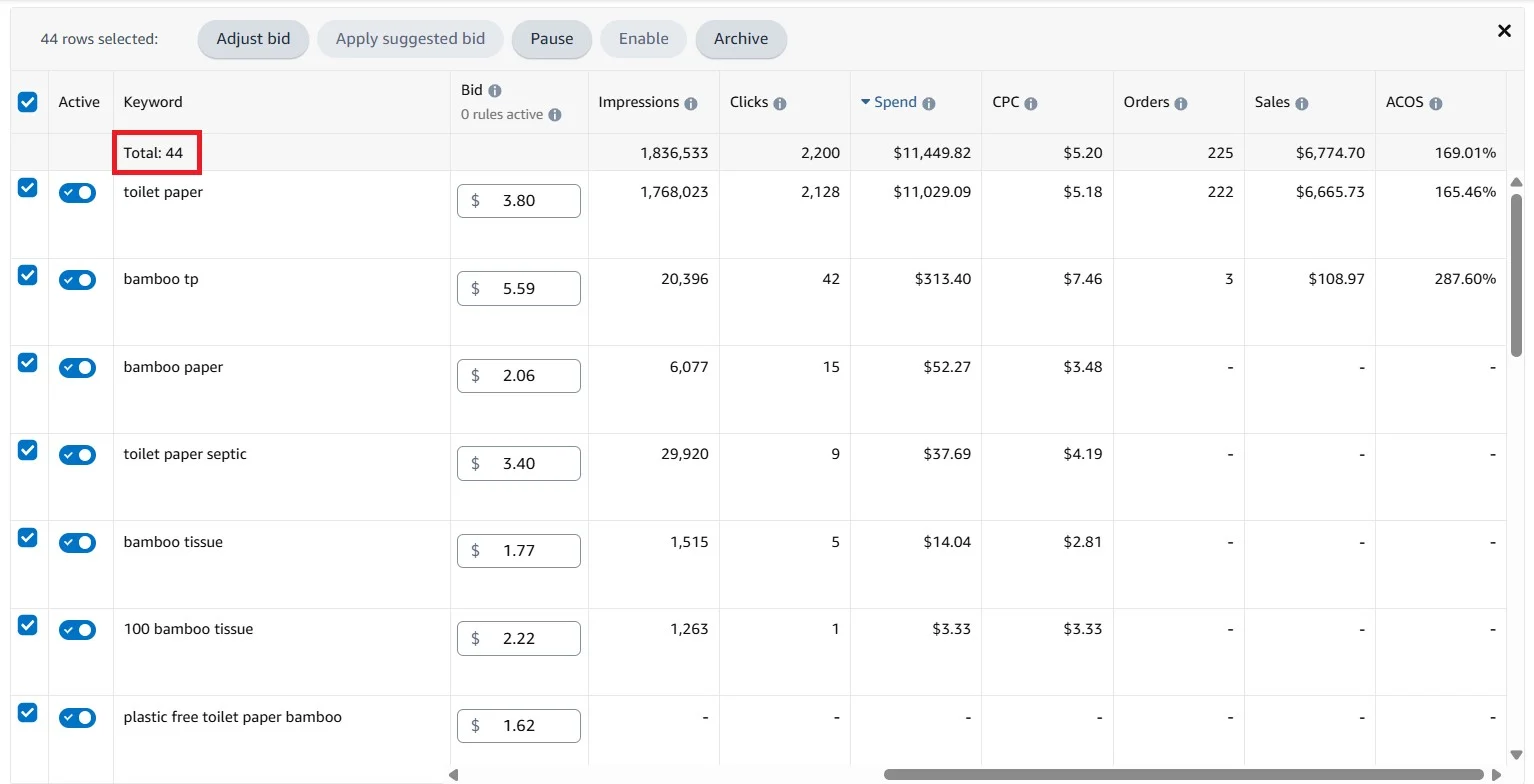

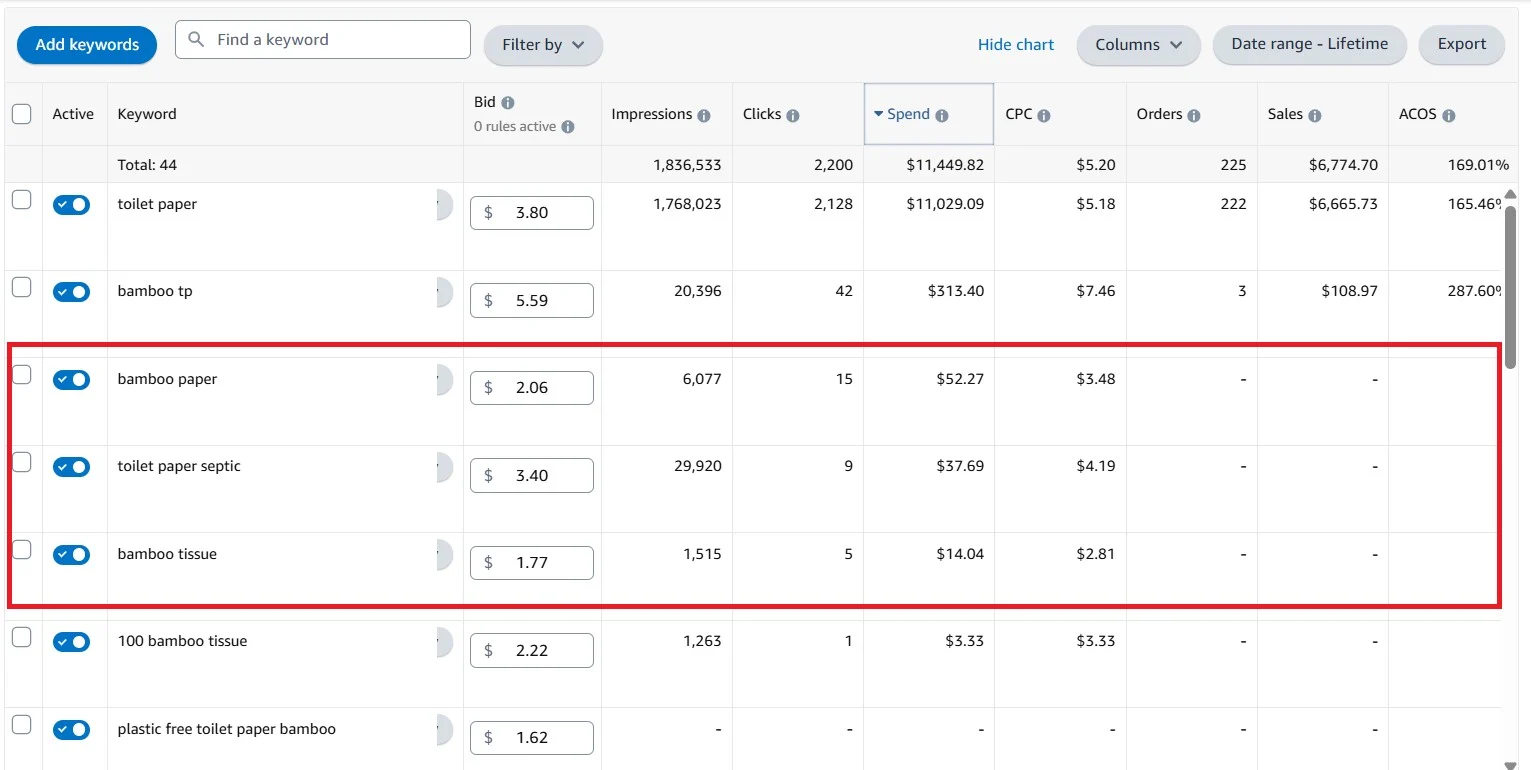

The Amazon PPC audit revealed that several ad groups contained 40+ keywords. As a result, broad, high-volume searches were absorbing most of the budget, while high-intent, purchase-ready searches received little to no exposure.

We restructured campaigns so each ad group focused on a small set of closely related keywords with similar intent. This allowed budgets to flow toward searches that were more likely to convert, instead of being consumed by generic traffic.

Impact: Bamboo-specific and intent-driven searches that were previously buried began receiving consistent impressions. Visibility improved without increasing ad spend, simply by correcting how budgets were distributed across keywords.

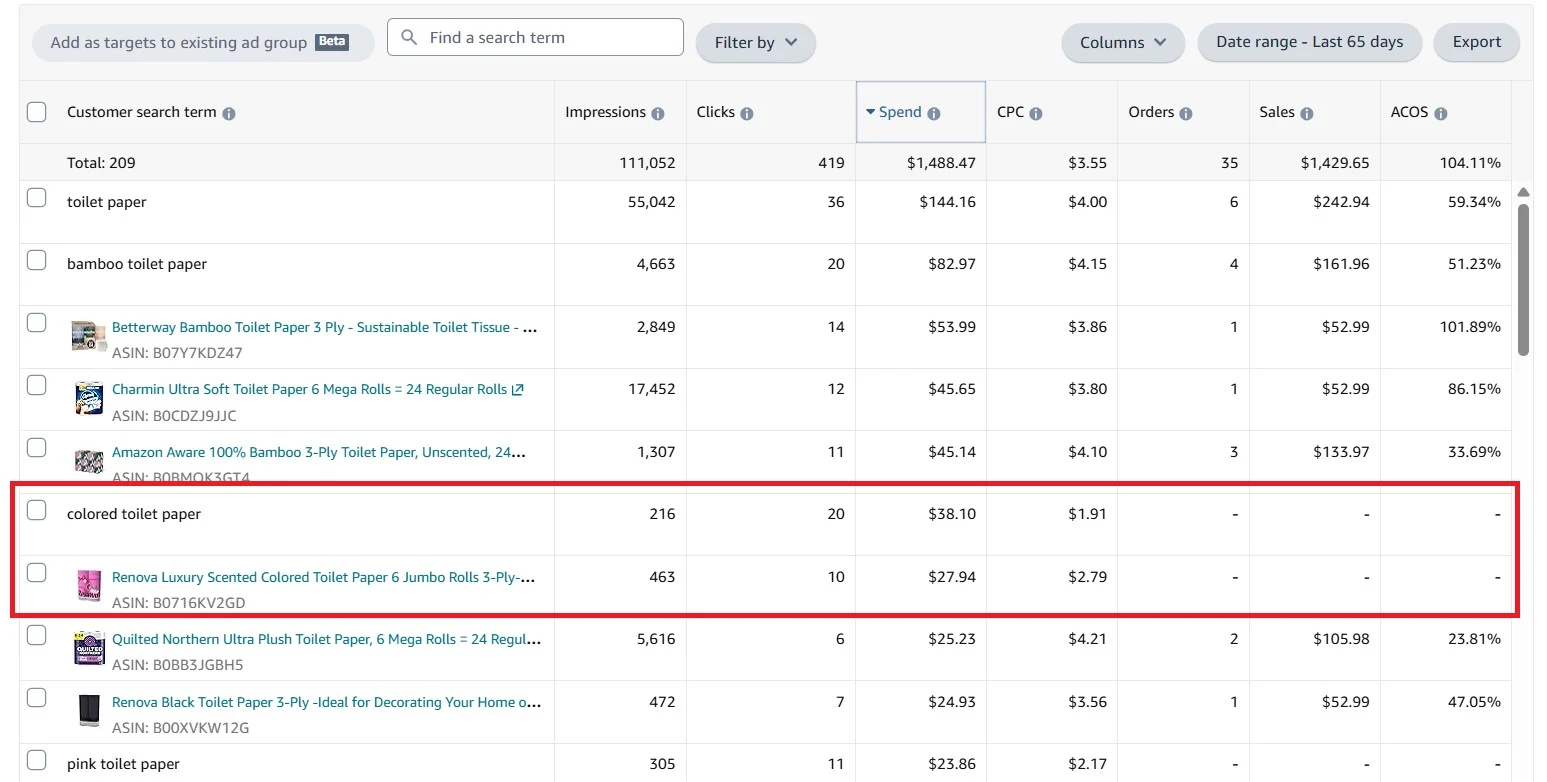

Phase 2: Eliminating Wasted Ad Spend and Low-Intent Traffic

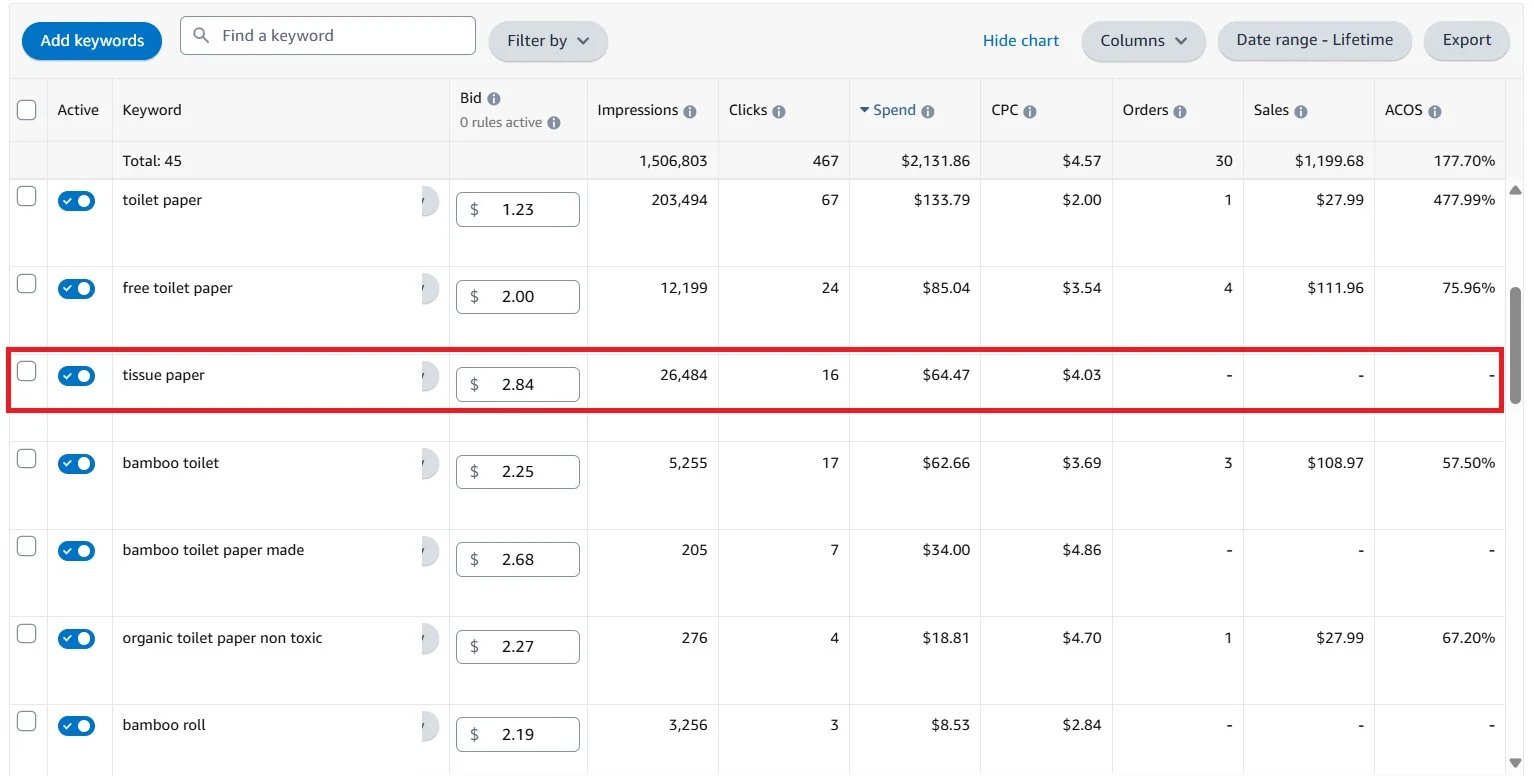

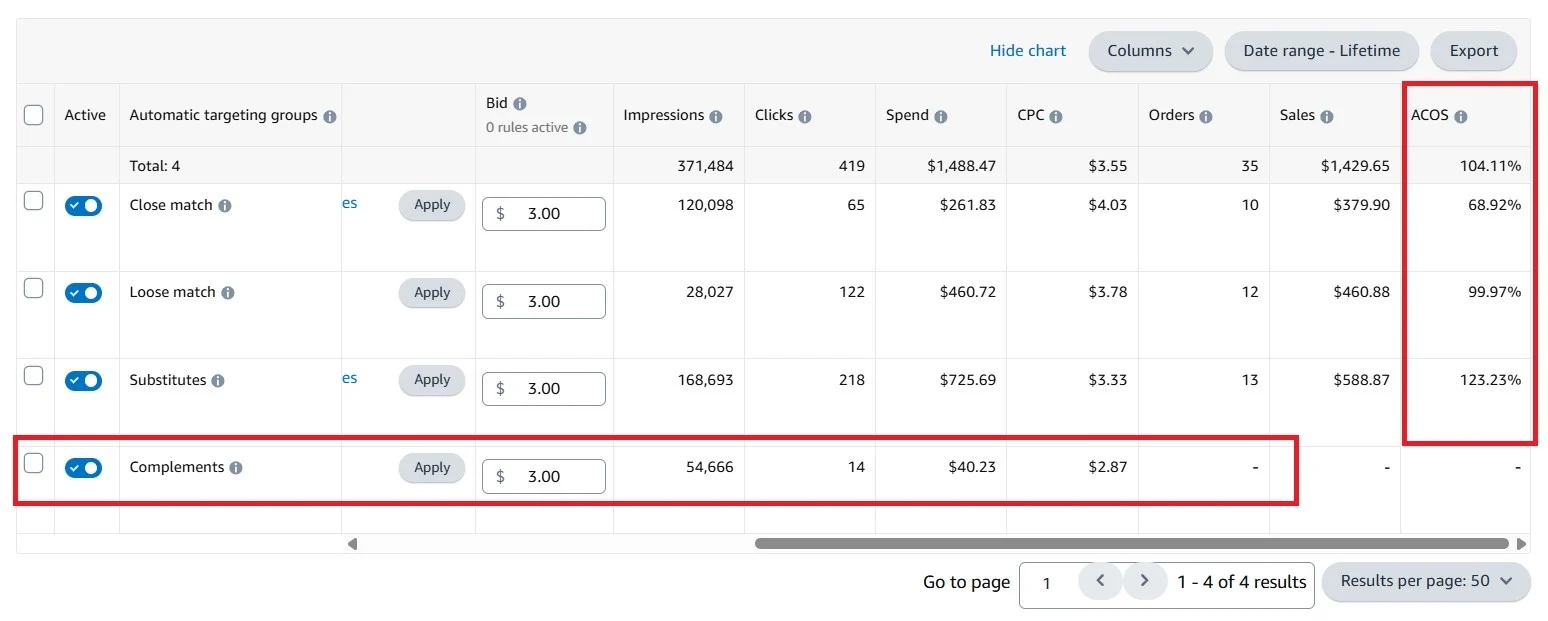

The audit showed that a large portion of ad spend was going toward searches that had little to do with the product. Campaigns were targeting broad terms like “tissue paper,” running non-performing keywords for weeks, and showing ads in placements that were expensive but not converting.

We addressed this in four clear steps.

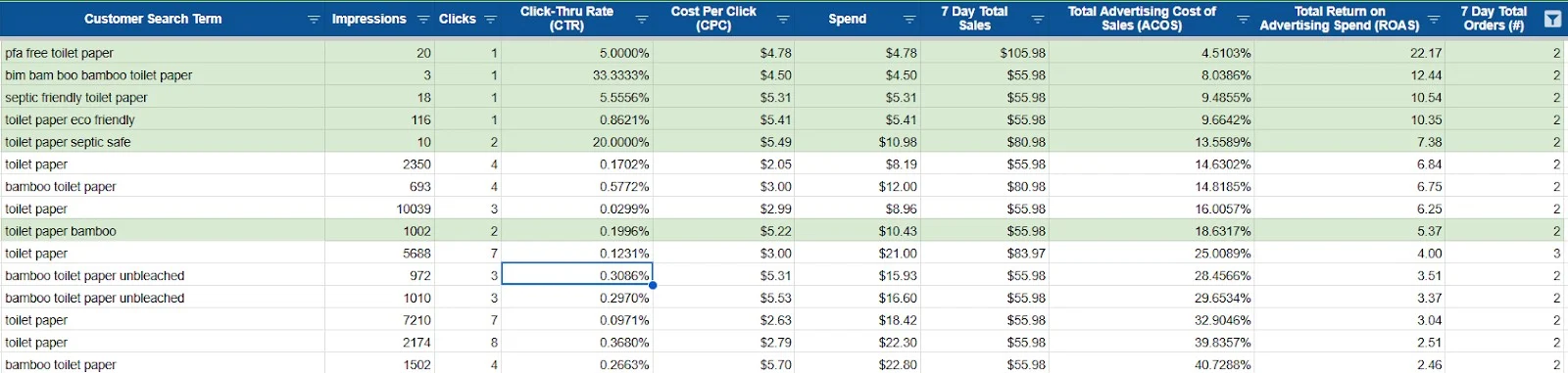

First, we removed irrelevant keyword targeting. Broad category searches that did not clearly match a bamboo, non-toxic, or eco-friendly intent were paused. Budget was redirected toward long-tail, product-specific searches that reflected why customers actually choose bamboo products, such as plastic-free, unbleached, and septic-safe.

Second, we cut non-performing targets. Keywords and product targets that were spending without producing sales were paused or bid down. This immediately stopped budget from leaking into low-quality traffic and freed spend for proven searches.

Third, we implemented consistent negative keyword management. Search terms that were consuming budget without results were added as negatives on a weekly basis. This prevented ads from continuing to show for irrelevant or low-intent searches and improved overall campaign efficiency.

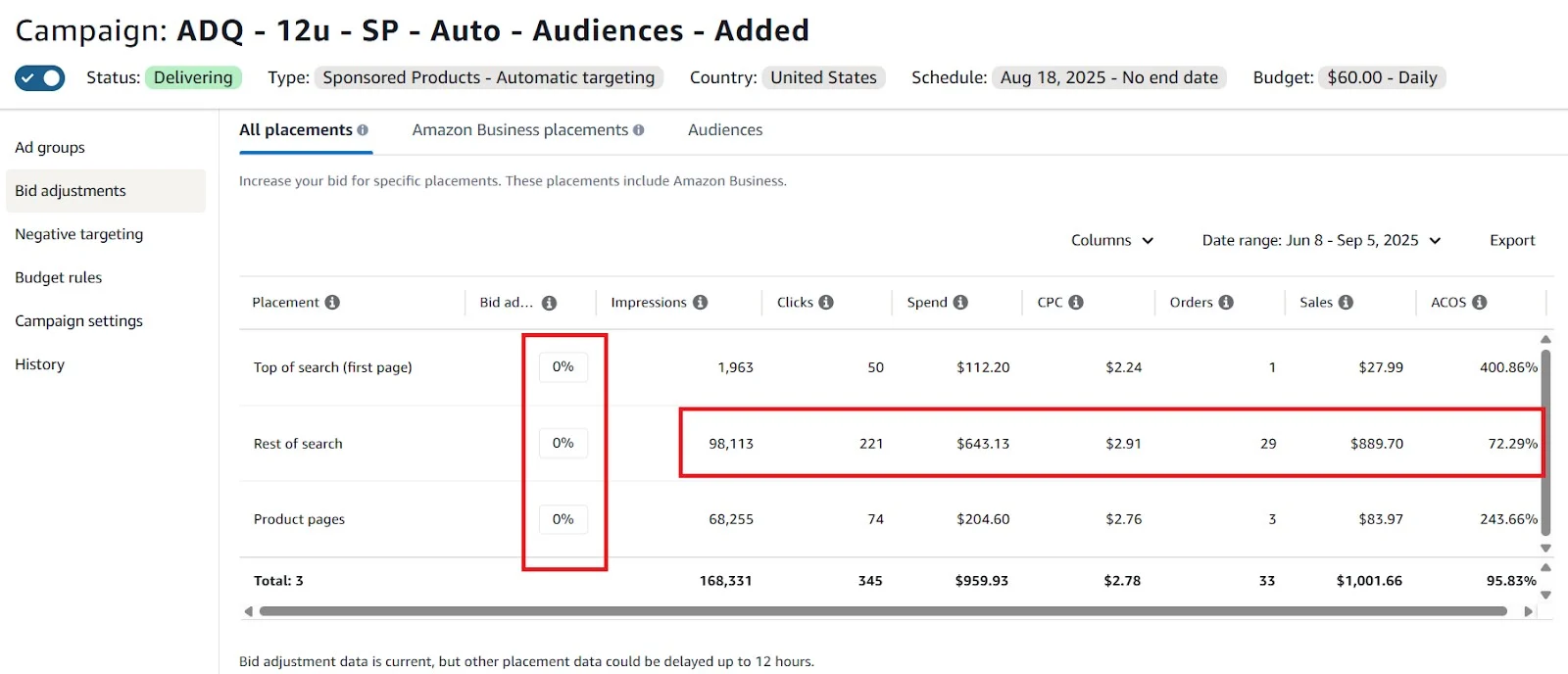

Finally, we optimized placements. Instead of paying premium prices across all placements, we reduced exposure in high-cost positions that weren’t converting and prioritized placements that delivered orders at a sustainable cost.

Phase 3: Improving the Listing and Protecting Branded Traffic

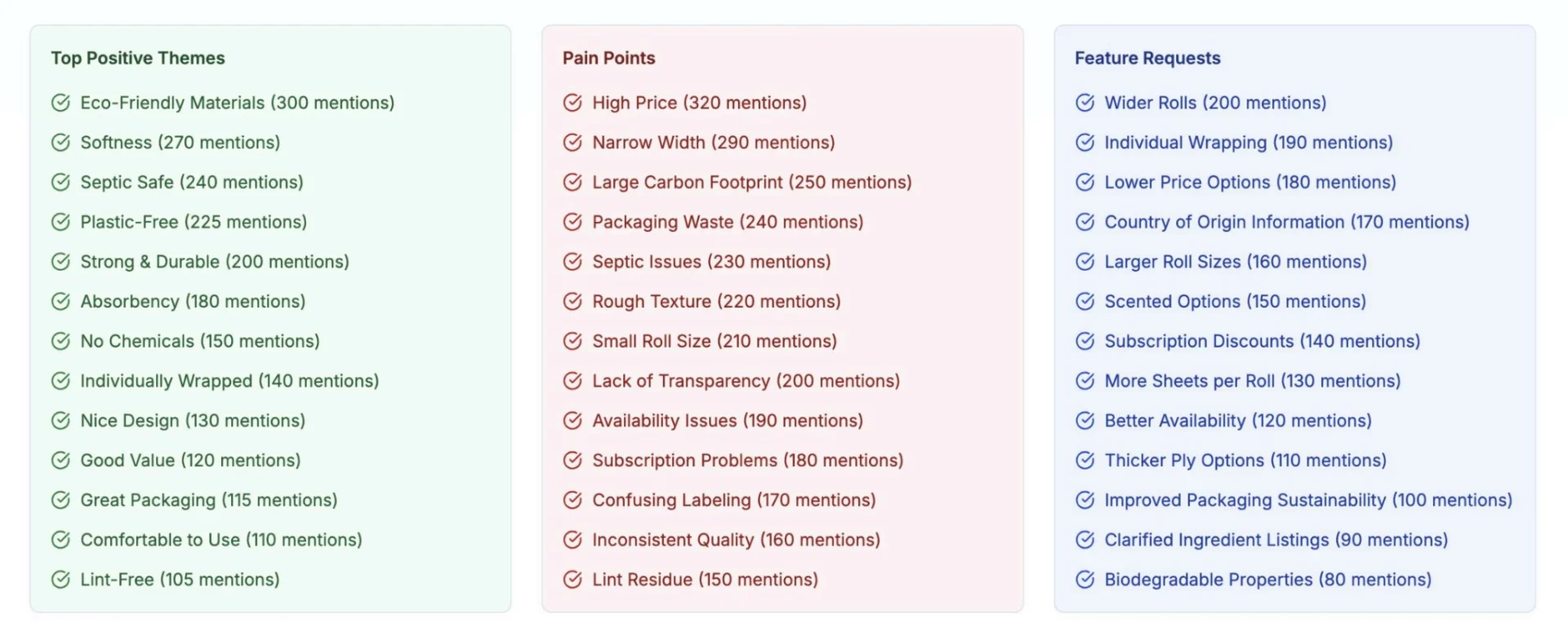

Beyond ads, the audit showed that the listing itself needed to do more of the selling. Key customer questions around material quality, softness, and value were not being answered clearly at first glance, which weakened conversion and made ad traffic less efficient.

To fix this, we grounded listing improvements in real customer feedback. We analyzed customer reviews from product listing as well as top competitor listings to understand what shoppers cared about most, what caused hesitation, and what ultimately drove purchase decisions.

Based on these insights, we:

- Rewrote product copy using customer language pulled directly from reviews.

- Updated visuals to clearly communicate bamboo material, safety benefits, and pack value.

- Prepared SEO-focused listing content to improve both conversion and search relevance.

- Ran managed A/B tests on listing copy and creative elements using Amazon’s testing tools.

- Scaled only the variants that showed clear improvement in engagement and conversion.

Impact: Ad traffic landed on a listing that clearly explained the product and value. Shoppers understood what they were buying, conversion rates increased, fewer ad clicks were wasted, and branded traffic was no longer lost to competitors.

Phase 4: Controlled Expansion Into High-Intent KWs Searches

Once wasted ad spend was under control, we shifted focus to controlled expansion. The audit showed that competitors were appearing across many relevant searches where Ollie & Vince had little or no visibility.

We closed this gap by testing new keywords in limited discovery campaigns, then moving only proven, converting searches into tightly managed campaigns with defined budgets and bids.

Impact: Brand increased visibility across competitor-dominated searches without driving up costs. Growth came from better keyword coverage and relevance, not from higher bids or risky spend increases.

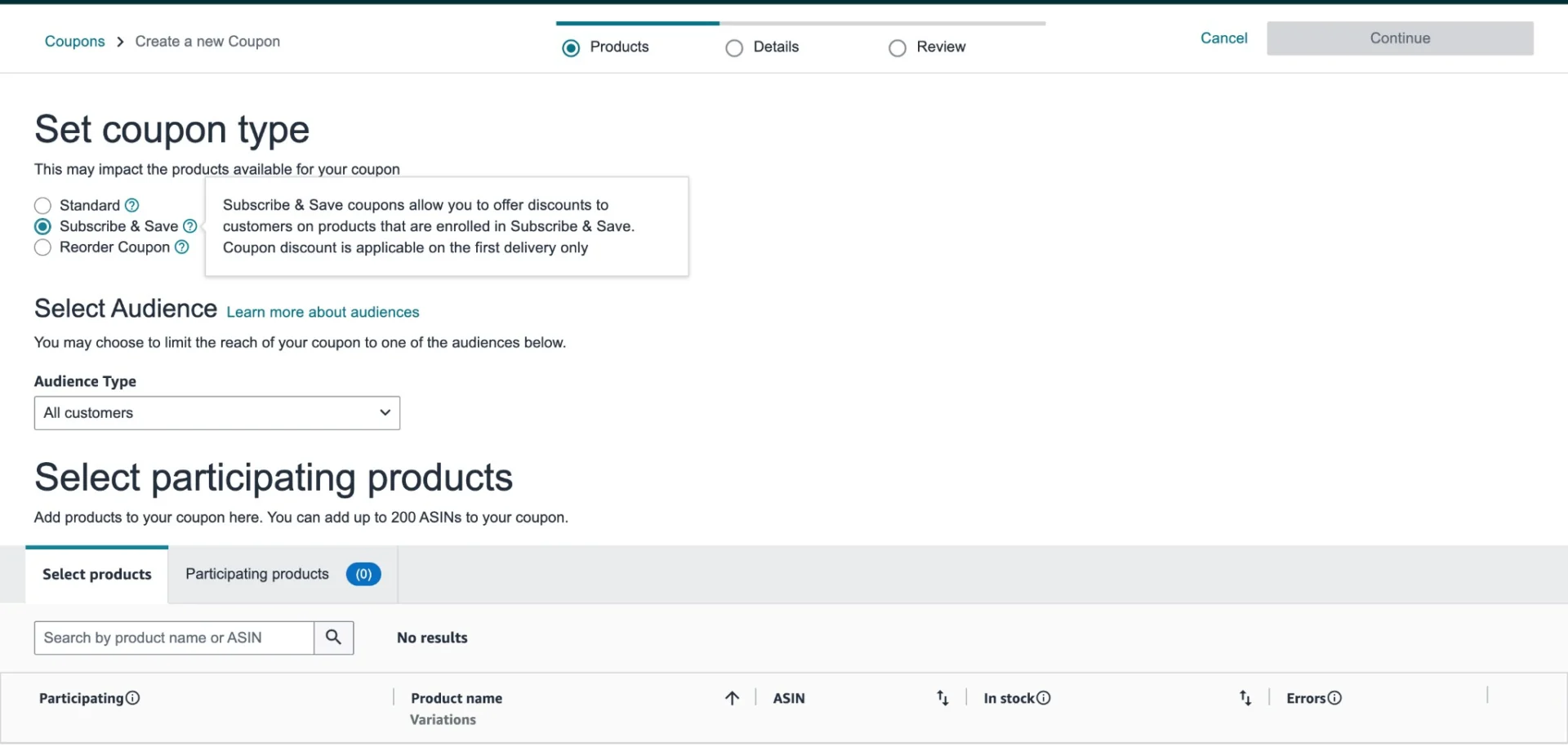

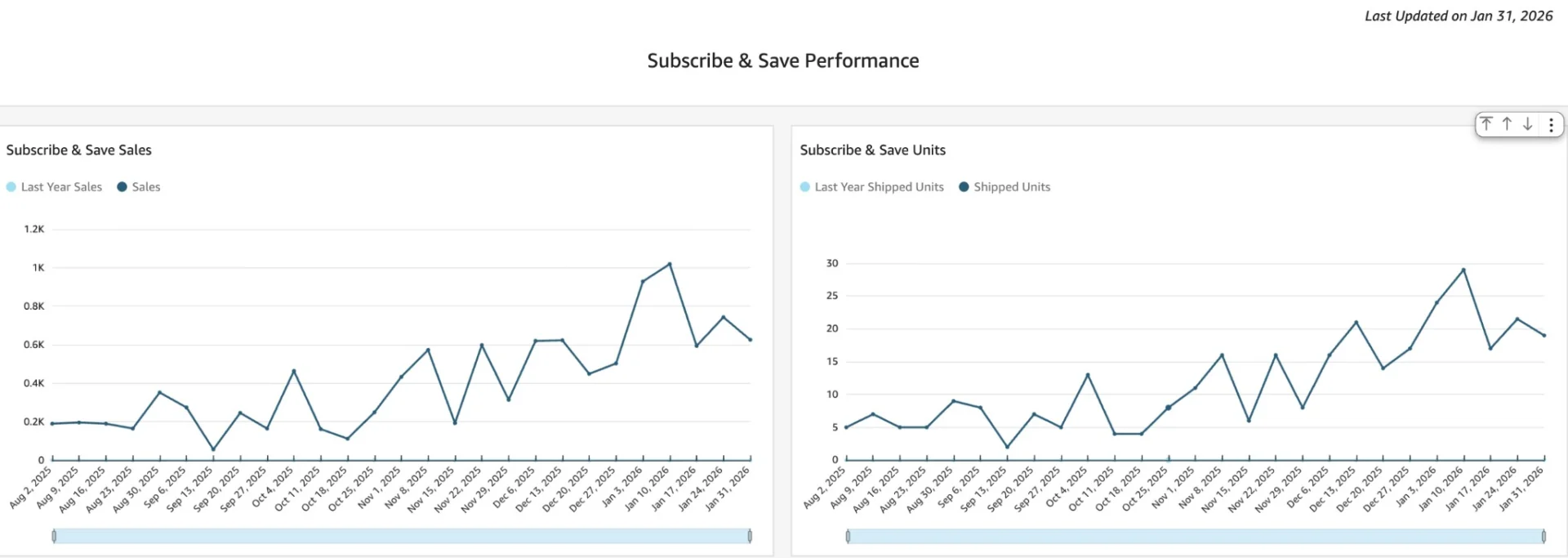

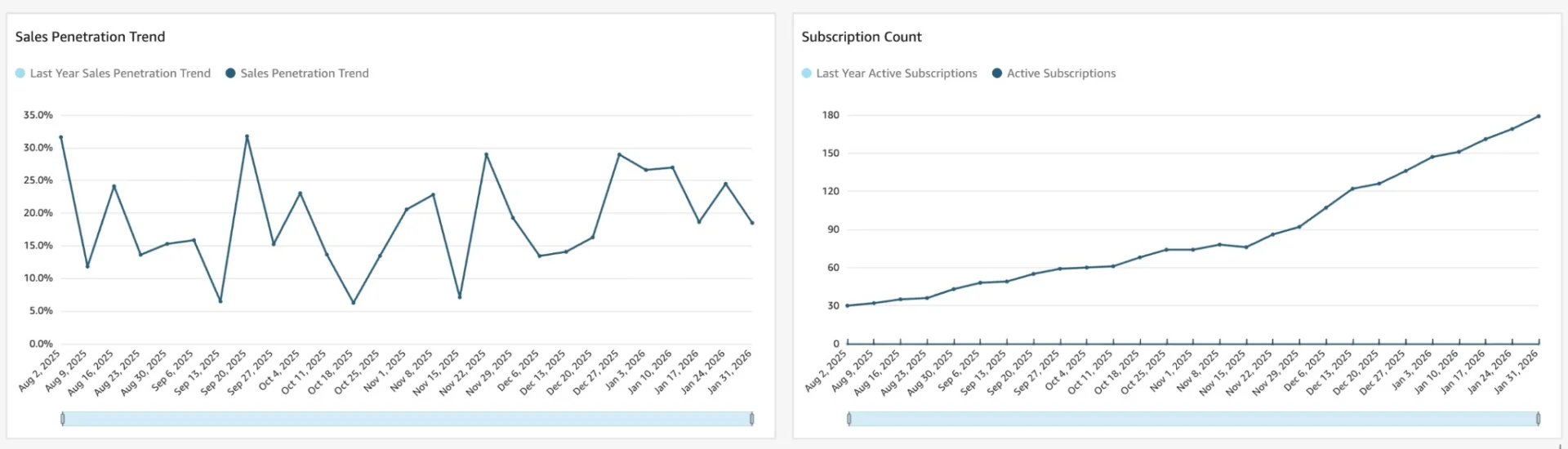

Phase 5: Repeat Purchases Through Subscribe & Save and Reorder Incentives

Subscription incentives were introduced at the point of purchase, particularly during high-traffic periods such as Prime Day. This allowed many New-to-Brand shoppers to subscribe on their very first order, converting first-time buyers into repeat customers immediately.

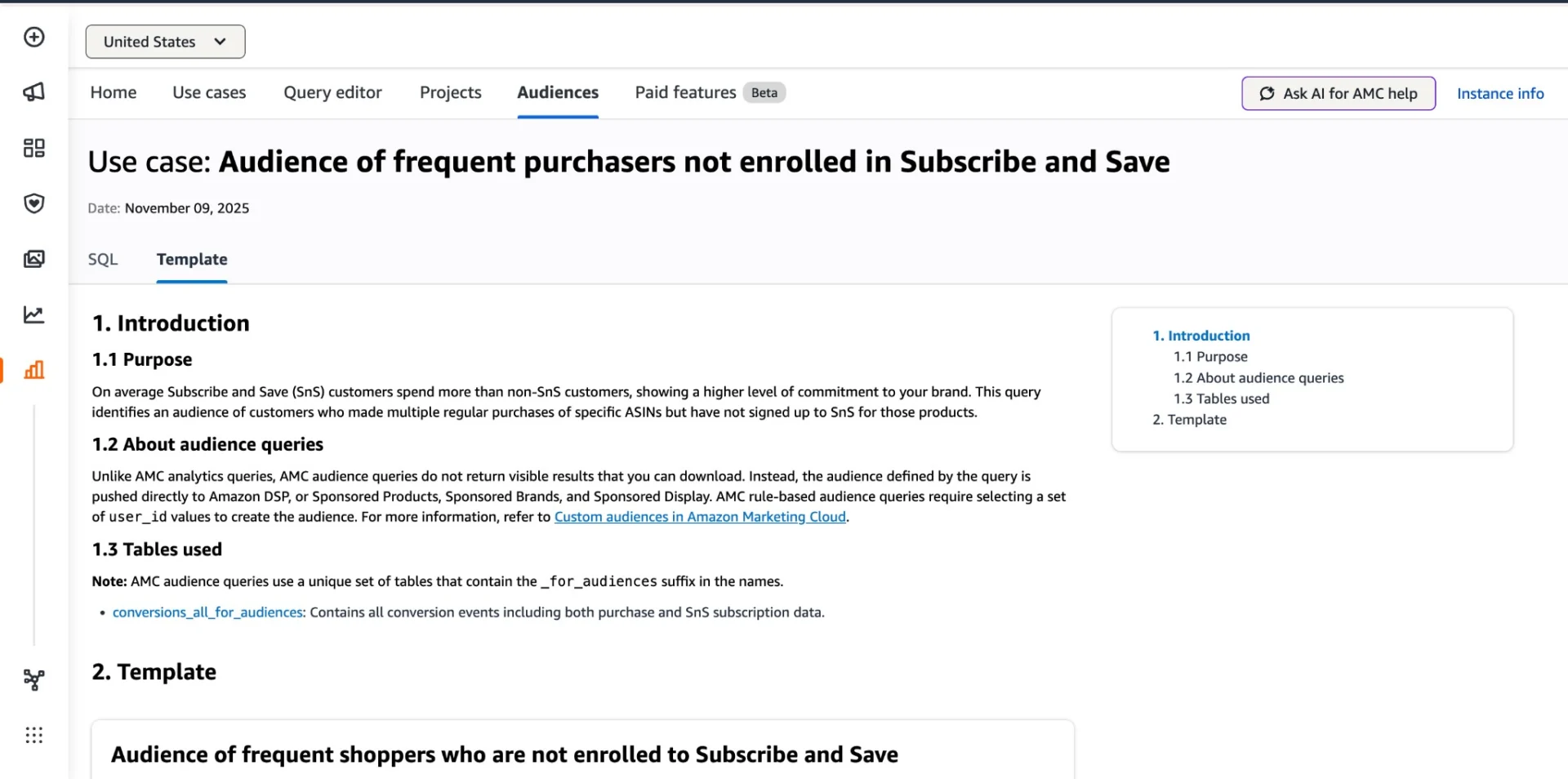

Audience who had frequently purchased the items but were not enrolled in Subscribe & Save, we re-engaged them using Amazon’s customer audience targeting.

Results: Lower ACOS, Higher Sales, Stronger Customer Acquisition

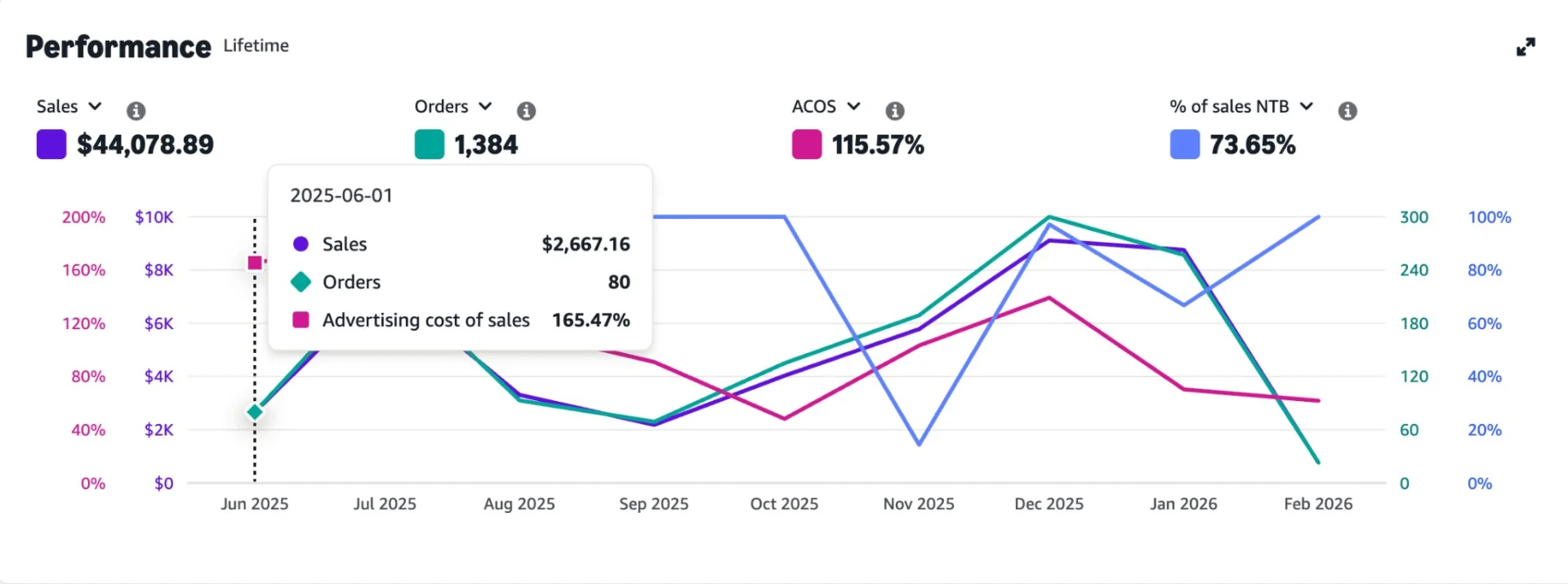

1. Ad Efficiency Improved While Revenue Increased

Before restructuring, Amazon Advertising was unprofitable. In September, ACOS climbed to ~165%, meaning ad spend exceeded the revenue generated from those ads. After fixing campaign structure, removing wasted keywords, and tightening bid control:

- ACOS improved from ~165% to ~61%

- Ad-driven sales increased from $2,667 to $8,756

- Traffic quality improved instead of simply reducing spend

This confirmed the problem was not the product, pricing, or market demand. The issue was inefficient spend and unfocused targeting. Once ads were aligned with real buyer intent, efficiency improved and revenue scaled at the same time.

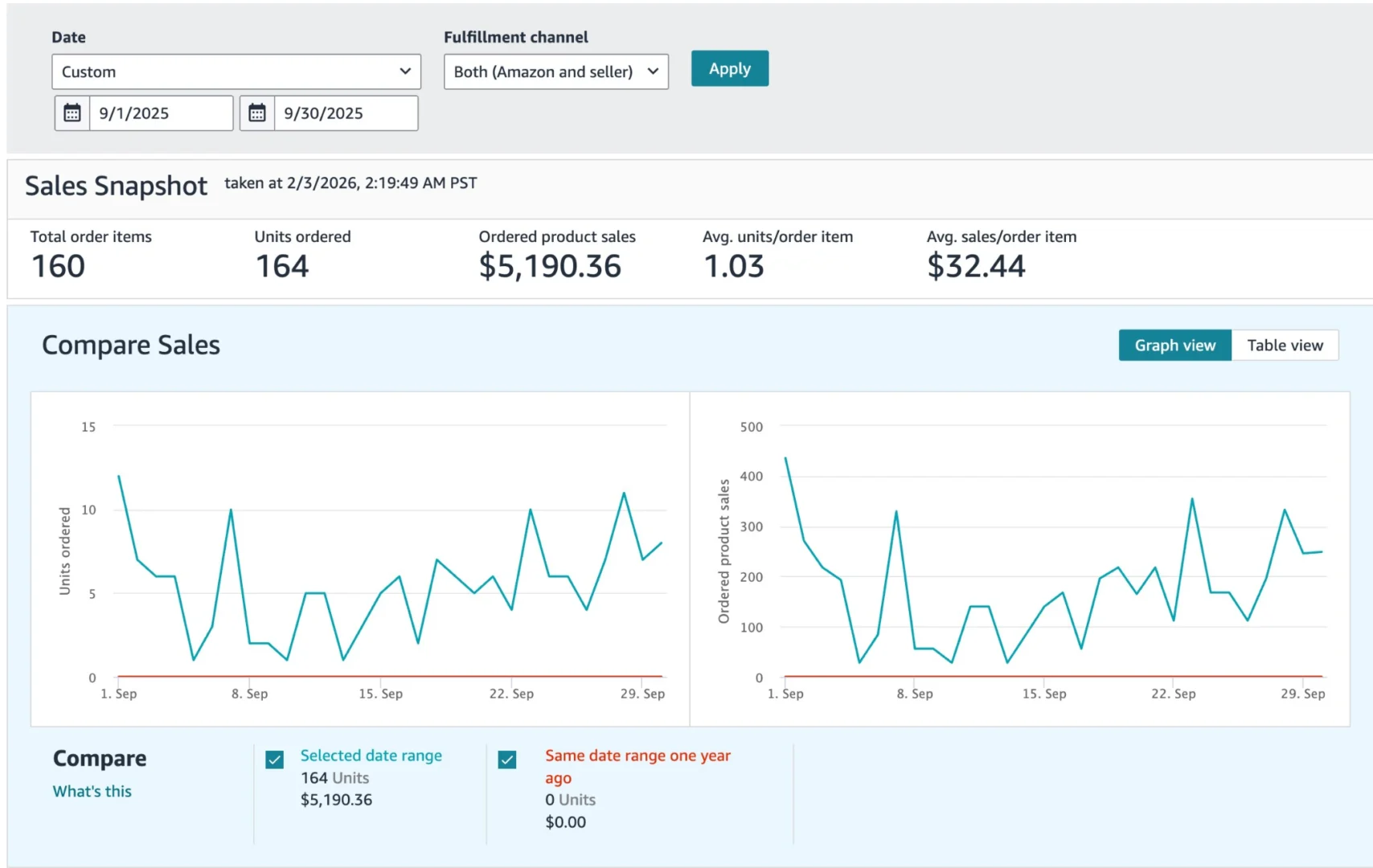

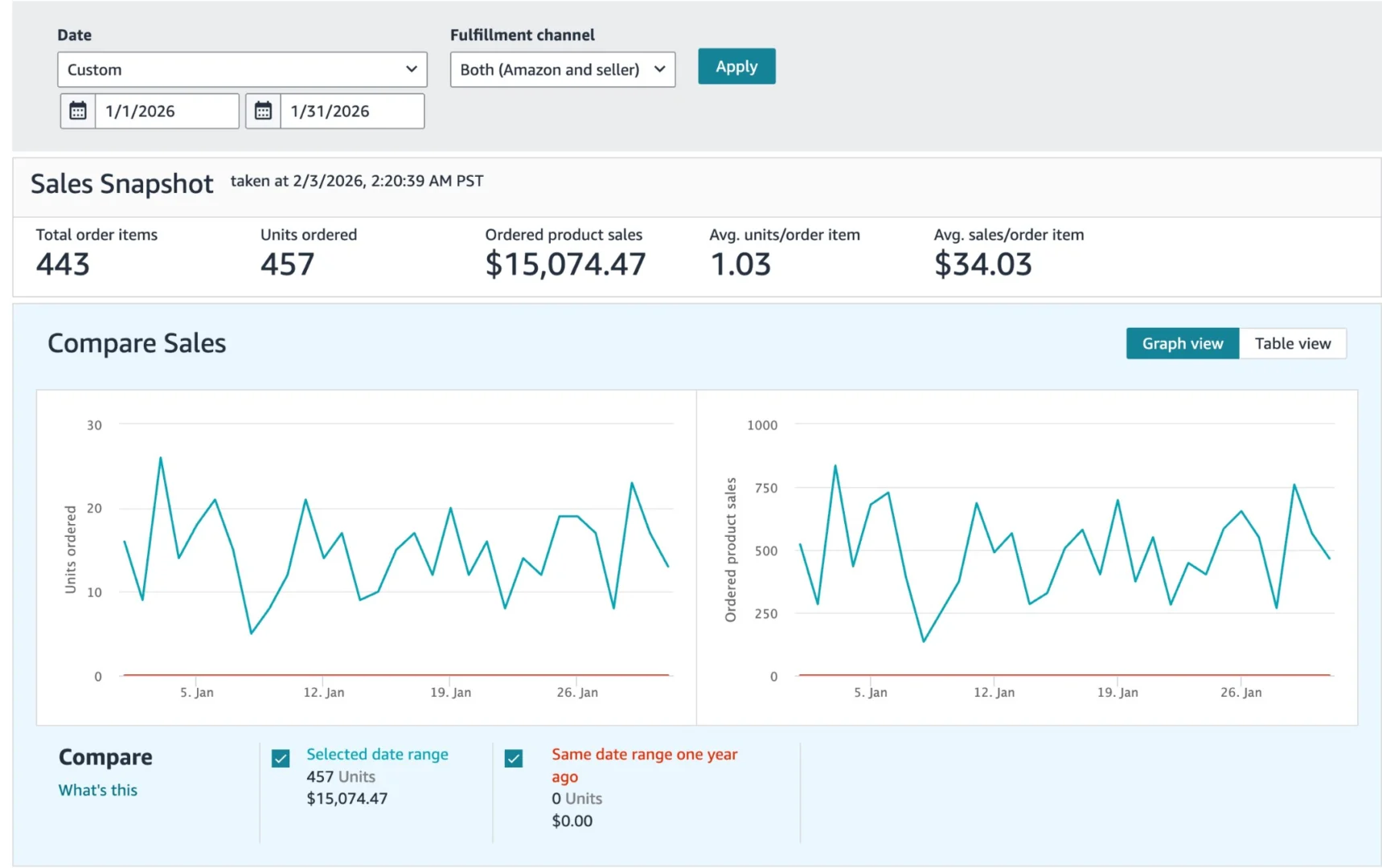

2. Monthly Revenue Increased After Campaign and Listing Fixes

Before Amazon PPC structure, targeting, and listing fundamentals were fixed, monthly revenue had plateaued. In September, sales remained limited due to inefficient ad spend and weak visibility on high-intent Amazon search terms. After correcting campaign structure, refining targeting, and improving listing clarity:

- September revenue: ~$5,190

- January revenue: ~$15,074

- Nearly 3× monthly revenue growth

This growth did not come from heavy discounts or sudden jumps in ad spend. Sales increased because ads reached shoppers who were ready to buy, the product page made the value clear, and more customers found the listing naturally through search.

3. New-to-brand Customers Acquired Through Amazon Ads

As ad targeting improved, campaigns began reaching shoppers who had not purchased from the brand before, rather than repeatedly serving ads to the same low-intent audience.

- Nearly 89% of ad-attributed orders came from New-to-Brand customers

- Over 73.65% of ad-attributed sales came from first-time customers

This showed that Amazon Ads were no longer just converting existing demand. Ad spend was actively bringing new customers into the brand, expanding the customer base and supporting long-term growth.

4. Subscribe & Save Orders Increased

By introducing subscription incentives at the first purchase and re-engaging past buyers through Amazon customer audience targeting, Subscribe & Save became a planned growth lever rather than a passive add-on. As a result:

- This represents an 88% increase in subscription orders within the measured period

- Active subscriptions steadily grew from ~30 to ~180, showing consistent adoption over time

- A larger share of repeat purchases shifted from one-time reorders to automatic subscriptions

This change created a more predictable revenue base. Instead of relying on customers to remember to reorder, the brand locked in future purchases early and reduced dependence on repeat ad spend for every sale.

Conclusion: Why In-House Amazon PPC Stopped Scaling

This case study highlights a common challenge for growing Amazon brands: in-house Amazon PPC management can maintain performance, but it often struggles to scale profitably.

The brand had a strong product, positive reviews, and an internal team actively managing Amazon Ads. Campaigns were live, bids were adjusted daily, and budgets were monitored closely. Yet despite the effort, growth stalled. Increasing ad spend only pushed ACOS higher, and performance became unpredictable.

When Amazon PPC was managed in-house, manual optimizations made it hard to control spend, separate high-intent traffic, or scale without rising CPCs. After shifting to a structured, intent-driven PPC framework, wasted spend was removed, listings converted traffic more efficiently, and growth became predictable and profitable. The outcome was not just better ad metrics, it was a shift from manual ad management to a predictable, scalable Amazon growth system.

- Amazon PPC became a predictable acquisition channel, not a margin risk

- New-to-Brand customer growth accelerated instead of stagnating

- Revenue scaled without requiring constant manual intervention

- Subscribe & Save transformed repeat purchases into a planned growth lever

This case confirms a critical insight for Health & Household brands on Amazon: managing Amazon ads in-house can support early traction, but sustainable scaling requires a specialized, system-driven execution model.

Ready to Scale Your Amazon Portfolio?

If you’re an Amazon brand owner, brand manager, or 3P seller facing unpredictable sales and reactive Amazon PPC management, it’s time to build a structured Amazon growth system.

Most Amazon brands treat Amazon PPC, listing optimization, and customer data as separate functions. As a full-service Amazon marketing agency, AMZDUDES brings them together into a unified Amazon growth strategy. We don’t just optimize campaigns or rewrite listings. We interpret Amazon data, identify structural gaps, and redesign how your brand is discovered, converted, and retained through Amazon advertising and organic growth.

What We Help You Achieve on Amazon

We help Amazon brands:

- Improve Amazon listing SEO and conversion rate to increase organic visibility

- Scale Amazon PPC campaigns with controlled ACOS and sustainable ROAS

- Acquire high-intent New-to-Brand customers Amazon can attribute and verify

- Increase Subscribe & Save adoption to build recurring revenue streams

- Leverage Amazon Marketing Cloud (AMC) to target and retarget high-intent shoppers

- Strengthen customer retention and lifetime value through repeat purchase strategies

Instead of relying on guesswork or short-term ad spikes, we apply the same Amazon growth framework used in this case study, designed for brands that want predictable, scalable, and profitable Amazon growth.

Book a Free Amazon Growth Strategy Call

Let’s review your Amazon listings, PPC campaigns, and customer data to identify growth opportunities and build a roadmap for sustainable scaling.