“Before working with AMZDUDES, our products were on page 5. Within the first two months, their targeted keyword strategy and listing optimization pushed our main products to the top 3 spots. We saw an immediate 40% jump in organic traffic due to which our number of sales is also increasing. Highly recommended Amazon SEO services.”

Amazon PPC Case Study for Food & Beverage Brand | 65% YoY Revenue Growth, New-to-Brand Customers & Repeat Purchase Strategy

Client Background

A fast-growing Food & Beverage brand partnered with AMZDUDES to scale Amazon sales beyond one-time purchases and unpredictable growth.

The brand was already generating sales through Amazon PPC and organic listings, but most revenue came from first-time buyers. Repeat purchases were limited, and Amazon PPC campaigns were driving traffic without a structured system to convert New-to-Brand customers into long-term buyers.

To grow sustainably, the brand needed an Amazon growth strategy that could increase New-to-Brand customer acquisition, improve repeat purchase rates, and build a predictable Amazon revenue engine powered by Amazon PPC, bundles, and Subscribe & Save.

Challenge / Underlying Problem

Although the Food & Beverage brand was generating sales on Amazon, its growth was limited by gaps in Amazon PPC strategy, customer lifecycle design, and data-driven decision-making.

The brand was investing in Amazon PPC and organic listings, but lacked a structured system to consistently attract New-to-Brand shoppers and build long-term demand. As a result, Amazon growth depended heavily on short-term conversions rather than sustainable customer value.

1) Misaligned Amazon PPC Strategy

Amazon ad spend was concentrated on branded and low-intent keywords. While this captured existing demand, it limited exposure in competitive Food & Beverage category searches.

The brand was not fully leveraging non-branded, high-intent keywords to expand reach among category shoppers, reducing its ability to scale New-to-Brand acquisition through Amazon PPC.

2) Weak Customer Retention and Subscribe & Save Adoption

Subscribe & Save was underutilized, and there was no structured approach to encourage reorders for replenishable products.

Without a clear retention mechanism, most buyers interacted with the brand only once, forcing continued dependence on paid traffic to sustain revenue growth.

3) Disconnected Amazon Data and Execution

Amazon data on keywords, audiences, and customer behavior was not integrated into PPC and catalog decisions.

The team lacked visibility into which campaigns and products were driving long-term value versus short-term conversions. This made it difficult to allocate Amazon PPC budgets efficiently and scale growth with confidence.

Strategy: Amazon Growth Framework for a Food & Beverage Brand

To scale the Food & Beverage brand on Amazon, AMZDUDES implemented a structured Amazon growth strategy focused on three outcomes: expanding category visibility, improving customer lifetime value, and scaling Amazon PPC efficiently.

Instead of optimizing Amazon PPC, catalog, and retention separately, we aligned them into one lifecycle-driven strategy where every click, every listing, and every offer supported long-term customer value.

1) Understanding Where Growth Was Really Coming From

Before scaling ads, we analyzed how customers were actually buying the brand on Amazon. We mapped the relationship between New-to-Brand customers, repeat buyers, and basket size across each SKU.

This revealed a clear pattern: some products naturally drove repeat purchases within 30–60 days but had low visibility, while others generated one-time orders with almost no retention. Bundles and multi-packs showed significantly higher repeat behavior than single units, which indicated that the brand’s growth ceiling was not acquisition alone, but how well it converted first purchases into habits.

This insight changed how we allocated PPC budgets. Instead of scaling ads across all products, we concentrated acquisition on SKUs and bundles with the highest long-term customer value, ensuring that Amazon PPC was fueling retention, not just short-term sales.

2) Expanding Amazon PPC from Brand Searches to Category Demand

We shifted Amazon PPC away from heavy reliance on branded keywords and toward category-level discovery, where real growth happens in Food & Beverage.

The brand began appearing in searches where shoppers were actively comparing options, such as snack packs, bulk food bundles, and healthy food multipacks. We positioned bundles and multi-packs as primary entry points in Sponsored Ads, so first-time buyers encountered higher-value offers instead of single units.

This approach allowed the brand to intercept customers evaluating competitors and capture demand from shoppers who had no prior brand awareness but strong purchase intent. Amazon PPC was no longer just defending existing demand—it was systematically creating new demand.

3) Using Bundles and Pack Sizes as Growth Drivers, Not Add-Ons

Bundles were engineered as a behavioral strategy, not a pricing tactic.

We designed multi-packs and variety packs around real consumption cycles, aligning pack sizes with natural reorder windows. Instead of selling single units that encouraged trial and churn, we created bundles that embedded the product into customers’ routines.

A customer buying a single item might finish it quickly and forget to reorder. A customer buying a 12-pack commits to a longer usage period, builds habit, and becomes significantly more likely to repurchase or subscribe. By positioning bundles as value-per-serving options and prioritizing them across listings and ads, we turned pack sizes into retention triggers.

Over time, bundles became the brand’s strongest lever for increasing average order value and repeat purchase probability.

4) Repeat Purchases with Subscribe & Save and Reorder Incentives

Subscribe & Save was treated not just as a retention purpose, but as a first-time customer acquisition lever. By offering subscription incentives at the moment of purchase, especially during high-traffic events like Prime Day, we converted New-to-Brand shoppers into repeat buyers on their very first order.

This meant many customers subscribed on their first order instead of waiting for a second purchase. For those who didn’t subscribe initially, we introduced reorder incentives timed around product depletion cycles. By re-engaging buyers shortly before they ran out of the product, we converted one-time customers into repeat buyers at the moment they were most likely to reorder.

The result was a structured repeat-purchase loop, where subscriptions and reorders were intentionally engineered rather than left to chance.

5) Scaling PPC Based on Customer Lifetime Value, Not Just ACOS

Instead of scaling campaigns based only on ACOS, we evaluated performance through the lens of customer lifetime value.

Some keywords looked inefficient on the surface but produced customers who repeatedly bought bundles and subscribed. Others appeared efficient but attracted low-retention buyers who rarely returned. We reallocated budget toward traffic sources that generated repeat customers, even if their initial acquisition cost was higher.

This shift allowed the brand to scale Amazon PPC without sacrificing profitability, because ad spend was justified by long-term revenue rather than single-order margins.

6) Capturing Warm Shoppers Instead of Only Cold Traffic

Beyond acquisition, we activated mid-funnel and retention campaigns to convert shoppers who had already shown intent.

Customers who viewed product pages, added items to cart, or purchased once but didn’t return were systematically re-engaged with tailored offers and controlled ad frequency. This ensured that high-intent shoppers were not lost after their first interaction with the brand.

By reallocating part of the PPC budget from cold traffic to warm audiences, the brand improved conversion efficiency and reduced wasted spend.

7) Expanding Basket Size Through Cross-Sell Behavior

We analyzed co-purchase patterns to understand how customers moved across the catalog.

Instead of treating products as isolated SKUs, we positioned the catalog as an ecosystem. Customers who bought one product were intentionally guided toward complementary products through bundles, listings, and PPC exposure.

This increased the number of SKUs per customer and created multiple reorder triggers within the same household. Over time, customers stopped behaving like single-product buyers and started behaving like portfolio buyers, significantly increasing lifetime value.

8) Creating the Amazon Flywheel

As repeat purchases increased, the brand entered a compounding growth loop.

More repeat buyers strengthened organic ranking signals, which reduced dependency on paid ads. Higher organic visibility attracted more New-to-Brand customers, who were then converted into subscribers and repeat buyers through bundles and incentives. As retention improved, customer acquisition costs declined, allowing the brand to scale PPC more aggressively without losing efficiency.

Amazon PPC, bundles, and Subscribe & Save stopped operating as separate tactics. Together, they formed a system where acquisition fueled retention, retention fueled organic growth, and organic growth reduced reliance on ads.

Results: From One-Time Buyers to a Scalable Amazon Growth

Within 12 months, the brand transformed Amazon from a transactional sales channel into a structured growth engine built on New-to-Brand acquisition, repeat buying behavior, and scalable PPC economics.

Instead of chasing short-term ad spikes, the brand built a sustainable Amazon channel where customer acquisition, retention, and basket expansion reinforced each other to drive consistent revenue growth.

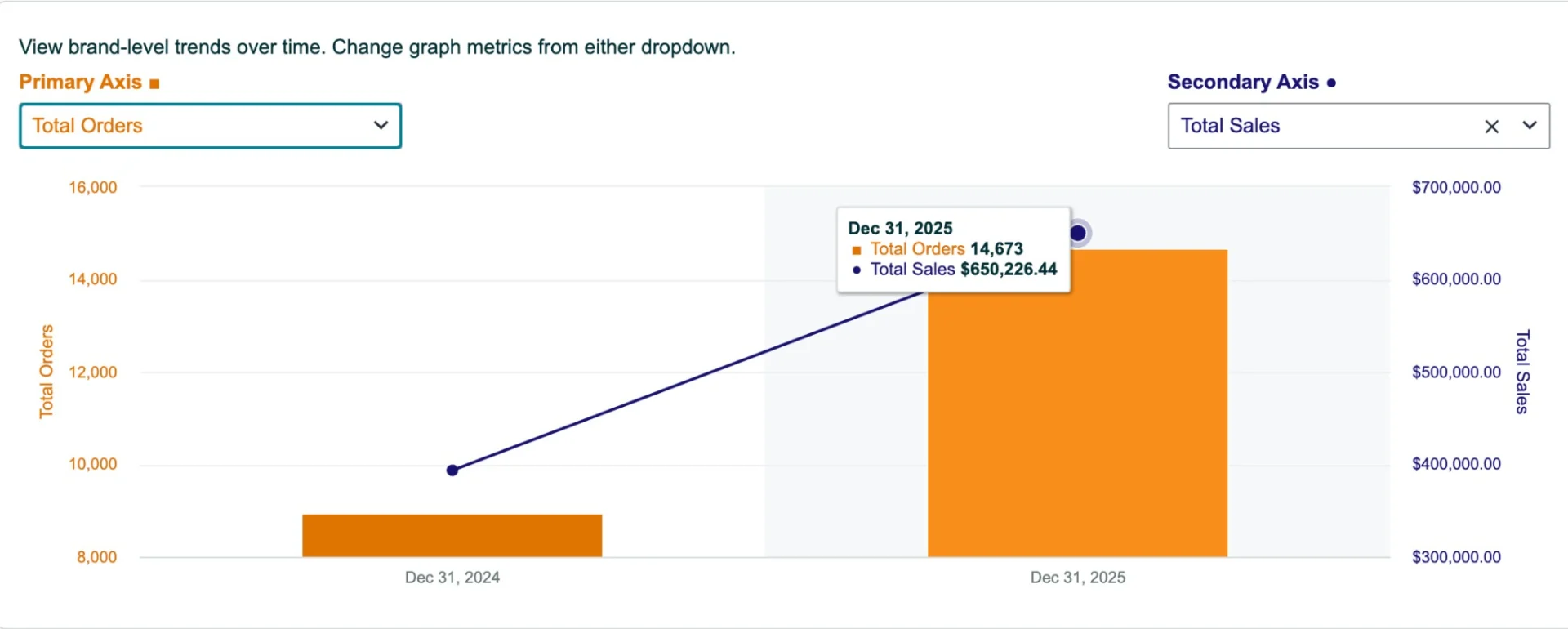

1. Accelerating Amazon Revenue Growth

The most immediate impact was a clear jump in Amazon revenue.

- 2024 Amazon Sales: $393,471

- 2025 Amazon Sales: $650,226

- Year-over-Year Growth: +65%

This growth was not driven by discounts or short-term ad pushes. It was the result of repositioning the brand in Amazon search, attracting more New-to-Brand shoppers, and increasing repeat purchases across the catalog.

Instead of relying on one-time buyers, the brand built a stronger Amazon sales foundation where customer discovery, conversion, and reorders worked together to drive consistent revenue growth.

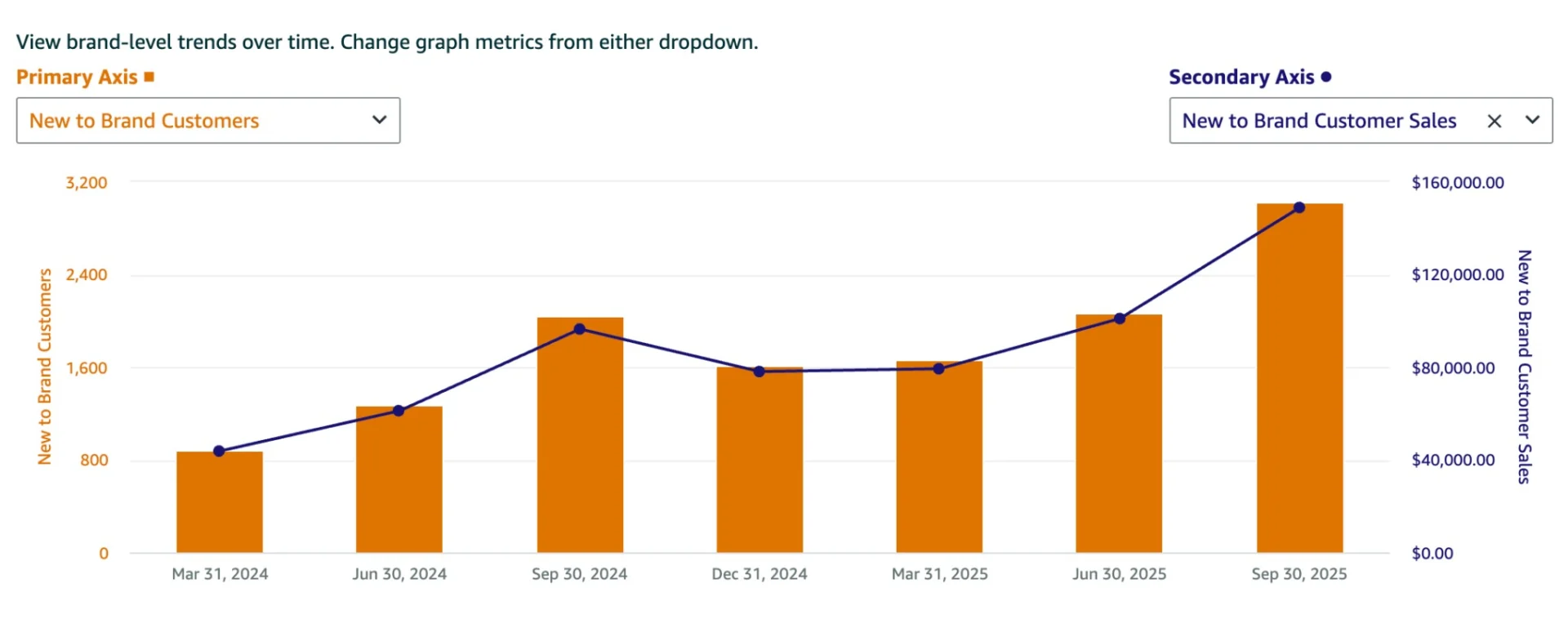

2. Winning New-to-Brand Customers at Scale

A key objective was to expand reach among first-time buyers in the Food & Beverage category.

- 8,853 New-to-Brand customers acquired in 2025

- $404,377 in New-to-Brand sales

New-to-Brand customers accounted for more than 60% of total Amazon revenue, showing that growth was driven by category-level demand rather than existing brand awareness.

By ranking and advertising for high-intent Food & Beverage searches, the brand began capturing shoppers who had never purchased from it before. This confirmed that when the brand appeared in the right Amazon searches, customers were willing to buy without prior familiarity.

3. Turning One-Time Buyers into Repeat Revenue

By combining bundles, multi-packs, and Subscribe & Save incentives, the brand systematically converted first-time buyers into returning customers.

- 844 repeat customers in 2025

- 981 repeat orders

- $45,444 in repeat customer revenue

Instead of relying solely on constant new customer acquisition, the brand built a growing base of repeat buyers. This shift stabilized monthly sales and strengthened Amazon’s confidence in the brand’s replenishable demand.

4. Stronger Retention and Faster Reorders

Customer behavior improved as repeat purchases increased.

Average repeat purchase rate: 6.11%

Average reorder interval: 6.93 weeks

Customers were not just buying again, they were buying sooner.

For a Food & Beverage brand, shorter reorder cycles signal stronger product adoption and higher customer loyalty. These signals also supported long-term Amazon ranking and visibility by demonstrating consistent demand.

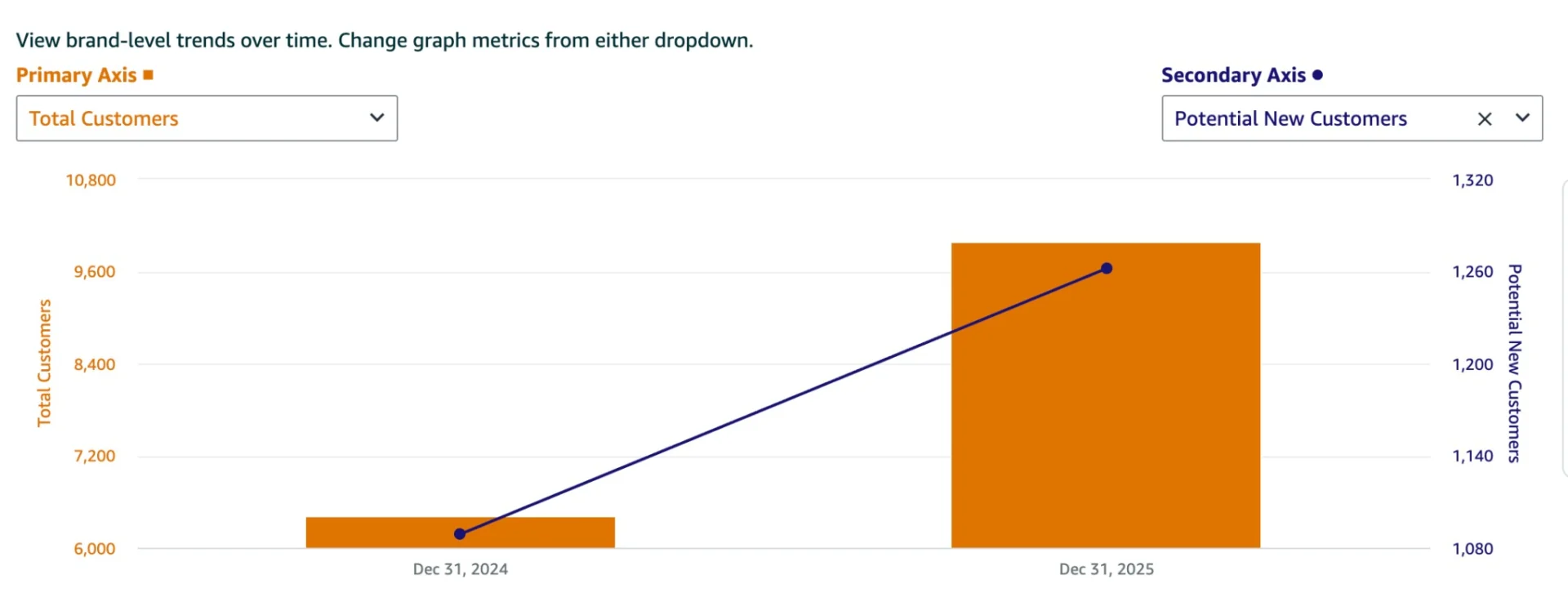

5. Expansion of the Amazon Customer Base

The brand significantly expanded its presence within the category.

- Total customers (2024): 8,308

- Total customers (2025): 13,692

- Potential new customers (2025): 15,697

This showed that the brand was not only growing revenue but also increasing its share of Food & Beverage category demand on Amazon.

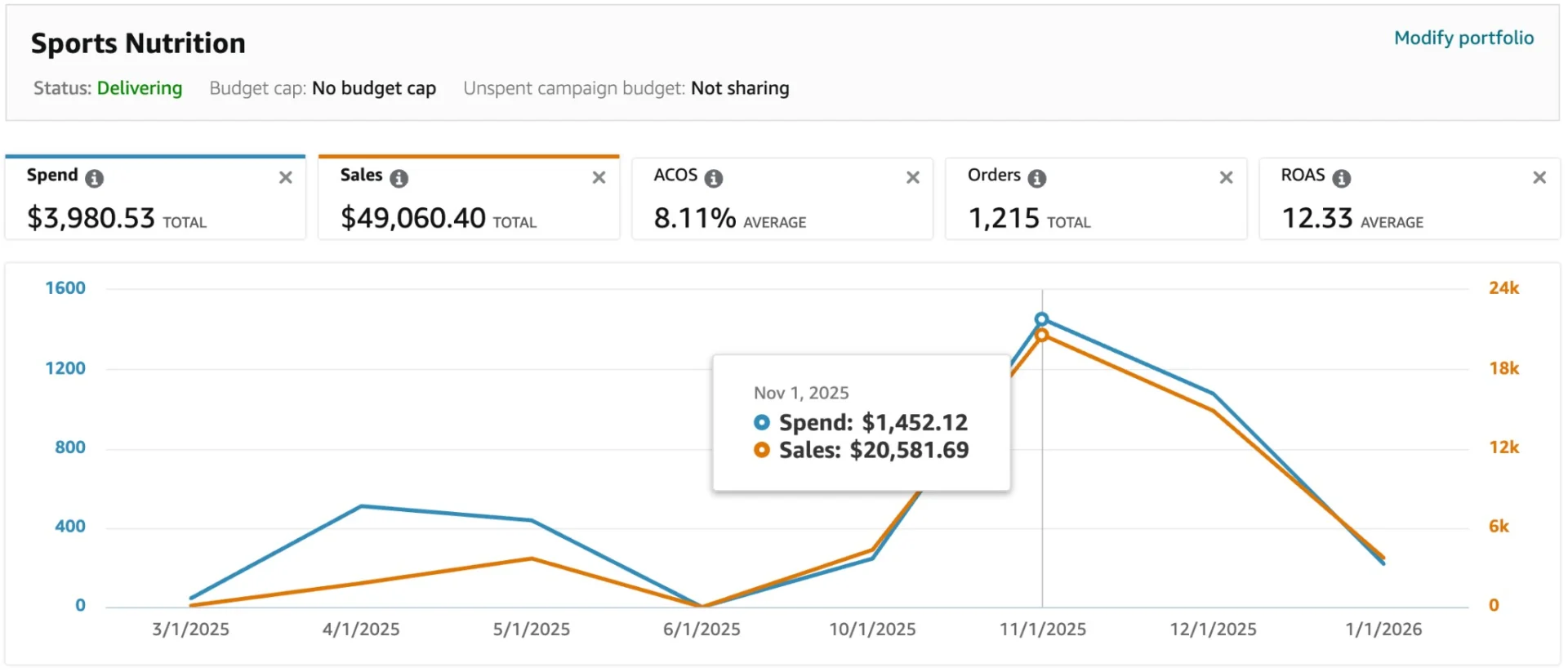

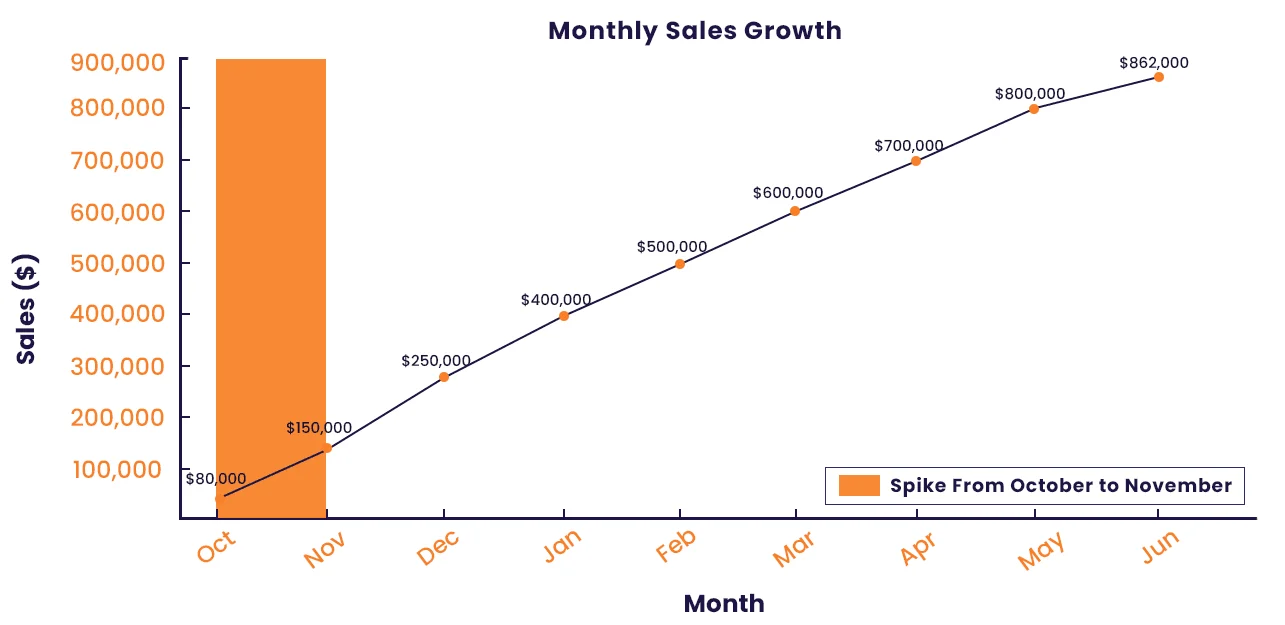

The monthly sales chart illustrates significant growth, with a notable spike from October to November due to our proactive listing of more products in the first month, which sold in the following month.

Conclusion

This case study shows how a Food & Beverage brand scaled on Amazon by integrating Amazon PPC, listing optimization, bundles, and customer lifecycle strategy into a single growth system.

By strengthening Amazon SEO, expanding New-to-Brand customer acquisition, and increasing order frequency through Subscribe & Save and multi-pack offerings, the brand built a predictable Amazon revenue model.

The impact was measurable: improved Amazon PPC efficiency, stronger customer retention signals, shorter reorder cycles, and sustained year-over-year revenue growth.

Instead of relying on short-term advertising spikes, the brand implemented a scalable Amazon growth strategy focused on long-term customer value, recurring purchases, and category-level visibility.

This is how AMZDUDES helps Food & Beverage brands grow on Amazon, through a structured Amazon PPC, SEO, and retention framework designed for sustainable, data-driven growth.

Ready to Scale Your Amazon Portfolio?If you’re an Amazon brand owner, brand manager, or 3P seller facing unpredictable sales and reactive Amazon PPC management, it’s time to build a structured Amazon growth system.

Most Amazon brands treat Amazon PPC, listing optimization, and customer data as separate functions. As a full-service Amazon marketing agency, AMZDUDES brings them together into a unified Amazon growth strategy.

We don’t just optimize campaigns or rewrite listings.

We interpret Amazon data, identify structural gaps, and redesign how your brand is discovered, converted, and retained through Amazon advertising and organic growth.

What We Help You Achieve on Amazon

We help Amazon brands:

- Improve Amazon listing SEO and conversion rate to increase organic visibility

- Scale Amazon PPC campaigns with controlled ACOS and sustainable ROAS

- Acquire high-intent New-to-Brand customers Amazon can attribute and verify

- Increase Subscribe & Save adoption to build recurring revenue streams

- Leverage Amazon Marketing Cloud (AMC) to target and retarget high-intent shoppers

- Strengthen customer retention and lifetime value through repeat purchase strategies

Instead of relying on guesswork or short-term ad spikes, we apply the same Amazon growth framework used in this case study, designed for brands that want predictable, scalable, and profitable Amazon growth.

Book a Free Amazon Growth Strategy Call

Let’s review your Amazon listings, PPC campaigns, and customer data to identify growth opportunities and build a roadmap for sustainable scaling.

👉 Schedule Your Free Amazon Growth Strategy Call