“Before working with AMZDUDES, our products were on page 5. Within the first two months, their targeted keyword strategy and listing optimization pushed our main products to the top 3 spots. We saw an immediate 40% jump in organic traffic due to which our number of sales is also increasing. Highly recommended Amazon SEO services.”

Amazon Expansion Case Study for DTC Brands | Scaling to $438K Revenue with 92% New-to-Brand Sales

Client Background

This Sports & Outdoors brand was a well-established DTC business, generating over $1M annually through its own website. Despite strong product demand, premium positioning, and a loyal customer base, Amazon remained an untapped but strategically important sales opportunity due to concerns about preserving brand control and profitability.

Like many established DTC brands, the client wanted to expand onto Amazon without damaging brand positioning, while building a profitable Amazon PPC foundation that could scale alongside the brand’s existing DTC success.

The brand partnered with AMZDUDES to launch Amazon the right way focused on control, visibility, and long-term growth rather than short-term ad spikes.

Challenge: Launching Amazon as a Controlled, Predictable DTC Growth Channel

The brand had no existing presence on Amazon but saw it as a critical next step to increase brand reach, customer acquisition and revenue growth as long as it did not disrupt its DTC business model.

Brand Positioning and pricing control: The brand had invested heavily in premium positioning and a consistent customer experience. Launching on Amazon without guardrails risked inconsistent listings, price erosion, and loss of brand credibility.

Unauthorized seller exposure: Amazon’s open marketplace model often attracts third-party sellers early. Without brand protection in place, unauthorized sellers can undercut pricing, compete for the Buy Box, and appear under the brand’s listings, damaging margins and customer trust before the brand establishes authority.

Uncertain Amazon PPC performance: With no historical Amazon data, advertising felt unpredictable. The brand lacked clarity on acquisition cost, customer quality, and whether Amazon PPC could scale without compressing margins.

To move forward, the brand required an Amazon marketing agency with proven experience in DTC-to-Amazon expansion, one that could enforce brand control, design a profitable Amazon PPC strategy, and build repeat purchase mechanics that support long-term customer value rather than short-term sales spikes.

Strategy: How We Helped a DTC Brand Launch Amazon as a Controlled Growth Channel

1) Brand Control Established from Day One:

Before scaling traffic or launching Amazon PPC, full ownership of the brand’s presence on Amazon was secured.

The brand was enrolled in Amazon Brand Registry to establish trademark-backed control over listing content and unlock enforcement tools. Seller restrictions and brand safeguards were implemented early to reduce the risk of unauthorized sellers entering the catalog, undercutting pricing, or competing for the Buy Box.

2) Structured Amazon PPC Aligned with DTC Economics

Campaigns were structured by funnel intent: discovery, consideration, and conversion, allowing budgets to scale without sacrificing efficiency. New-to-Brand-focused campaigns were prioritized to ensure Amazon delivered incremental customer acquisition rather than cannibalizing existing DTC demand.

Performance was evaluated using DTC-relevant metrics such as incremental revenue, contribution margin, customer acquisition cost, and conversion quality, rather than isolated ROAS or vanity spend metrics.

3) Catalog Structured for Amazon Shopper Behavior

The catalog launched with a deliberate mix of single SKUs, bundles, and multipacks, informed by Amazon keyword demand and observed purchase behavior.

Bundles expanded keyword coverage without discounting core products, while multipacks supported higher average order value and replenishment behavior. This structure allowed the brand to capture more value per customer while maintaining pricing discipline.

4) Ongoing Brand Protection and Seller Control

Brand protection continued beyond launch.

Unauthorized seller activity, listing misuse, and trademark violations were actively monitored using Amazon Brand Registry enforcement tools and structured reporting workflows. Seller behavior was reviewed at the ASIN level to identify early signs of gray-market activity.

To strengthen control further, key SKUs were enrolled in Amazon Transparency, preventing unauthorized resellers from sourcing products through retail or third-party channels and reselling them on Amazon. Only authenticated units with Transparency codes were eligible for sale, reducing Buy Box hijacking and pricing erosion.

6) Consistent Brand Voice and Visual Identity

Amazon content was aligned with the brand’s existing DTC identity.

Product titles, bullets, and descriptions reflected the brand’s established voice rather than generic, keyword-stuffed copy. Messaging remained consistent across listings, A+ Content, and the Brand Store, ensuring a single, cohesive brand narrative throughout the Amazon buyer journey.

Visual presentation followed the brand’s creative standards. Imagery, layout, and typography reinforced credibility, differentiation, and premium positioning in a competitive category.

Results: Amazon Scaled as a DTC Customer Acquisition Channel

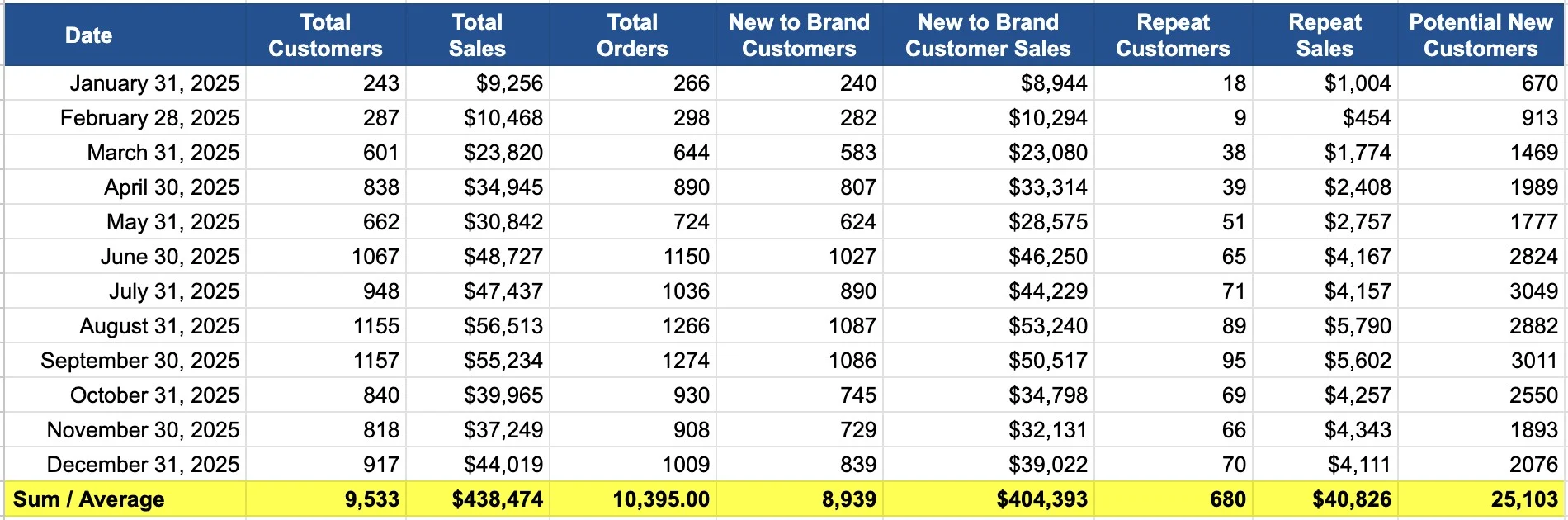

Over a 12-month period, the Amazon channel generated $438,474 in total revenue from 10,395 orders, with growth driven primarily by new customer acquisition. 8,939 New-to-Brand customers were acquired, contributing $404,393 in sales (~92% of total revenue).

Monthly sales increased from $9.2K in January 2025 to sustained $40K–$56K peak months, while monthly customers grew from 243 to 1,100+, and orders peaked at 1,274 per month. During seasonal pullbacks, revenue stabilized in the $37K–$44K range.

Repeat behavior formed early. 680 customers returned to purchase again, generating $40,826 in repeat revenue, with an average 6.82% repeat purchase rate and a ~4.3 week reorder cycle. This confirmed Amazon customers were not one-time buyers, they were beginning to contribute to lifetime value.

1) Efficient Scaling of Amazon Advertising

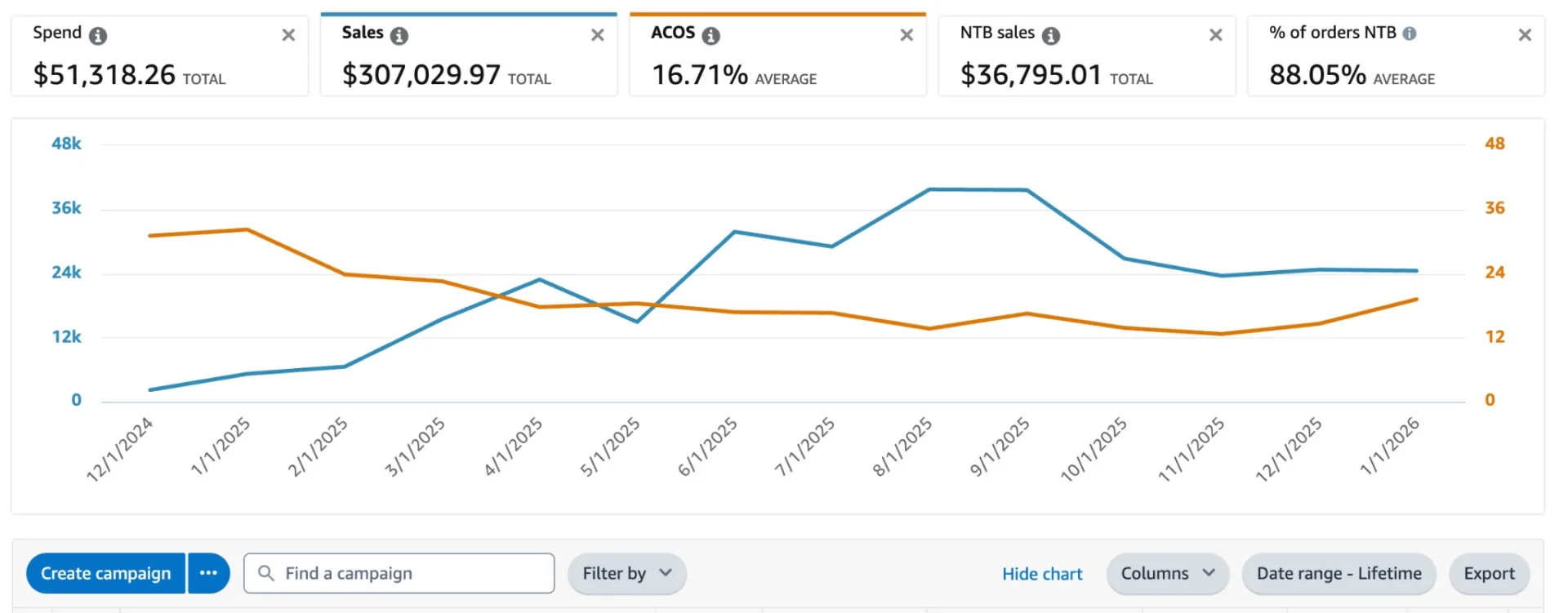

Over a 14-month period, Amazon Ads generated $307,029.97 in sales from $51,318.26 in spend, holding a 16.71% average ACOS and 5.98 ROAS.

The account delivered 7,750 total orders from 83,642 clicks, with a $0.61 average CPC and 0.70% CTR, confirming efficient traffic acquisition at scale.

Customer acquisition quality remained high, with 1,105 New-to-Brand orders and 88.05% of ad-attributed orders coming from first-time customers, reinforcing Amazon’s role as an incremental acquisition channel rather than recycled demand. These results show controlled scale with improving efficiency, stable CPCs, and sustained New-to-Brand contribution over the full 14-month window.

These results confirm that Amazon scaled as a predictable, acquisition-led growth channel, delivering sustained revenue, high New-to-Brand contribution, early repeat behavior, and improving efficiency.

Conclusion

This case study demonstrates how Amazon was scaled into a $438K revenue channel as a controlled extension of a DTC brand, without sacrificing pricing control, margins, or customer quality.

By maintaining brand ownership of listings, enforcing consistent pricing, and leveraging Amazon Brand Registry, the brand preserved its identity and margin integrity while scaling revenue.

Unauthorized seller risk was actively mitigated through continuous monitoring and Amazon Transparency enrollment, preventing Buy Box hijacking and price undercutting as volume grew.

Strategic Amazon PPC delivered highly efficient performance $307K in ad-attributed sales from $51.3K spend at a 16.7% ACOS, with 88% of ad orders from New-to-Brand customers, underscoring predictable customer acquisition.

Importantly, this expansion on Amazon did not cannibalize DTC demand. 92% of Amazon revenue came from new customers, and repeat behavior began to emerge with a ~4.3-week reorder signal, supporting long-term value.

Ready to Scale Your Amazon Portfolio?

If you’re an Amazon brand owner, brand manager, or 3P seller facing unpredictable sales and reactive Amazon PPC management, it’s time to build a structured Amazon growth system.

Most Amazon brands treat Amazon PPC, listing optimization, and customer data as separate functions. As a full-service Amazon marketing agency, AMZDUDES brings them together into a unified Amazon growth strategy.

We don’t just optimize campaigns or rewrite listings. We interpret Amazon data, identify structural gaps, and redesign how your brand is discovered, converted, and retained through Amazon advertising and organic growth.

What We Help You Achieve on Amazon

We help Amazon brands:

- Improve Amazon listing SEO and conversion rate to increase organic visibility

- Scale Amazon PPC campaigns with controlled ACOS and sustainable ROAS

- Acquire high-intent New-to-Brand customers Amazon can attribute and verify

- Increase Subscribe & Save adoption to build recurring revenue streams

- Leverage Amazon Marketing Cloud (AMC) to target and retarget high-intent shoppers

- Strengthen customer retention and lifetime value through repeat purchase strategies

Instead of relying on guesswork or short-term ad spikes, we apply the same Amazon growth framework used in this case study, designed for brands that want predictable, scalable, and profitable Amazon growth.

Book a Free Amazon Growth Strategy Call

Let’s review your Amazon listings, PPC campaigns, and customer data to identify growth opportunities and build a roadmap for sustainable scaling.