“Before working with AMZDUDES, our products were on page 5. Within the first two months, their targeted keyword strategy and listing optimization pushed our main products to the top 3 spots. We saw an immediate 40% jump in organic traffic due to which our number of sales is also increasing. Highly recommended Amazon SEO services.”

Amazon Beauty Brand Case Study | Full-Funnel Amazon PPC, Bundle Strategy & AMC Audience Targeting

Client Background

A premium brand in the Beauty & Personal Care category partnered with AMZDUDES to scale its Amazon business beyond keyword-driven PPC and fragmented catalog performance.

The brand operated in a highly competitive Amazon beauty market where success depends not only on ads, but also on brand positioning, compliance, customer lifecycle marketing, and catalog economics.

While the brand had established demand on Amazon, its growth was constrained by underutilized bundles, limited audience targeting, and PPC campaigns built around keywords rather than customer behavior. Premium A+ Content and Amazon Marketing Cloud (AMC) were available but not strategically leveraged to drive full-funnel growth.

The brand’s objective was clear: to build a scalable Amazon growth system that integrates bundles, audience intelligence, and full-funnel Amazon advertising while strengthening brand perception in the Beauty & Personal Care category.

Challenge / Underlying Problem

Although the Beauty & Personal Care brand was generating sales on Amazon, its growth was constrained by structural gaps in catalog design, audience strategy, and Amazon PPC execution.

The first challenge was bundle underutilization. Customer purchase data showed strong cross-buy behavior across multiple products, but the catalog structure did not reflect this. Bundles were not positioned as primary conversion assets, limiting average order value and reducing the brand’s ability to monetize existing demand.

The second challenge was keyword-driven PPC without customer insights. Amazon PPC campaigns were optimized around keywords and bids, not customer behavior. As a result, the brand was capturing traffic but not systematically targeting high-value audiences such as repeat buyers, multi-product customers, or high-intent shoppers. Amazon Marketing Cloud (AMC) data was available but not operationalized into audience segments or full-funnel targeting.

The third challenge was inefficient funnel coverage in Amazon advertising. Sponsored Products were driving most conversions, while Sponsored Brands, Sponsored Display, and audience-based campaigns were not fully integrated into a cohesive funnel. This allowed competitors to intercept branded searches and limited the brand’s ability to control visibility across discovery, consideration, and retention stages.

The fourth challenge was underleveraged Premium A+ Content and brand storytelling. Listings lacked a structured narrative that connected products into a system, which reduced cross-sell adoption and weakened brand differentiation in a crowded beauty category. Premium A+ modules were present but not strategically designed to influence bundle uptake or repeat behavior.

In short, the brand was growing on Amazon, but without a system that aligned catalog economics, audience intelligence, and full-funnel Amazon PPC. To scale sustainably in the Beauty & Personal Care category, the brand needed to restructure its Amazon growth model around bundles, customer behavior, and lifecycle-driven advertising.

Strategy: Full-Funnel Amazon Growth System for a Beauty Brand

To scale the Beauty & Personal Care brand on Amazon, AMZDUDES built a full-funnel growth system that aligned catalog structure, customer intelligence, keyword strategy, and Amazon PPC into one integrated framework.

Instead of optimizing ads in isolation, we treated Amazon as a brand ecosystem where bundles, search visibility, audiences, and promotions work together to drive acquisition, conversion, and lifetime value.

The strategy focused on increasing average order value through bundles, expanding category visibility through keyword gap analysis, shifting PPC from keyword-driven to customer-driven targeting, and using promotions strategically to convert peak-season demand into long-term customers.

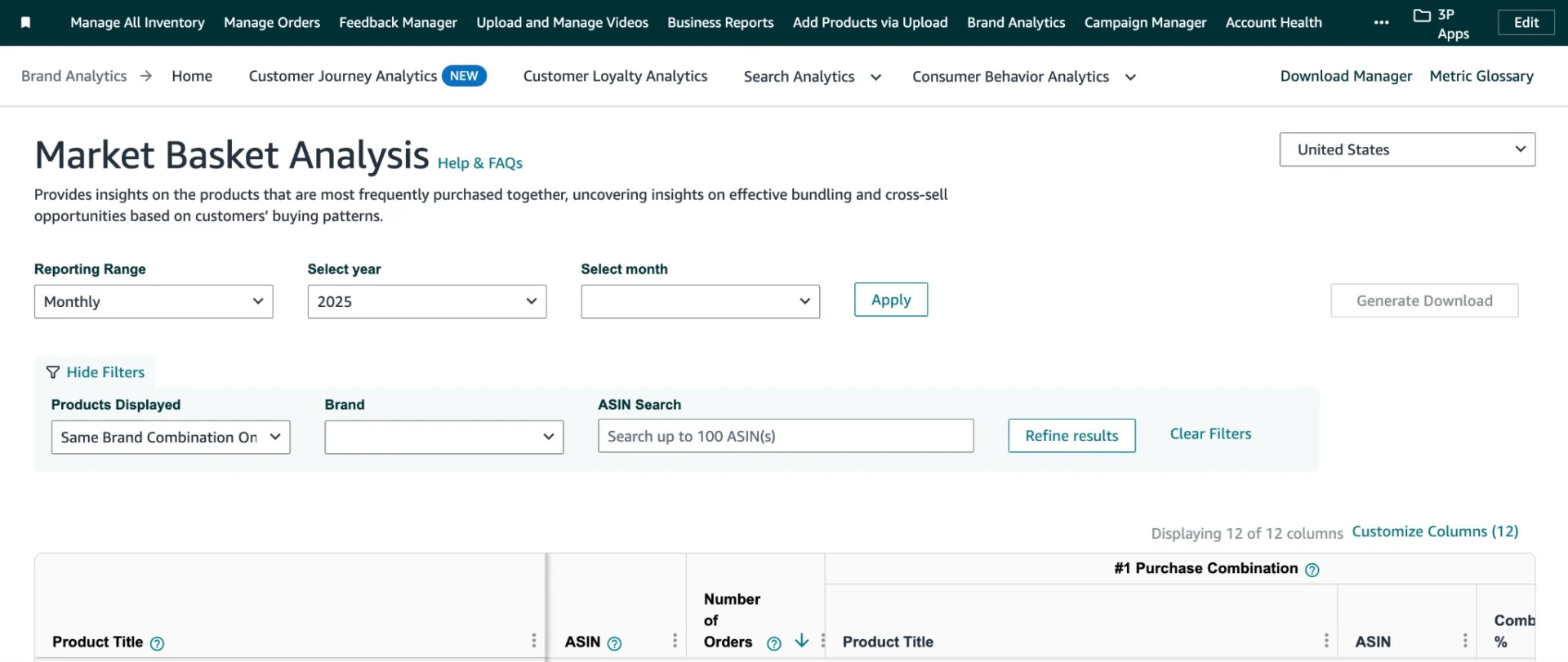

A) Rebuilding the Catalog Around Bundles and Cross-Purchase Behavior

Amazon data revealed that customers were already buying multiple products together, but the catalog was structured around single SKUs. This limited basket size and reduced the brand’s ability to monetize existing demand in the beauty category.

Bundles were created based on Market Basket Analysis, grouping products that customers frequently purchased together. These bundles were positioned as primary purchase options across listings, A+ Content, and PPC campaigns. Variation structures, titles, and visual hierarchies were aligned to highlight bundle value, routines, and cost-per-use advantages.

Bundles became the primary lever for increasing average order value, improving contribution margins, and accelerating multi-product adoption across the catalog.

B) Expanding Visibility Through Competitor Keyword Gap Analysis

We conducted a deep keyword gap analysis of close competitors to identify high-intent search terms where competitor products were ranking above the brand. This analysis revealed critical visibility gaps across category and non-branded keywords in the beauty segment.

Based on this data, we mapped three layers of keyword opportunities:

- Brand-dominant keywords where competitors were intercepting branded demand.

- Category keywords where competitors owned top organic and paid positions.

- Emerging search terms with high conversion potential but low brand visibility.

We then restructured listings and PPC campaigns around these gaps. Listings were optimized to improve indexing for missing category keywords, while PPC campaigns were designed to systematically attack competitor rankings rather than randomly expanding keyword lists. This allowed the brand to move from defending existing demand to actively capturing competitor traffic and category-level shoppers searching for beauty products on Amazon.

C) Full-Funnel Amazon Advertising Structure

We rebuilt the advertising system around intent stages rather than campaign types.

At the bottom of the funnel, branded Sponsored Products and Sponsored Brands campaigns defended brand demand and captured high-intent searches. Cross-ASIN targeting was deployed to prevent competitors from intercepting branded traffic.

In the mid-funnel, non-branded category keywords and competitor ASIN targeting captured shoppers comparing category products. Sponsored Display remarketing converted warm audiences who had viewed listings but not purchased.

At the top of the funnel, discovery campaigns and lookalike audiences expanded reach beyond existing demand. Seasonal reactivation campaigns brought back past buyers during peak periods. This created a continuous flow from discovery to conversion to retention. Instead of relying on isolated campaigns, the brand controlled visibility across the entire Amazon customer journey.

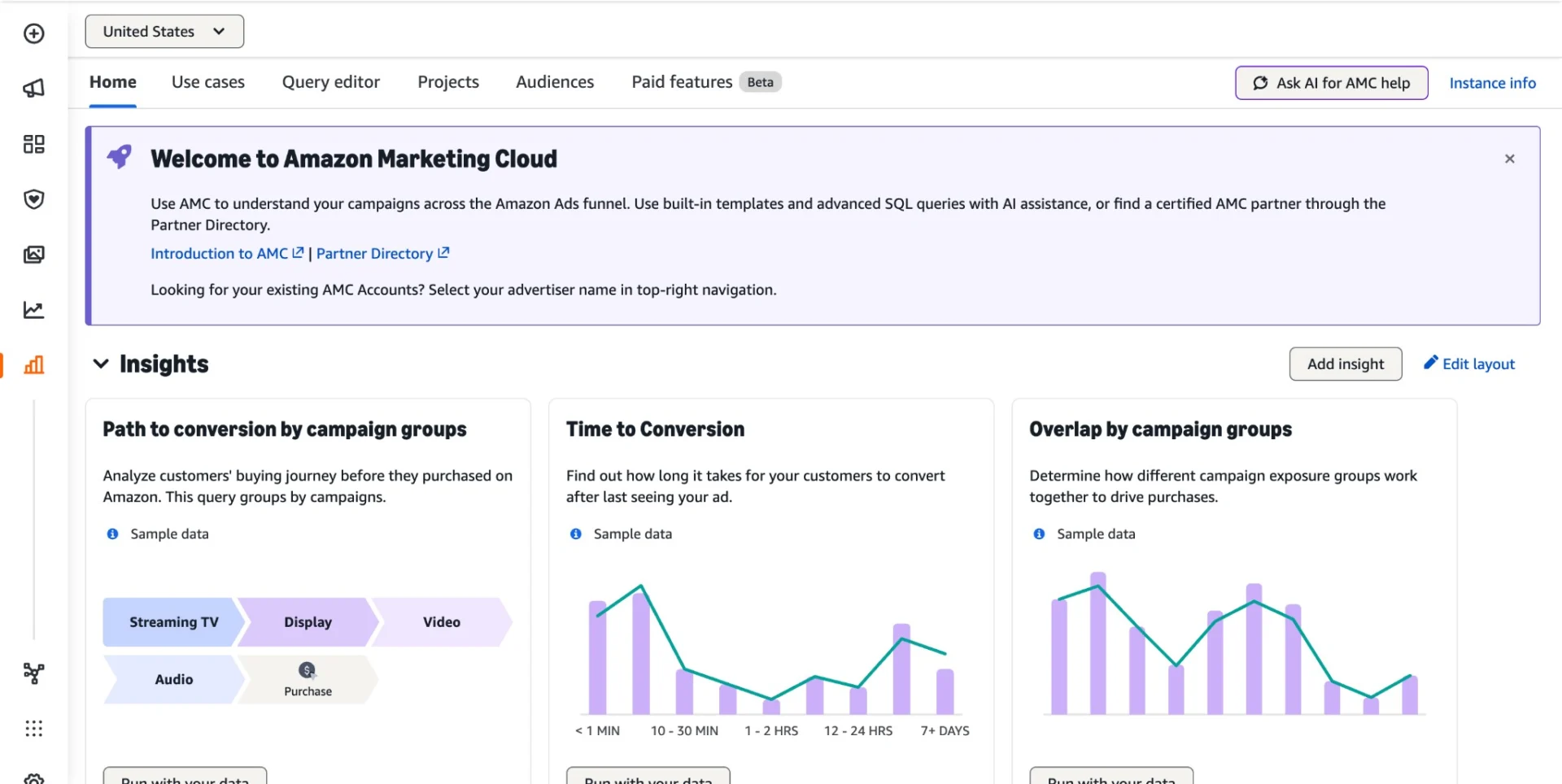

D) Audience Targeting Using Amazon Marketing Cloud

Using Amazon Marketing Cloud, PPC execution shifted from keyword-only buying to intent-based audience buying built on real shopper behavior across the catalog.

We activated high-intent audiences that Amazon sellers care about most: shoppers who viewed detail pages multiple times, searched the brand, added products to cart, saved items to wishlists or registries, interacted with Sponsored Ads, explored Subscribe & Save, or purchased before but didn’t convert again. These were customers already inside Amazon’s buying loop, not cold traffic.

Missed-opportunity audiences were rebuilt across:

- Detail page viewers who didn’t purchase

- Branded search users intercepted by competitors

- Add-to-cart non-buyers

- Wishlist and registry savers

- Review readers and SnS explorers

Instead of pushing more impressions blindly, we applied optimal frequency controls at the campaign and cross-campaign level. Under-served audiences (exposed ~50% less than optimal frequency) were expanded to capture incremental demand, while over-saturated audiences (exposed ~50% more than optimal frequency without converting) were suppressed to stop wasted spend and creative fatigue.

Seasonality was handled deliberately. Shoppers exposed only during off-peak periods were re-activated during Prime Day and holiday peaks, allowing the brand to capitalize on high-intent traffic without restarting discovery from zero. Frequent purchasers who were not enrolled in Subscribe & Save were segmented and targeted separately, pushing higher-LTV behavior rather than one-off orders.

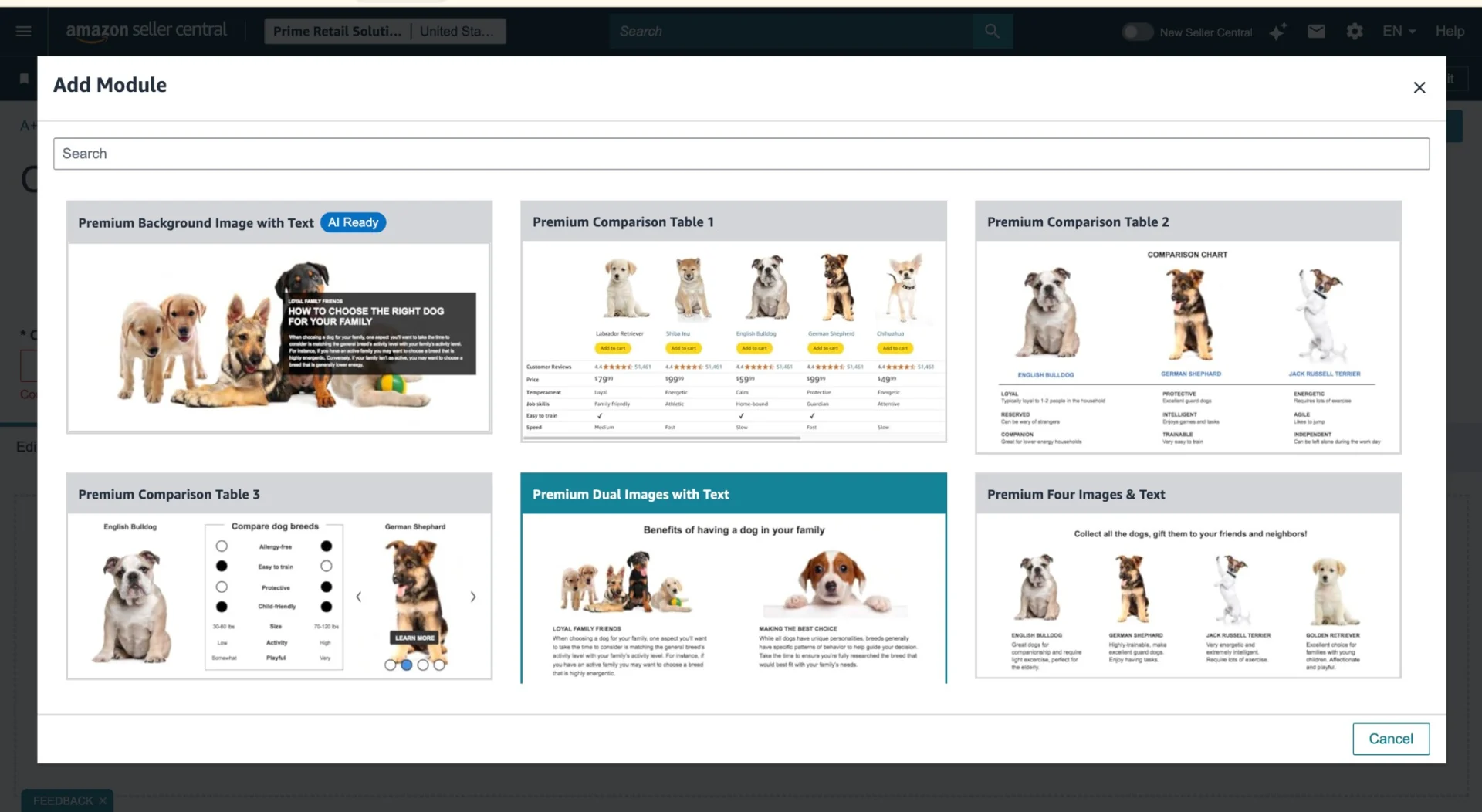

E) Using Premium A+ Content to Drive Cross-Sell and Brand Perception

Premium A+ Content was redesigned to drive cross-sell, not just showcase individual SKUs. Content modules explained how products work together within real beauty routines (pre-care, treatment, post-care), making it clear which products should be purchased together.

Bundles were embedded directly into the content structure. Comparison tables highlighted the value of bundles versus single products, while visual modules demonstrated the functional benefits of using multiple products together. This shifted buying behavior from single-item purchases to multi-product orders.

Lifestyle imagery reinforced premium brand positioning, while benefit-driven copy clarified why the brand’s product delivered stronger results than generic alternatives in the Beauty & Personal Care category.

Results: Full-Funnel Growth, Higher Order Value, and Scalable Amazon Performance

By aligning bundles, Premium A+ Content, Amazon PPC, and audience targeting, the brand transitioned from product-level selling to full-funnel growth in the Beauty & Personal Care category. The results reflected stronger unit economics, improved ad efficiency, and sustainable customer acquisition during peak demand periods.

1) Higher Average Order Value Through a Bundle & Pack Size Growth Strategy

Instead of treating bundles as secondary add-ons, we repositioned bundles and multi-pack sizes as the primary way customers experienced the brand. Bundles were systematically integrated across product detail pages and merchandising strategy, allowing the brand to increase average order value and margin efficiency without requiring a proportional increase in advertising spend.

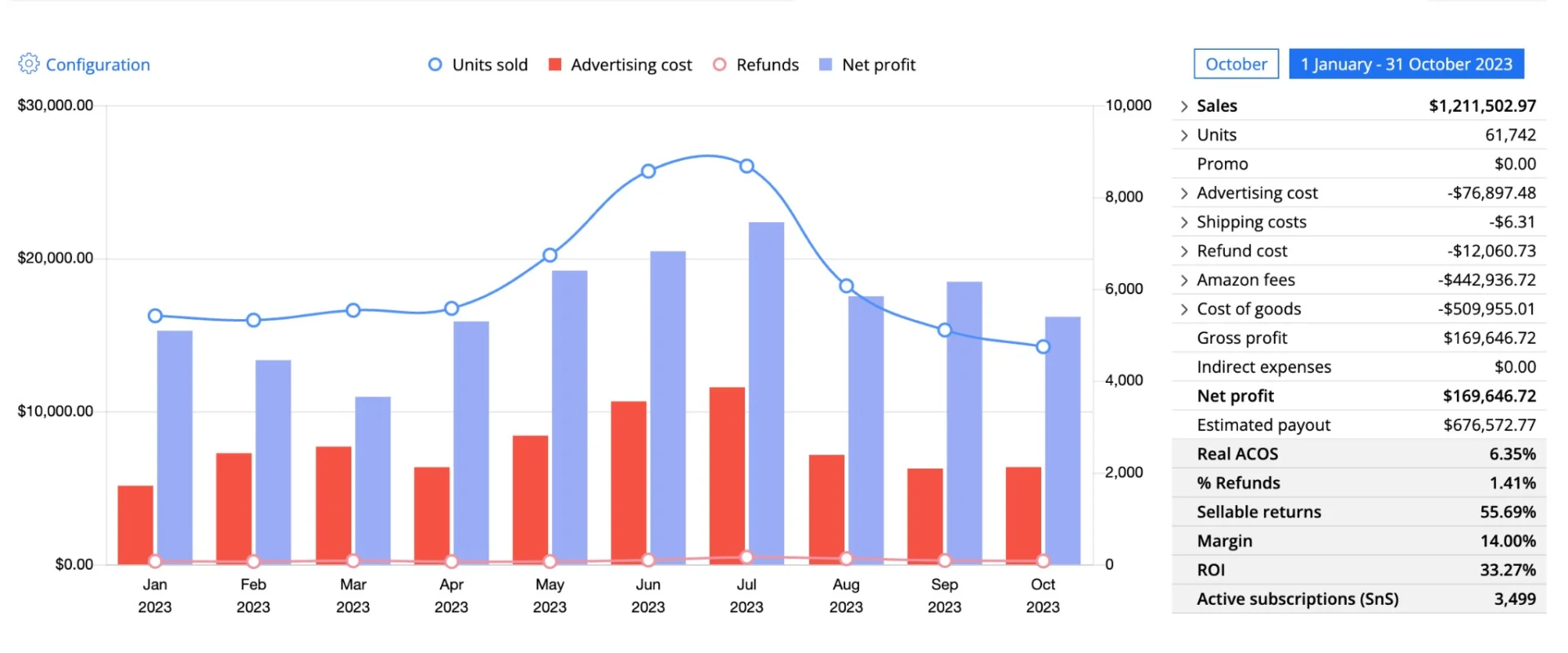

The year-over-year impact confirms this shift:

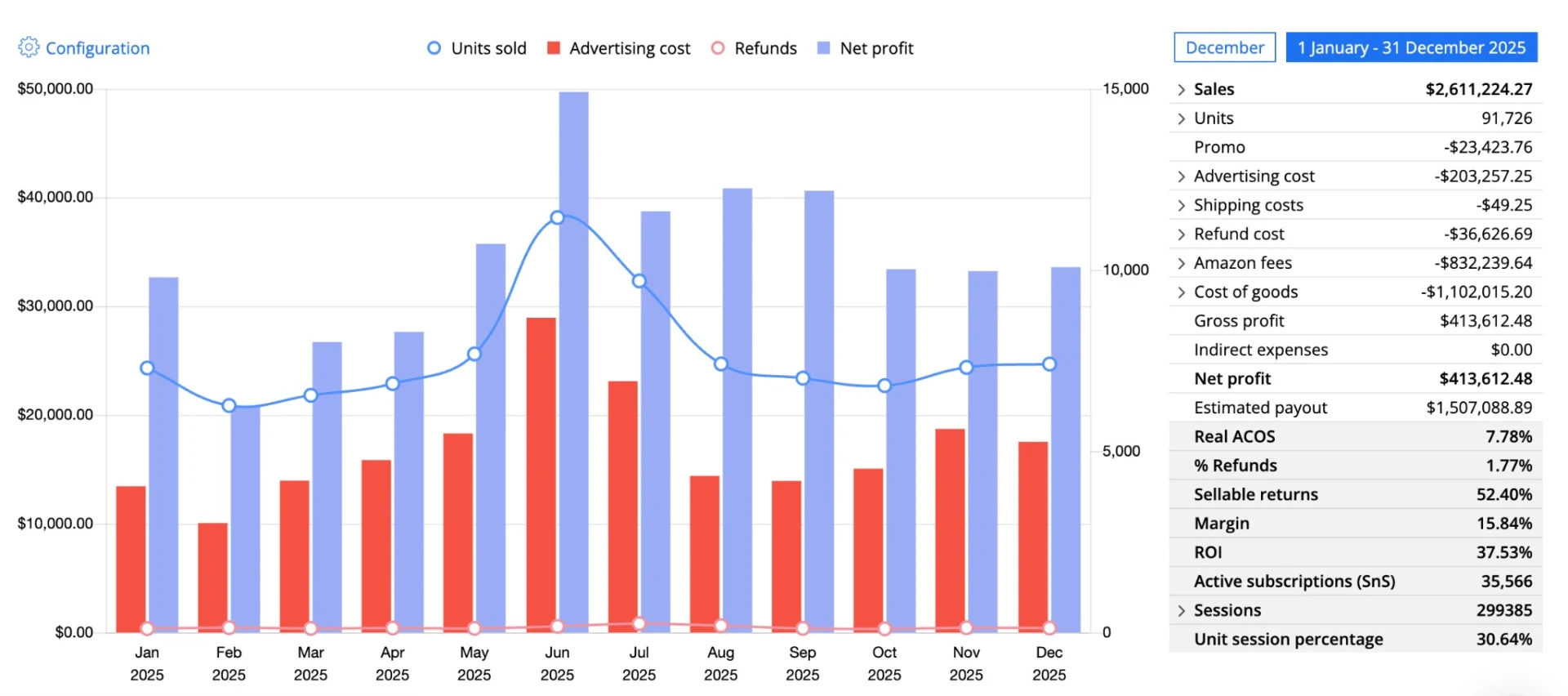

Improved Return on Investment & Profit Efficiency

- Units sold increased ~29% from 2023 to 2025, while gross profit more than doubled, growing from ~$169K to $413K. Growth was driven by higher value per order.

- Net margin improved from ~14% in 2023 to 15.84% in 2025, reflecting stronger contribution margins from bundled purchases compared to single-SKU sales.

- ROI increased from ~33 to 37.53, meaning every dollar invested in traffic and advertising generated materially more profit as bundles became the dominant revenue structure.

BEFORE

AFTER

Bundles became the brand’s primary growth lever, directly increasing Average Order Value alongside margin efficiency. As bundles scaled, AOV increased from ~$20.3 in 2023 to ~$35 in 2024 and ~$38 in 2025, allowing revenue to grow faster than unit volume.

This higher order value and improved margins created additional profit headroom, which was reinvested into PPC to scale hero SKUs, accelerate customer acquisition, and sustain profitable growth.

2) Improved Amazon Sales and Conversion Performance

Following product listing optimization and the rollout of Premium A+ Content, the brand achieved sustained improvements in Amazon conversion rate, sales efficiency, and average order value, even as traffic and order volume scaled.

Higher Amazon Conversion Efficiency

Unit Session Percentage increased from 23.37% in 2023 to 30.65% in 2024, and remained stable at ~30.3% in 2025. This represents a ~30% improvement in conversion efficiency, demonstrating that growth was driven by stronger product presentation and buyer confidence.

Revenue Growth Through Conversion, Retention, and Order Value

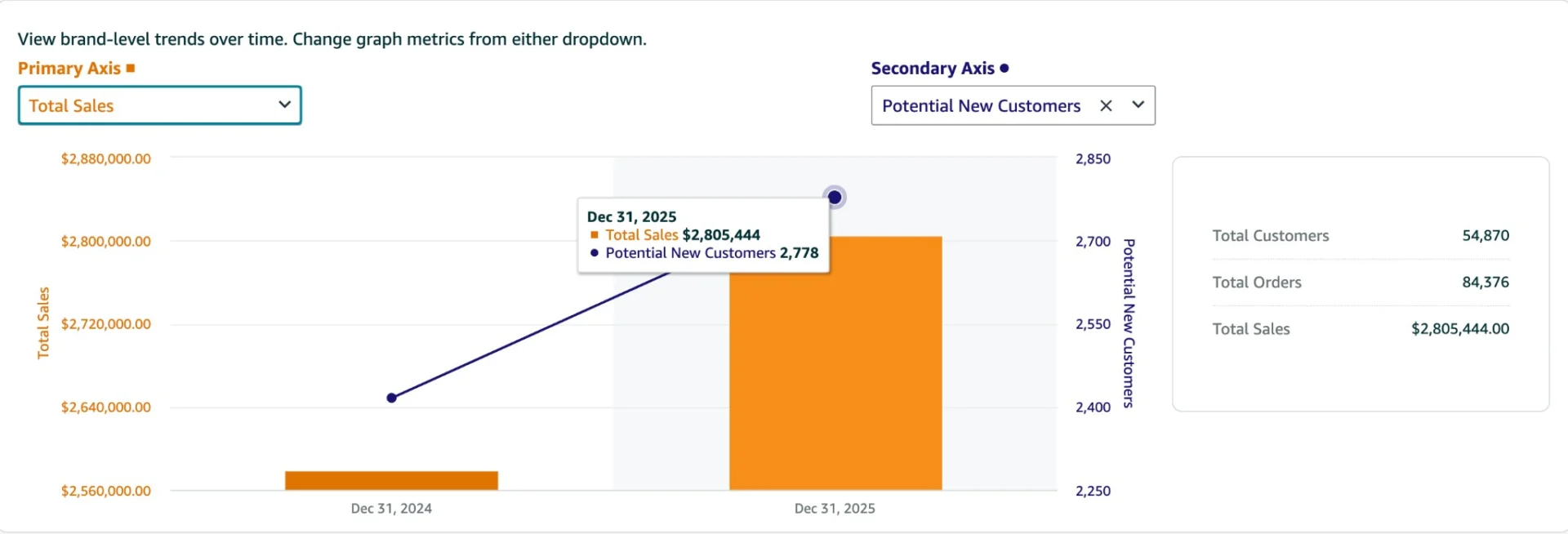

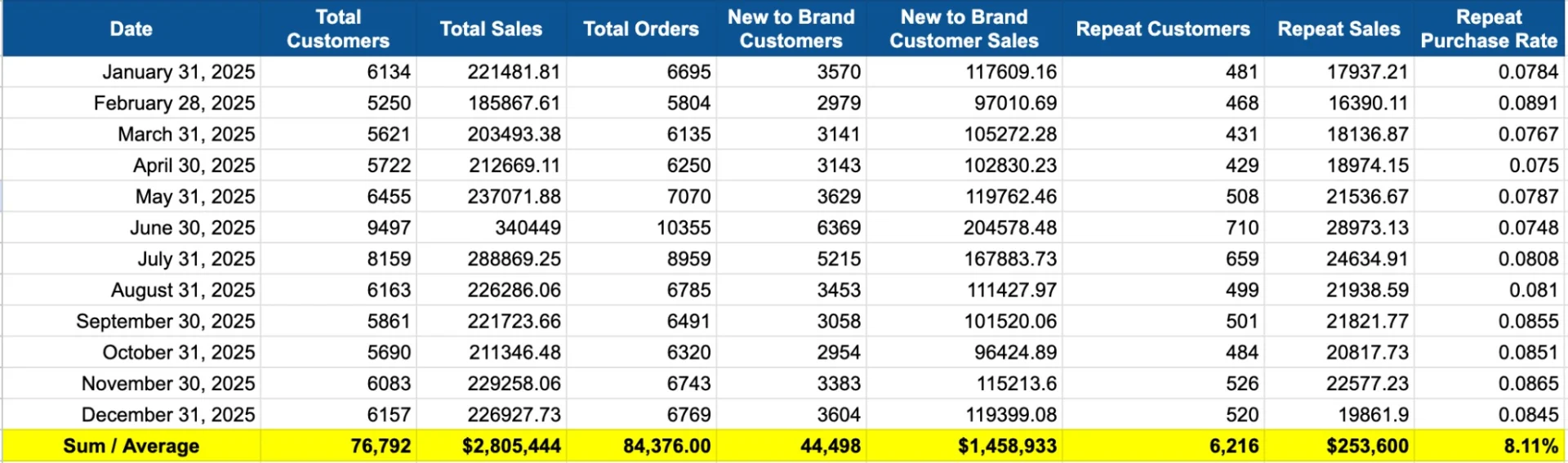

Amazon revenue scaled from $1.45M in 2023 to $2.38M in 2024, reaching $2.61M in 2025. This growth was powered by a combination of higher conversion rates, improved order value through bundles, and stronger repeat purchase behavior.

In 2025, the brand generated $2.8M in Amazon revenue, acquiring 44,498 New-to-Brand customers who contributed $1.46M (52%) of total sales. At the same time, the brand sustained an 8.11% repeat purchase rate across 6,216 returning customers, with an average 4–5 week reorder cycle (4.61 weeks).

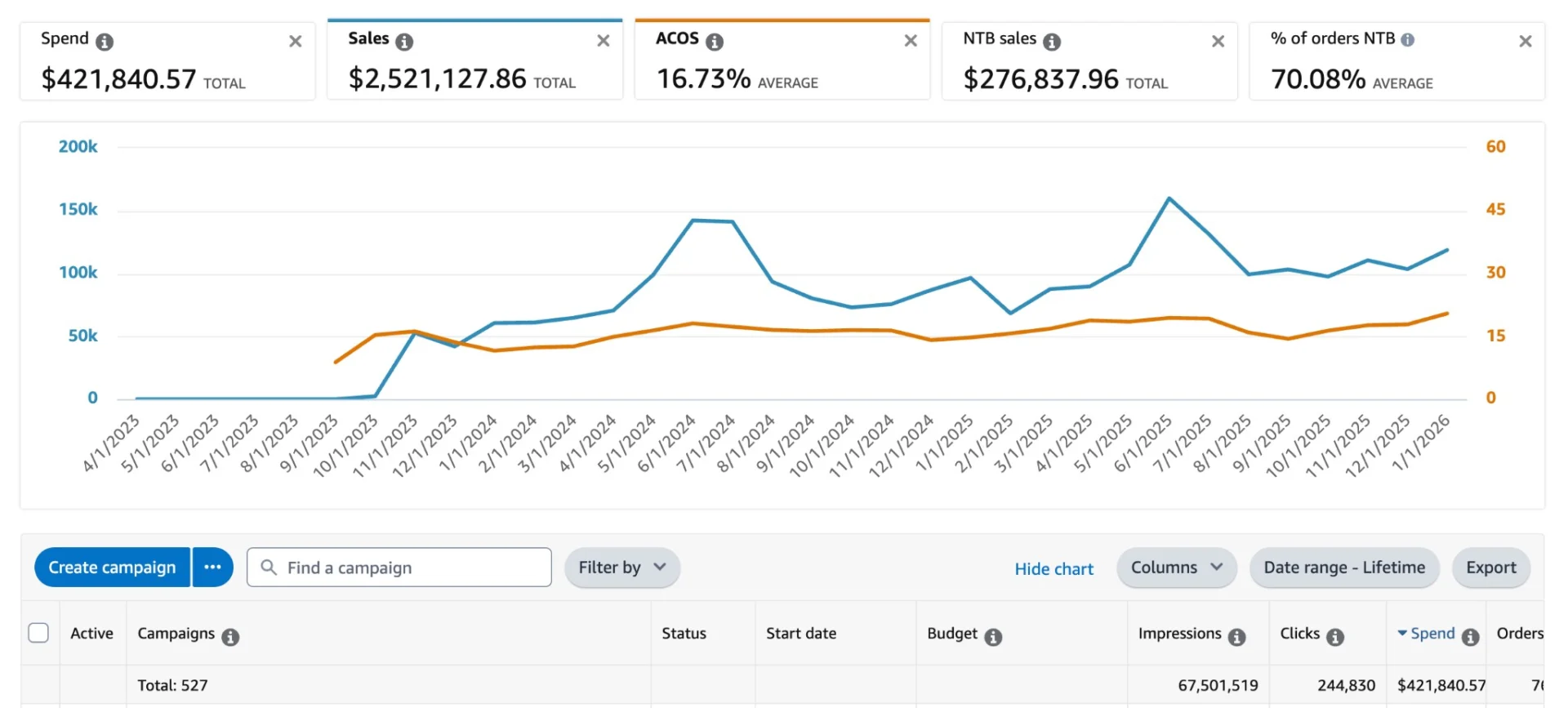

3) Amazon Ads Performance Results (Full-Funnel Impact)

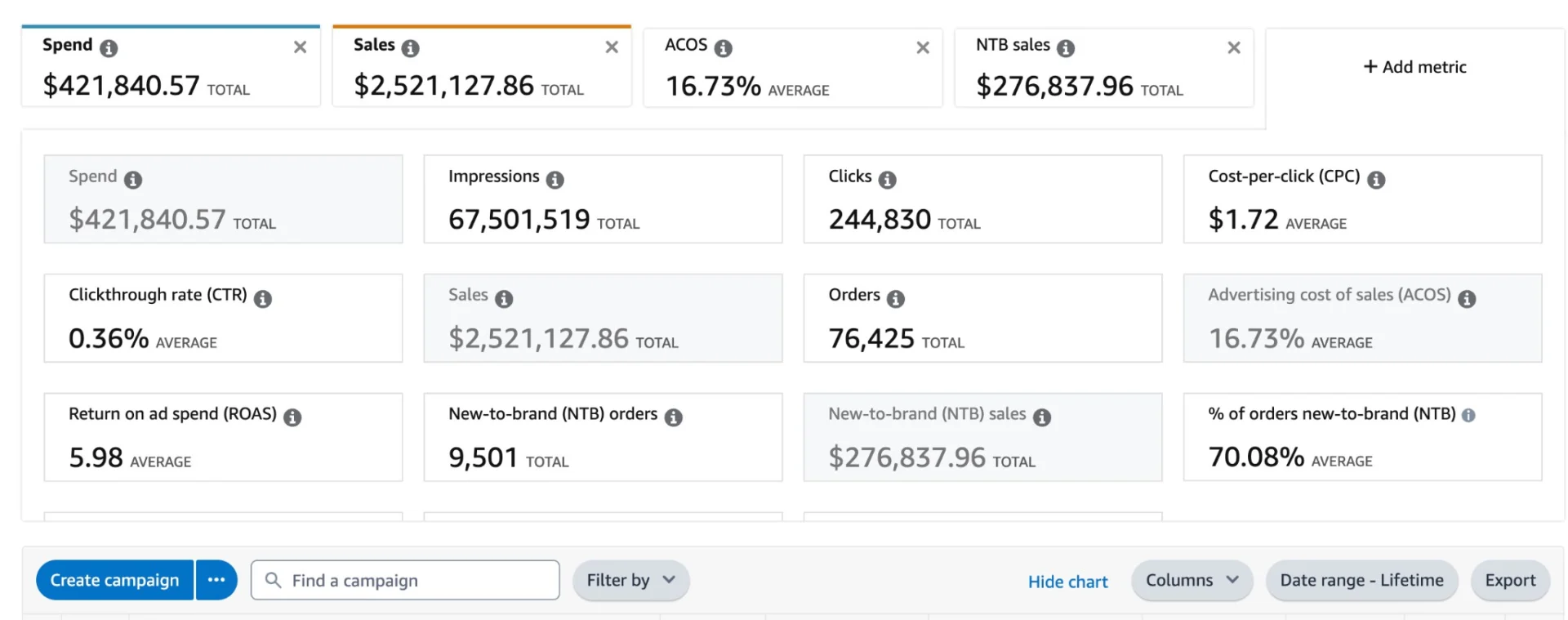

- Awareness (Reach): The account generated 67.5M impressions, driven primarily by non-branded discovery campaigns, Sponsored Brands, Sponsored Brands Video, and category-level Sponsored Products.

- Consideration (Traffic Quality): Across 244,830 clicks, the account maintained a blended CPC of $1.72. Discovery campaigns were intentionally optimized for controlled reach and new customer acquisition. Lower CTRs at this stage reflected disciplined discovery spend feeding higher-intent campaigns downstream.

- Conversion (Purchase Outcomes): The brand generated 76,425 total orders, delivering a ~31% blended conversion rate and an average $5.52 cost per order. Once shoppers entered the funnel, purchase intent was strong, confirming alignment between listings, bundles, Premium A+ Content, and mid-funnel PPC execution.

- Efficiency (Profitability): Despite active new customer acquisition and category expansion, the account sustained a 16.73% ACOS and a 5.98 ROAS. Importantly, 70.08% of ad-attributed orders were New-to-Brand, generating $276,837 in NTB sales.

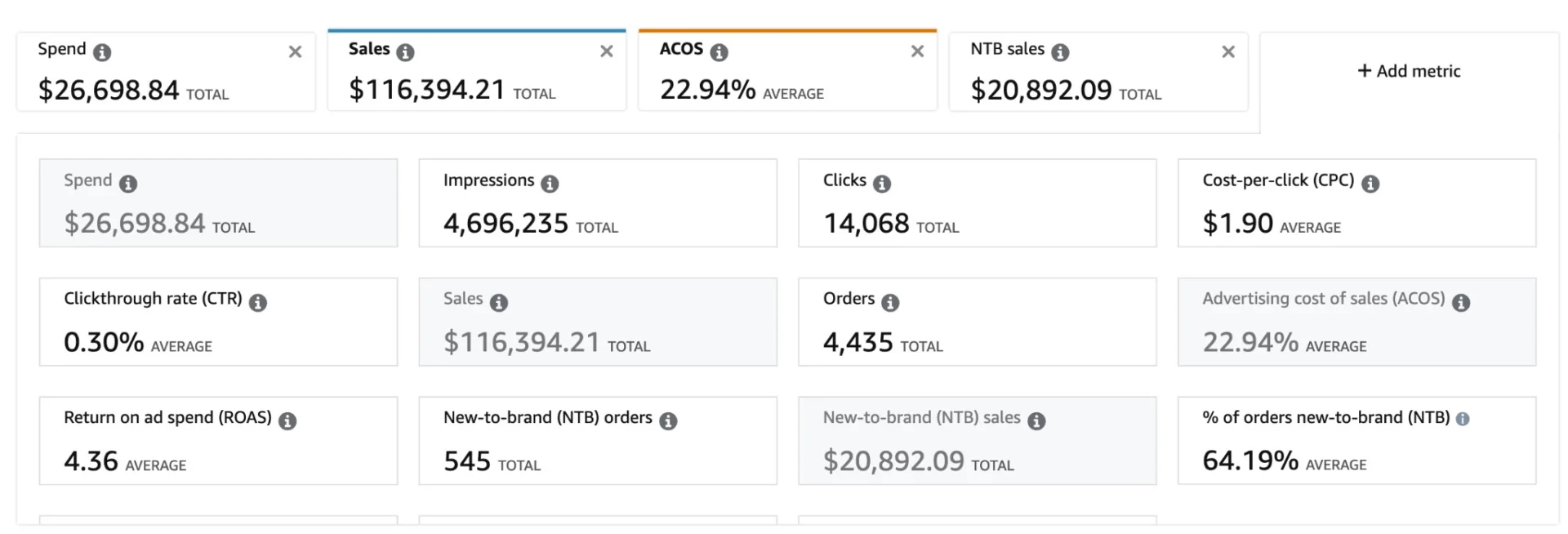

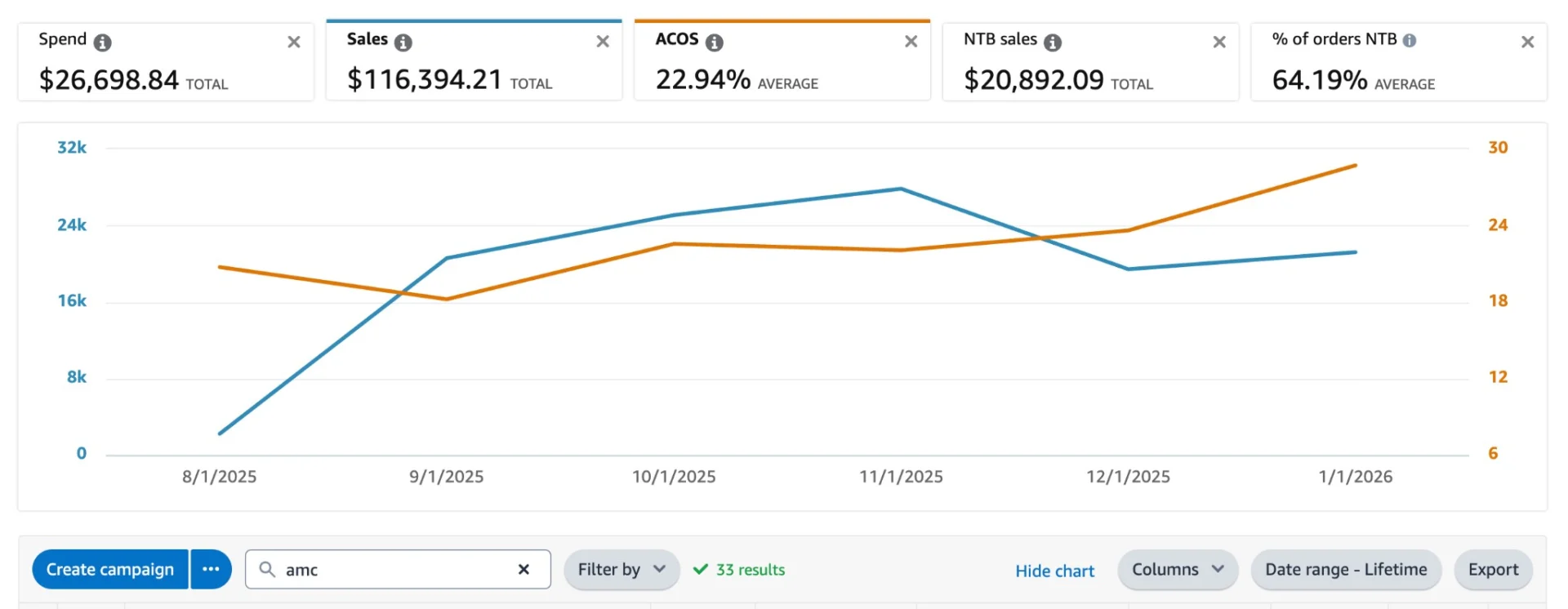

4) Improved Ads Efficiency Through Audience-Based Targeting

Across AMC-driven campaigns, the brand generated $116K+ in sales from $26.7K in spend, holding ~22.9% blended ACOS while actively running discovery and audience expansion. 64% of total orders came from New-to-Brand customers, confirming that growth was incremental, not recycled branded demand.

CPC remained stable around $1.7–$2.1, even with broad and video placements active, multiple AMC campaigns delivered ROAS between 4× and 9×, including non-branded and mid-funnel segments.

Most importantly, spend stopped leaking into low-intent impressions. Budget flowed toward shoppers Amazon had already qualified through engagement, exposure, or prior purchase behavior. That’s why performance stabilized even as reach scaled.

AMC allowed us to stop paying for guesses and start paying for intent. PPC became predictable, scalable, and efficient, without relying on aggressive bids, inflated CPCs, or short-term traffic spikes.

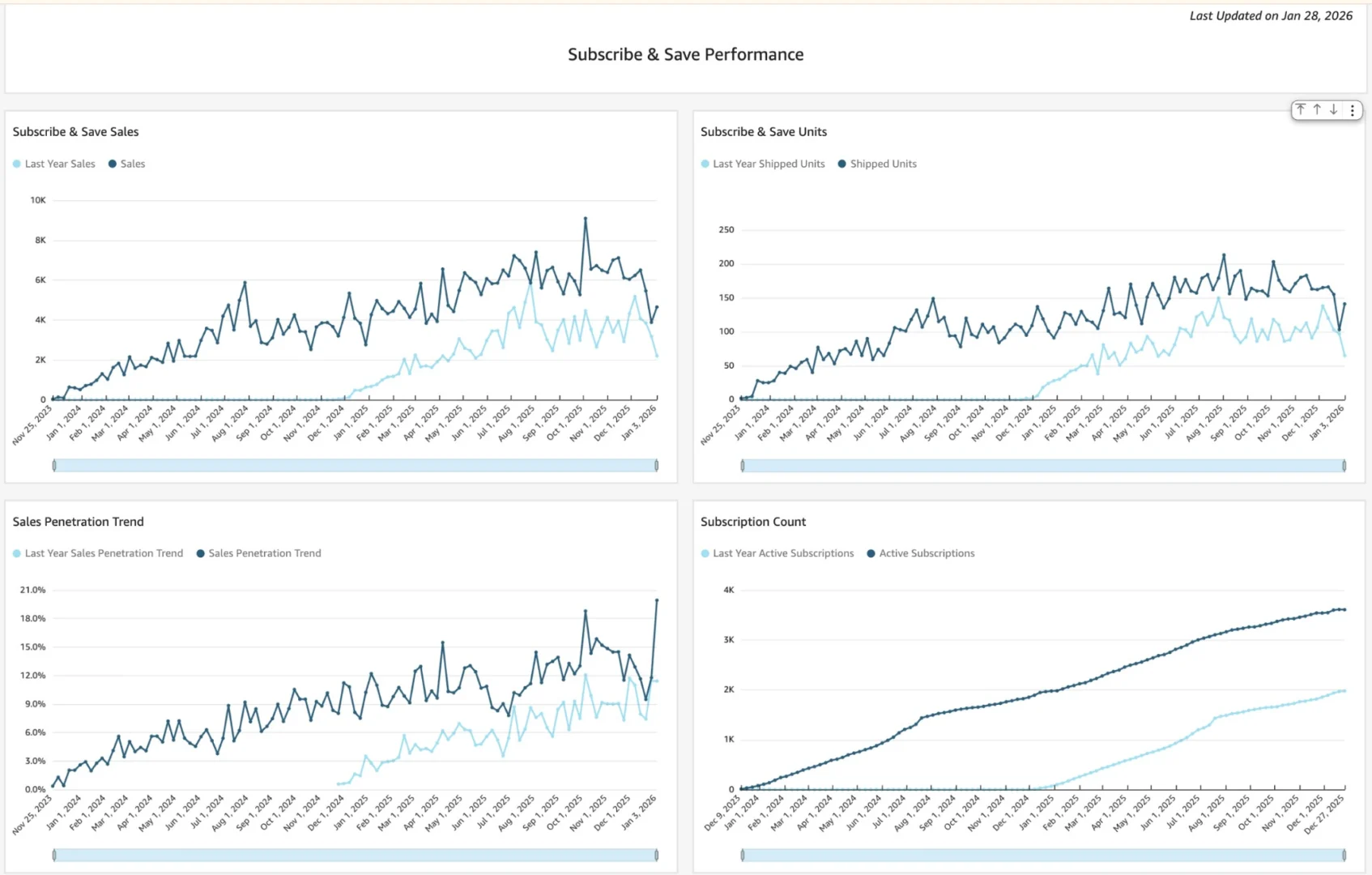

Subscribe & Save Growth During Peak Seasons

Subscribe & Save became a meaningful revenue and retention driver once incentives were aligned with buying behavior instead of being applied broadly.

- Subscribe & Save sales and units grew sharply year over year, with peak daily sales increasing from roughly $3K–$4K in the prior year to $6K–$9K during peak months, and shipped units scaling from ~70–100 units/day to 150–220+ units/day at peak.

- Subscribe & Save sales and units grew consistently year over year, with peak daily sales increasing from roughly $3K–$4K last year to $6K–$9K during peak periods, and shipped units scaling from ~80–120 units/day to 150–200+ units/day at peak.

- Active subscriptions scaled steadily throughout the year, growing from near zero in the prior period to 3,500+ active subscriptions, with a smooth upward curve and no post-promotion drop-off.

- Sales penetration from Subscribe & Save increased from low single digits to the mid-to-high teens, peaking around 18–19% during Prime Day and Q4, compared to materially lower penetration in the prior year.

- Momentum held after peak periods, with subscription count, daily subscription sales, and penetration remaining elevated into late Q4 and early Q1 indicating customers stayed subscribed rather than churning after incentives ended.

By activating first-time Subscribe & Save offers during peak traffic windows and targeting frequent repeat buyers not yet subscribed, peak demand was converted into recurring revenue.

Conclusion

This engagement replaced keyword-driven PPC and single-SKU selling with a full-funnel Amazon growth system built on bundles, audience targeting, and lifecycle advertising.

The catalog was restructured around bundles and pack sizes, increasing AOV from ~$20.3 (2023) to ~$38 (2025). Revenue grew faster than unit volume (+29% units vs +80%+ revenue), while gross profit more than doubled to $413K and ROI increased to 37.53.

Listings and Premium A+ Content improved conversion efficiency, lifting Unit Session Percentage from 23.37% to ~30% and supporting revenue growth from $1.45M (2023) to $2.84M (2025). In 2025, the brand generated $2.8M, with 44,498 New-to-Brand customers contributing 52% of total sales, and an 8.11% repeat purchase rate on a 4-5 week reorder cycle.

Amazon Ads were restructured for full coverage across discovery, consideration, and retention. The account generated 67.5M impressions, 244,830 clicks at $1.72 CPC, 76,425 orders, and maintained 16.73% ACOS and 5.98 ROAS, with 70.08% of ad-attributed orders coming from New-to-Brand customers.

Amazon Marketing Cloud enabled audience-based targeting at scale, producing $116K+ in sales from $26.7K spend (~22.9% ACOS), while stabilizing CPC and eliminating low-intent spend.

Subscribe & Save shifted from a promotion tactic to a retention channel. Daily subscription sales increased from ~$3K–$4K to $6K–$9K, units scaled to 150–200+ per day, active subscriptions reached 3,500+, and sales penetration grew to ~18–19%, with elevated levels sustained after peak periods.

Result: The brand moved from isolated PPC execution to a scalable Amazon operating system that increased order value, improved conversion, acquired new customers profitably, and converted peak demand into recurring revenue.

Ready to Scale Your Amazon Portfolio?

If you’re an Amazon brand owner, brand manager, or 3P seller facing unpredictable sales and reactive Amazon PPC management, it’s time to build a structured Amazon growth system.

Most Amazon brands treat Amazon PPC, listing optimization, and customer data as separate functions. As a full-service Amazon marketing agency, AMZDUDES brings them together into a unified Amazon growth strategy.

We don’t just optimize campaigns or rewrite listings. We interpret Amazon data, identify structural gaps, and redesign how your brand is discovered, converted, and retained through Amazon advertising and organic growth.

What We Help You Achieve on Amazon

We help Amazon brands:

- Improve Amazon listing SEO and conversion rate to increase organic visibility

- Scale Amazon PPC campaigns with controlled ACOS and sustainable ROAS

- Acquire high-intent New-to-Brand customers Amazon can attribute and verify

- Increase Subscribe & Save adoption to build recurring revenue streams

- Leverage Amazon Marketing Cloud (AMC) to target and retarget high-intent shoppers

- Strengthen customer retention and lifetime value through repeat purchase strategies

Instead of relying on guesswork or short-term ad spikes, we apply the same Amazon growth framework used in this case study, designed for brands that want predictable, scalable, and profitable Amazon growth.

Book a Free Amazon Growth Strategy Call

Let’s review your Amazon listings, PPC campaigns, and customer data to identify growth opportunities and build a roadmap for sustainable scaling.