Key Takeaways

- Clear pricing structures remove confusion When you understand how each model works, you can judge proposals with confidence and choose support that fits your goals.

- Benchmark pricing gives you a reference point They help you compare retainer ranges, ad spend ratios, and service depth without guessing what is fair or inflated.

- Your catalog shapes the cost. SKU count, campaign depth, category pressure, and optimization frequency all influence where your brand lands in the market range.

- Different brand stages need different support levels. Small sellers need clean structure and efficient visibility. Mid market brands need broader coverage and deeper insight. Enterprise teams need forecasting, control, and consistent scalability.

- Agencies vary in expertise and value. Strong partners align PPC with inventory health, catalog readiness, and profitability. Low priced Amazon PPC management services often cut corners and limit long term growth

- AMZDUDES fits within the mid to premium benchmark tiers Our pricing reflects the depth of strategy, operational alignment, and stability that brands need to scale with clarity.

Amazon PPC pricing creates doubt for many brands. One proposal looks low. Another feels high. None explain what the numbers mean for visibility or profitability. That uncertainty slows decisions and hurts performance.

You deserve clear pricing benchmarks and logic that reflects how Amazon actually works. Real Amazon PPC management cost. Real PPC variables. Real campaign expectations.

This guide breaks down the pricing models agencies use for Amazon PPC management. It shows what each model costs in the current market and why brands land in different ranges.

By the end, you gain a clear view of the landscape and the confidence to choose a structure that supports long-term profitability.

Different Amazon PPC Management Pricing Models

Amazon PPC feels complex when pricing structures are unclear. Most brands see similar proposals but never understand how agencies actually calculate their fees. This section brings clarity. Each model has a purpose. And each one shapes how much optimization and precision you can expect.

Flat monthly management fee

Some agencies charge a simple flat fee. The structure is stable. The brand knows the cost every month. This model works when the catalog is small and the campaigns need consistent optimization without deep volatility. Flat fees give predictable support but rarely scale with aggressive growth.

Percentage of ad spend

Many agencies charge a percentage of monthly ad spend. The logic is simple. Higher spend requires more optimization, more testing, and more insight. This model fits brands that push visibility and expansion. It also fits categories with fast auction shifts. The percentage reflects the effort needed to keep campaigns efficient.

Hybrid pricing (Flat + Percentage)

A hybrid structure blends a base fee with a spend percentage. This model gives balance. The base covers essential management. The percentage covers the extra work that comes with higher budgets and more complex catalogs. Hybrid pricing supports scalability for brands with multiple SKUs and ongoing testing needs.

Performance-aligned structures

A few agencies offer performance-aligned pricing. The idea connects Amazon PPC cost to outcomes like target ACoS or growth in specific campaigns. This model is rare. It only works when inventory flow, compliance, and forecasting stay stable. Brands with chaotic catalogs or supply gaps cannot use performance pricing effectively.

Market Benchmarks for Each Amazon PPC Pricing Model (2024–2025)

Most brands want a clear view of what Amazon PPC management actually costs. The ranges below reflect an average of industry reports, public agency pricing pages, and research across Amazon service providers. These PPC benchmarks give you a transparent starting point. They help you compare proposals with confidence and understand which model fits your level of visibility and optimization needs.

| Pricing Model | Typical Cost Range | Best Fit For |

| Flat monthly fee | 500 to 2500 USD per month for small catalogs. 1500 to 5000 USD per month for mid level or complex catalogs. | Brands with steady ad spend and simple structures. |

| Percentage of ad spend | 10 to 15 percent of monthly ad spend. Some agencies reach 20 percent for complex accounts. | Brands focused on visibility and scalable budgets. |

| Hybrid pricing | A base fee plus a smaller percentage of ad spend. The mix shifts based on catalog depth. | Brands with multiple SKUs or fast growth plans. |

| Setup and onboarding | 500 to 2000 USD as a one time fee. | Any brand starting fresh with new structure. |

| Standard contract minimums | 3 month terms for small brands. 6 to 12 months for advanced accounts. | Brands that want consistent optimization and stable forecasting. |

These benchmarks act as reference points. They help brands decide if a proposal supports visibility, optimization, and profitability at their current stage. They also give you enough clarity to avoid underpriced offers that limit efficiency or overpriced offers that fail to support scalability.

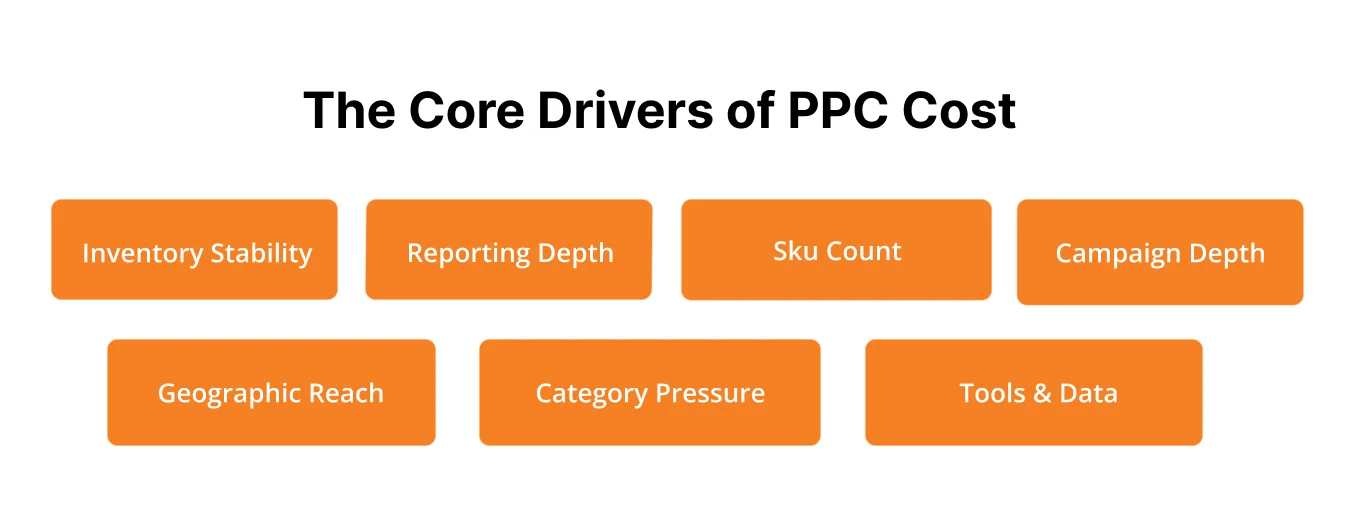

The Cost Variables That Shift Amazon PPC Management Pricing

Amazon PPC works differently than Google or Meta. Every product carries its own performance history. Every keyword reacts to inventory levels, sessions, and conversion rate. Each campaign ties directly to marketplace visibility, not just clicks. That complexity changes the workload behind PPC management. It also shapes how agencies structure their pricing.

These variables explain why brands land in different parts of the benchmark range.

SKU count and catalog complexity

Each SKU brings its own ranking needs, keyword depth, and performance patterns. A two-SKU brand can centralize learning. A fifty-SKU brand cannot. The shift in workload comes from managing many small ecosystems at once, each with its own optimization path and seasonal behavior.

Campaign depth across SP, SB, SD, and DSP

Sponsored Products operate like the engine. Sponsored Brands and Sponsored Display add layers that influence visibility at different stages of the journey. DSP adds an entirely separate logic. Once a brand uses multiple formats, the manager must balance intent, reach, and retargeting across funnels. The work becomes strategic rather than routine.

Category competitiveness and CPC inflation

Some categories respond slowly. Others react within hours. High velocity niches like supplements, beauty, pet care, and electronics shift fast because competitors adjust bids throughout the day. The manager must watch keyword movement, competitor actions, and CPC changes more often. Complexity rises because the window for mistakes becomes smaller.

Geographic coverage across markets

Each marketplace behaves like its own micro-economy. The search terms change. The buyer patterns change. The CPC patterns shift with local competition. Managing multiple regions means the manager runs several environments in parallel. The skill required is not volume but cross-market coordination.

Inventory stability and operational readiness

PPC only works when inventory flow stays healthy. When stock levels drop, the manager must adjust campaigns to protect keyword history and maintain efficiency. When inventory rebounds, campaigns need controlled reactivation. The extra work comes from maintaining stability while avoiding visibility loss during operational swings.

Frequency of optimization and reporting depth

Some brands need weekly tuning. Some need near-daily refinement. The frequency changes the nature of the work. Daily optimization needs tighter time windows, more granular monitoring, and more structured forecasting. Advanced reporting requires deeper insight, not more screenshots.

Tooling and data sophistication

Using basic tools keeps workflows simple. Using advanced analytics, AMC layers, or third-party forecasting tools requires a different skill set. The manager must interpret more signals and merge them into one clear path. The workload increases because the decisions become more informed, not because there are more tasks.

Why these variables matter

Understanding these variables gives you real clarity. You see the work behind PPC execution instead of guessing. You also see why two proposals can be worlds apart even when the ad spend is the same. When you map these variables to your own catalog, you get an accurate sense of what level of management your brand actually needs.

Pricing Benchmarks by Brand Size: What Small, Mid-Market, and Enterprise Sellers Actually Pay

Brands at different stages invest in different levels of PPC management. The shift comes from catalog size, operational maturity, and the type of optimization needed to maintain visibility and profitability. These benchmarks help you understand what similar brands spend and what kind of support comes with each stage.

Small sellers

Small sellers manage tight catalogs with focused objectives. Most pay between 500 and 1500 USD per month for management. Their ad spend sits between 1000 and 5000 USD. At this stage, their focus is on building clean structures, consistent visibility and improving efficiency with Sponsored Products. The brand relies on steady insight rather than aggressive testing because the goal is to build a stable foundation.

Mid-market brands

Mid market brands handle wider catalogs and more daily activity. Their PPC management fees often land between 1500 and 5000 USD per month. Ad spend ranges from 5000 to 50,000 USD. For instance, an agency might charge $975 or 15% of spend (whichever is higher) for monthly ad spend in the $5k–$30k range.

These brands need layered campaign structures, broader keyword coverage, and more frequent optimization. The workload shifts because the brand now balances ranking goals, seasonal shifts, and multi-format campaigns. Maturity also brings a need for clearer forecasting and better protection of existing visibility.

Enterprise advertisers

Enterprise brands run large catalogs with high velocity. Management fees usually start at 5000 USD per month and rise with portfolio size. Ad spend often exceeds 50,000 USD and can scale into six figures. In real terms, a brand spending ~$100,000/month on Amazon ads might pay $10,000–$20,000 management fees.

Enterprise teams need deeper analytics, marketplace coordination, and structured optimization across Sponsored Products, Sponsored Brands, Sponsored Display, and DSP. Their PPC decisions must align with forecasting, inventory flow, and global visibility plans. The workload becomes strategic rather than tactical.

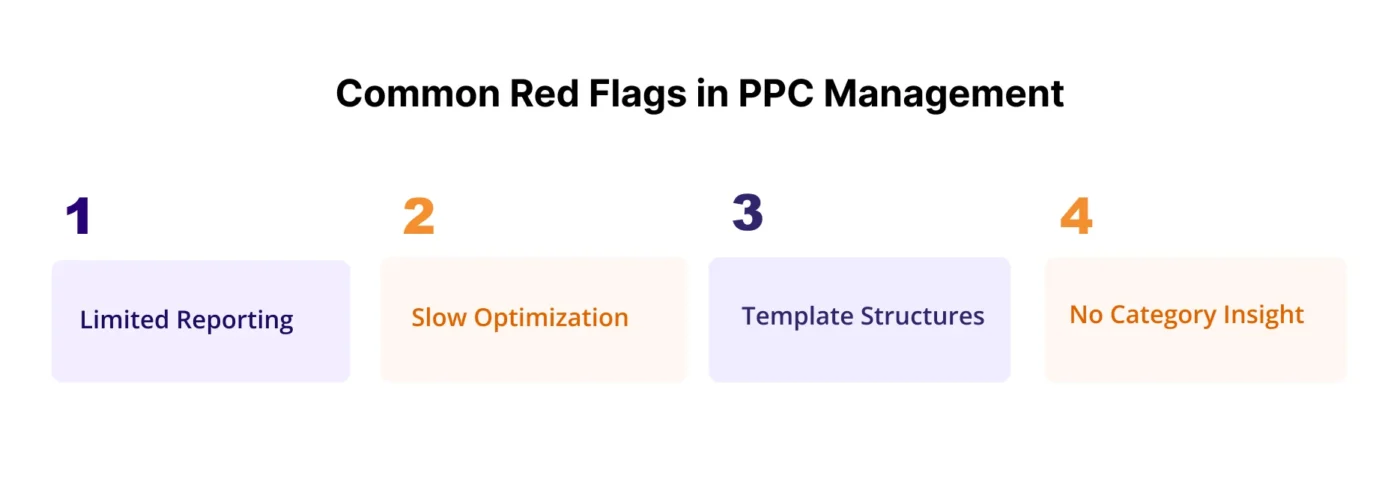

How to Judge Whether an Agency’s Pricing Matches Their Expertise

Pricing only makes sense when you understand the value behind it. Many brands compare proposals without a clear way to judge what each agency truly delivers. This section helps you evaluate Amazon PPC advertising cost with more confidence so you can choose support that strengthens visibility and protects profitability.

Different Agency Tiers

Low tier agencies focus on basic execution. They offer simple setups and minimal optimization. Standard tier agencies balance routine work with strategic planning and maintain steady visibility. Premium tier agencies support deeper insight, cleaner forecasting, and multi-format campaigns. Each tier reflects a different level of operational depth.

Strategy and Insight Influence Cost

Stronger agencies do more than adjust bids. They refine intent based structures. They integrate PPC with inventory flow and margin goals. They run controlled tests that improve long term scalability. This level of planning requires more analysis and more precision. The pricing reflects the quality of these decisions.

Red Flags in Underpriced PPC Management

Some proposals look attractive at first. A closer look reveals gaps. Limited reporting. Delayed adjustments. Templates used for every account. No insight into category shifts. These signals show an agency that reduces workload instead of improving outcomes.

Agency Vs. Market Benchmarks

Start with the scope of work. Compare it to your catalog size and your visibility goals. Look at optimization frequency and the tools used for analysis. Check if the agency offers the level of insight your category needs. When the scope aligns with market norms, the pricing makes sense. You gain clarity and avoid paying for work that does not match your stage of growth.

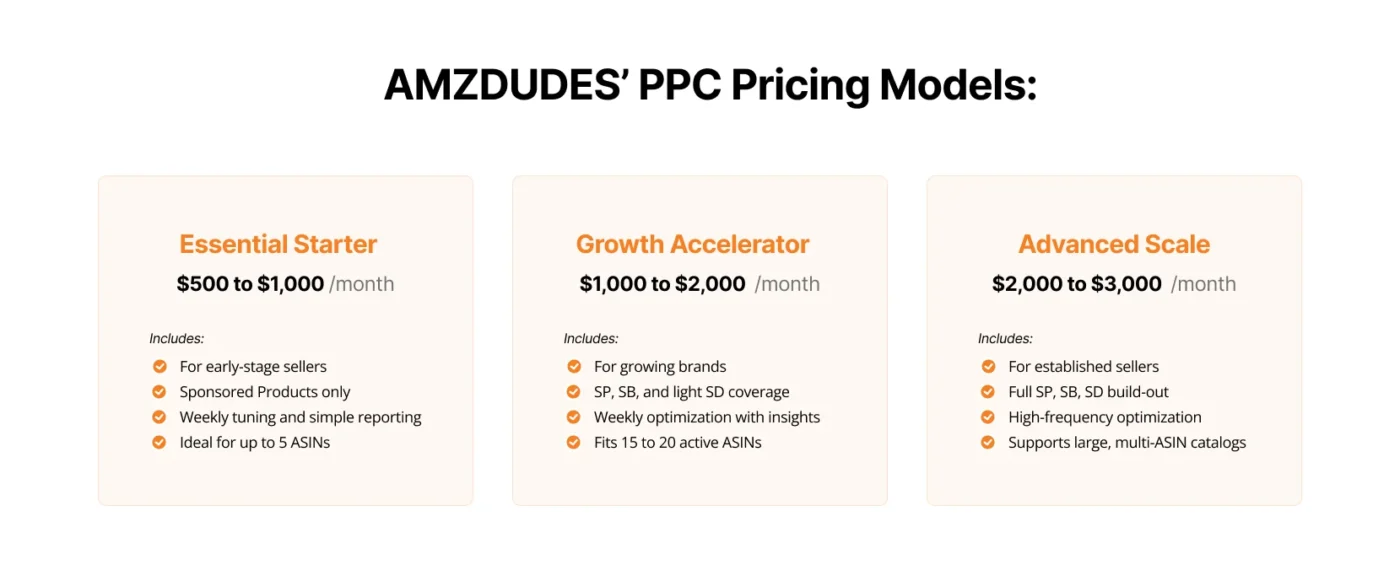

Where AMZDUDES Fits Within These Market Pricing Benchmarks

AMZDUDES sits in the mid to premium range of the market. The Amazon PPC agency pricing reflects the level of strategy, optimization, and account care needed to keep your visibility stable and your growth predictable. Each plan scales with your catalog, your spend, and the insight required to manage your campaigns with precision.

Essential Starter Plan

This plan builds a clean foundation. We set up your account, structure your first campaigns, and keep spend efficient. You get weekly refinement, transparent reporting, and a setup that prepares you for larger campaigns when you are ready.

What You Get:

- Clean initial setup with relevant keywords

- Sponsored Products campaigns built for visibility

- Weekly checks to control waste and improve performance

- Simple dashboards and monthly insight summaries

Growth Accelerator Plan

This plan shifts you from basic management to strategy. Your campaigns expand across more ad types. Your optimization becomes more frequent. Your reporting becomes more actionable. You gain clarity on what drives growth and how to scale it properly.

What You Get:

- Sponsored Products, Brands, and light Display coverage

- Competitor and keyword expansion

- Weekly bid and placement adjustments

- Clear visual reports with recommendations

Advanced Scale Plan

This plan supports full funnel advertising. You get deeper analysis, faster adjustments, and structured experimentation across campaigns. Performance is managed in detail so your growth stays steady and predictable.

What You Get:

- Sponsored Products, Brands, and Display at full depth

- Frequent optimization based on real time performance

- Creative and audience testing for incremental gains

- Advanced reporting and monthly strategy planning

Included in All Plans

Every plan comes with complete account care so your operations and PPC work together.

Account Support: Issue resolution, Buy Box checks, listing recovery, and escalation help.

Inventory Alignment: Restock alerts, sell through insights, and weekly inventory checks.

Listing Optimization: Content audits, keyword improvements, and conversion focused updates.

Reporting and Communication: Weekly summaries, strategy calls, and a dedicated success manager.

Conclusion

Amazon PPC becomes easier to manage when you know how pricing works and what affects it. Once you understand the models, the ranges, and the variables behind each quote, the decision feels clearer. You can choose support that matches your catalog needs and protects your profitability.

AMZDUDES uses this same level of clarity in its Amazon PPC management pricing models. Every plan stays transparent. Every fee reflects the work needed to maintain visibility, precision, and steady growth. Small brands, growing brands, and enterprise teams all get a structure designed around their goals.

If you want a clearer view of what your brand should invest and how to scale with confidence, you can schedule a consultation. We will walk you through the right model for your stage and help you build a plan that supports long term performance.