“Before working with AMZDUDES, our products were on page 5. Within the first two months, their targeted keyword strategy and listing optimization pushed our main products to the top 3 spots. We saw an immediate 40% jump in organic traffic due to which our number of sales is also increasing. Highly recommended Amazon SEO services.”

Amazon 3P Seller Case Study | Managing 21 Brand Accounts Profitably Through Amazon 3P Marketing Strategy & Brand Control

Client Background

The client is an experienced Amazon 3P seller operating as an authorized brand partner, managing 21 brand accounts with Amazon Brand Registry access across multiple categories.

Instead of building a single private label, the business model focused on partnering with established brands and operating their Amazon presence, with full control over Brand Registry assets, listings, and advertising access.

As the designated Brand Registry administrator for each brand, the client maintained full control over Amazon operations, including:

- Catalog Ownership: End-to-end management of listings, parent-child variations, SEO structure, Premium A+ Content, and Brand Stores.

- Amazon Advertising Execution: Management of Sponsored Products, Sponsored Brands, Sponsored Display, and Amazon Marketing Cloud (AMC) for audience targeting and attribution.

- Brand Protection & Pricing Control: MAP enforcement, Buy Box monitoring, and removal of unauthorized resellers impacting pricing and conversion.

As the portfolio scaled to 21 Brand Registry-enabled accounts, operational complexity increased significantly. Each brand had different margin profiles, repeat purchase cycles, ad efficiency thresholds, and inventory constraints.

To support this, the Amazon 3P seller partnered with AMZDUDES to implement a structured Amazon 3P Brand Management and Marketing Strategy, designed to improve AOV, repeat orders, profitability, and operational control across the entire portfolio.

Challenge: Scaling a 3P Brand Portfolio Without Losing Control or Margin

The seller operated as an authorized Amazon 3P partner with Amazon Brand Registry access across multiple brands. While the portfolio was already generating revenue, scaling introduced operational complexity and margin pressure typical of multi-brand Amazon 3P businesses.

Key challenges included:

1. Brand Onboarding Inefficiency

Brand outreach relied on standard presentations that did not clearly communicate a differentiated Amazon growth strategy. Without a data-backed narrative around Amazon PPC efficiency, brand control, MAP enforcement, and margin protection, securing exclusive or long-term 3P partnerships with high-quality brands became more difficult.

2. Fragmented Amazon Execution

Amazon SEO, Amazon PPC, pricing, inventory planning, and account health were managed as separate functions across brands. This limited operational leverage across the portfolio and contributed to inconsistent IPI (Inventory Performance Index) scores, uneven Buy Box stability, and missed opportunities to apply proven strategies across multiple brand catalogs.

3. Declining Margins at Higher Scale

Advertising spend scaled alongside revenue, but TACoS gradually increased. A heavy reliance on low-AOV SKUs without structured Virtual Bundles, pack sizes, or tiered pricing reduced contribution margins, making growth increasingly dependent on higher ad spend rather than improved unit economics.

4. Weak Repeat Purchase Economics

Sales growth was driven primarily by first-time purchases. Subscribe & Save adoption remained low, and there was no structured retargeting of high-intent shoppers such as detail page viewers or past buyers. This limited customer lifetime value and increased dependence on continuous top-of-funnel acquisition.

5. Limited Amazon Advertising

Amazon PPC strategy focused mainly on manual keyword targeting. Limited use of Amazon Marketing Cloud (AMC) meant New-to-Brand customers were not evaluated by long-term value, and high-ROAS audience segments for retargeting and lifecycle advertising were underutilized.

6. Unauthorized Resellers and Buy Box Instability

Unauthorized resellers were listing products across multiple brand catalogs, creating Buy Box instability and pricing conflicts. This reduced price control, weakened brand positioning, and negatively impacted PPC conversion rates as traffic leaked to lower-priced offers.

7. Unrecovered FBA and Inventory Losses

As operations expanded, recoverable revenue was lost through unclaimed FBA reimbursements, inefficient restocking cycles, inbound placement fees, long-term storage costs, and delayed repricing, profitability declined quietly month over month despite increasing sales.

Strategy: Amazon 3P Management Framework

1. Brand Outreach Strategy

We redesigned brand outreach by repositioning the seller from a typical Amazon reseller (wholsale) to an authorized Amazon brand partner focused on brand control, listing ownership, and revenue recovery.

Instead of cold inventory pitches, outreach led with Amazon-specific problems brands already recognized: unauthorized sellers, Buy Box loss, price erosion, and broken listings.

The audits focused on issues brands immediately recognized:

- Branded keyword loss (Share of Voice): Competitors and unauthorized sellers ranking on branded terms and capturing Sponsored Brand placements.

- Buy Box loss and Price Erosion: Buy Box analysis quantified revenue loss caused by unauthorized sellers undercutting MAP and diverting sales.

- Listing and Catalog Issues: Duplicate ASINs, split reviews, incorrect brand names, and reseller-created listings hurting conversion and organic rank.

The pitch deck reframed the conversation from wholesale pricing to owning the Amazon channel. As a result, the seller transitioned from a transactional supplier to a long-term Amazon operating partner, with brands granting full Brand Registry control in exchange for clean listings, protected pricing, and scalable Amazon growth.

2. Amazon Portfolio Management for 21 Brands

All brands operated under the same rules for catalog structure, Amazon SEO, advertising execution, and reporting, eliminating ad-hoc decisions and enabling learnings from one brand to be deployed across the entire portfolio.

- Parent–child variation standardization: Rebuilt variation structures to prevent review fragmentation, split rankings, and suppressed conversion rates.

- Catalog ownership and hygiene enforcement: Removed duplicate ASINs and reseller-created listings to consolidate reviews, sales velocity, and indexing under the authorized catalog.

- Unified Amazon SEO framework: Standardized backend search terms, root keyword indexing, and title/bullet optimization across all brands.

- Consistent Amazon Ads Structure: Deployed Sponsored Products, Sponsored Brands, and Sponsored Display using shared naming conventions, bidding logic, and testing rules to maintain control as spend scaled.

- Centralized data and reporting: Aggregated Brand Analytics and Amazon Marketing Cloud (AMC) data at the portfolio level to track audience overlap, category risk, and performance trends in real time.

3. Improved Margin Through AOV and Catalog Optimization

Using Amazon Brand Analytics and Market Basket Analysis, we evaluated customer purchasing behavior across the Amazon portfolio to identify where Amazon PPC spend was driving revenue without contribution margin.

Amazon Catalog & AOV Optimization Actions:

- Market Basket Analysis at scale: Identified ASINs frequently bought together but sold as single units, revealing missed Average Order Value (AOV) and margin expansion opportunities.

- Virtual bundles and multipacks launched: Deployed Amazon Virtual Bundles and multi-pack offers to increase AOV without additional inventory, FBA prep, or operational complexity.

- Low-margin SKU PPC spend reallocated: Flagged low contribution-margin SKUs consuming ad budget and reduced exposure in Sponsored Products, Sponsored Brands, and Sponsored Display campaigns.

- Hero ASIN and bundle prioritization: Reallocated Amazon PPC budgets toward hero ASINs and bundle purchase paths with the highest profit per order, not just highest conversion rate.

- Intent-based SKU role definition: Positioned single-unit SKUs as customer acquisition entry points, while bundles and multipacks were optimized for margin expansion and profitability.

This approach increased order value without increasing customer acquisition costs. Advertising spend stopped “buying volume” and instead supported margin-positive growth, allowing the portfolio to scale profitably as ad spend increased.

4. Lifecycle & Retention Strategy (Customer Lifetime Value)

Growth was extended beyond first-time purchases by implementing a portfolio-wide Amazon retention and subscription strategy focused on repeat purchase behavior and Customer Lifetime Value (LTV).

Retention & LTV Actions Implemented:

- Repeat Purchase Behavior analysis: Used the Repeat Purchase Behavior report to identify SKUs with consistent reorder patterns and strong repeat purchase signals across categories.

- Subscribe & Save (SnS) expansion: Enrolled high-repeat SKUs into Subscribe & Save with controlled, tiered discounts (5%–10%) to improve retention while protecting contribution margin.

- First-order subscription conversion: Applied Amazon Lead-In Coupons to encourage first-time buyers to start subscriptions early in the customer lifecycle.

- Post-purchase subscription audience targeting: Built audiences of past purchasers who completed a one-time purchase without enrolling in Subscribe & Save and re-engaged them with subscription-led offers to increase repeat orders and LTV.

This shifted revenue from single-order dependency to predictable repeat demand, increased Customer Lifetime Value (LTV), and reduced reliance on rising acquisition costs as the portfolio scaled.

5. Audience-Based Advertising Using Amazon Marketing Cloud (AMC)

Amazon advertising was expanded from keyword-only targeting to audience-based targeting using Amazon Marketing Cloud (AMC) to to target shoppers based on verified purchase behavior, engagement signals, and ad exposure history.

AMC Audience Strategy Implemented:

- Finding and scaling high-value customers: Identified customers who historically spent more across the catalog and used AMC to reach similar shoppers, improving new customer acquisition quality instead of just increasing traffic.

- Re-engaging interested shoppers who didn’t buy: Targeted shoppers who showed clear interest but left without purchasing, including those who viewed product pages multiple times, added items to cart, saved products, read reviews, or clicked ads without converting.

- Reducing wasted ad exposure: Adjusted ad frequency so interested shoppers saw ads enough to convert, while shoppers repeatedly exposed without action were shown fewer ads to avoid fatigue and wasted spend.

- Reconnecting during peak buying periods: Re-engaged shoppers who had seen the brand during slower periods and brought them back during high-intent moments like Prime Day and holiday events.

- Encouraging subscriptions from repeat buyers: Targeted customers who had already purchased but hadn’t enrolled in Subscribe & Save, helping convert one-time buyers into repeat customers with higher long-term value.

6. Profit Protection & Operational Control

Revenue growth was paired with operational controls to prevent margin leakage across the portfolio. This strategy focused on three primary risk areas that impact net profit as scale increases: unrecovered FBA reimbursements, fulfillment fee inefficiencies, and stock-related Buy Box loss.

Actions Implemented:

- FBA reimbursement recovery: Performed an 18-month rolling audit of lost, damaged, and destroyed inventory to identify unreimbursed FBA cases and recover unclaimed funds.

- Inbound placement and fulfillment fee optimization: Reworked shipping plans to reduce inbound placement fees, unnecessary split shipments, and excess per-unit fulfillment costs as volume scaled.

- Restock forecasting and in-stock rate control: Implemented demand-based restock planning to maintain 85%+ in-stock rates on priority ASINs, protecting Buy Box ownership, organic rankings, and Amazon PPC efficiency.

Operational profit leakage was reduced as revenue scaled. Recovered reimbursements, lower fulfillment costs, and consistent in-stock availability ensured margin stability, Buy Box continuity, and predictable advertising performance at higher volume.

Results: Revenue Growth After Brand Control & Full Amazon Management

Revenue growth followed the establishment of brand authorization, Brand Registry administrator access, and full Amazon channel control across the portfolio.

Once brands granted official authorization, execution shifted from fragmented seller activity to end-to-end Amazon account management, including catalog ownership, pricing control, advertising eligibility, and operational oversight.

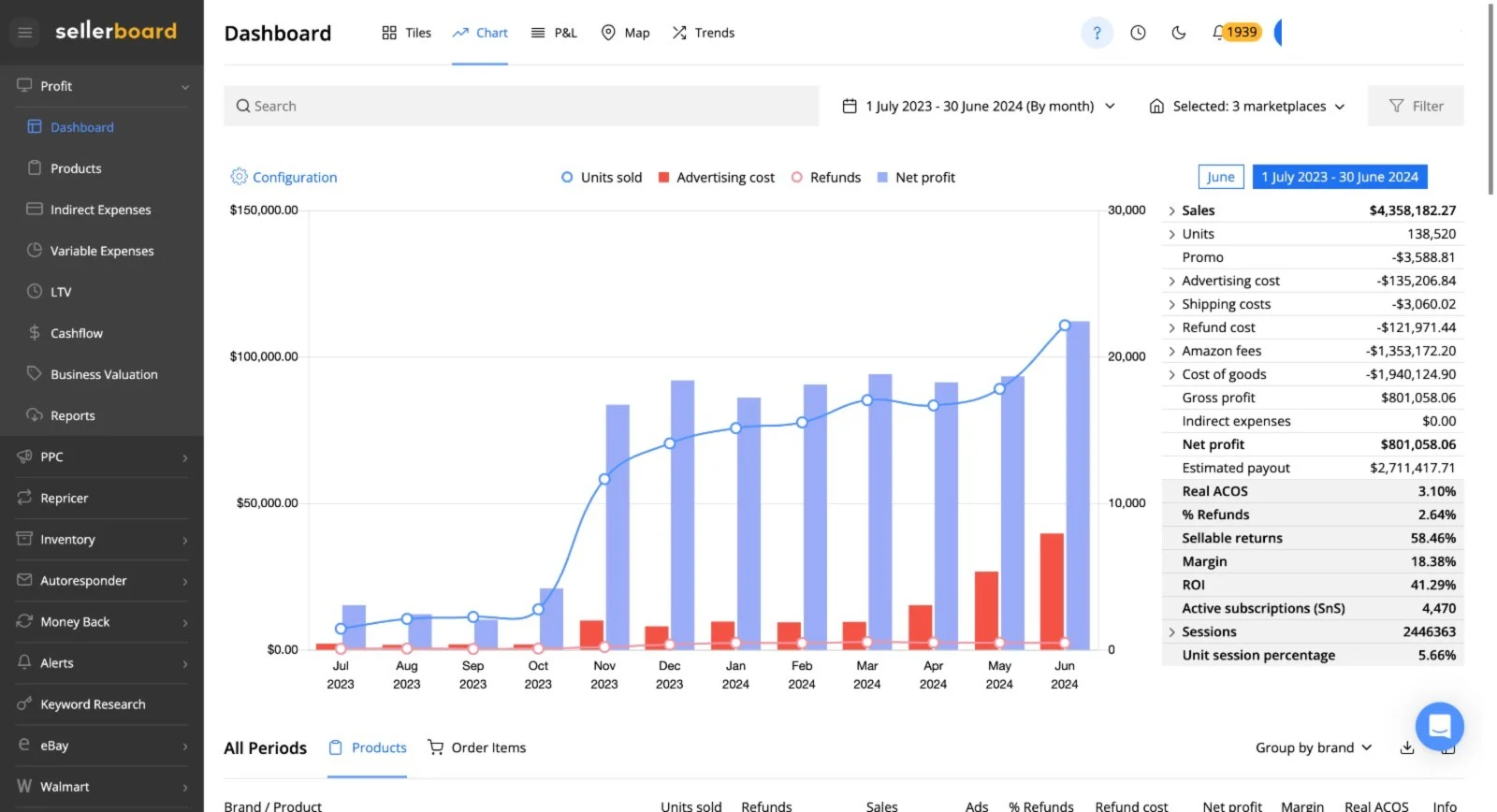

1. Amazon Revenue Performance (First 12 Months)

Over the 12 months, the managed Amazon portfolio generated $7.72M+ in ordered product sales from 240,474 units sold across 225,706 order items, with an average order value (AOV) of $34.24. Sales scaled consistently month over month without margin collapse.

Sales picked up in Q4 once brand partnerships were in place through Amazon Brand Registry. After unauthorized sellers were removed, the Buy Box stabilized, pricing came under control, and listings were cleaned up, Amazon PPC could finally scale on brand-owned catalogs without disruption.

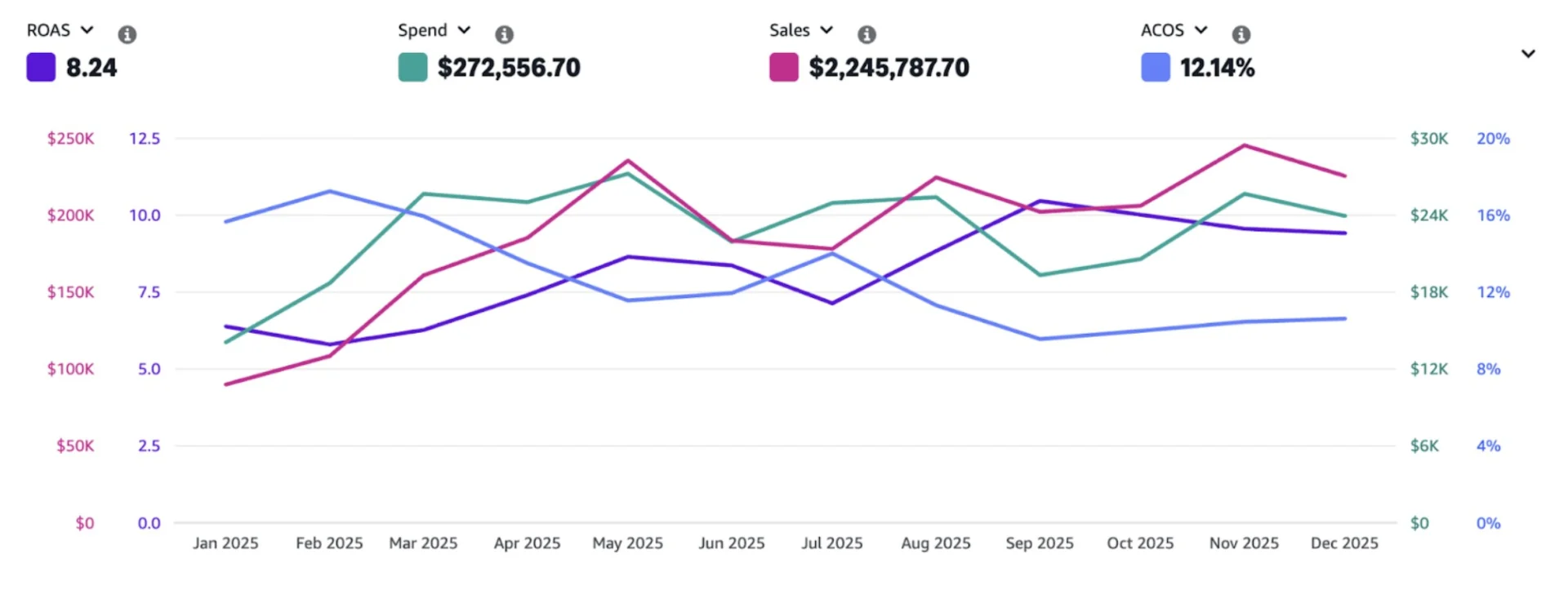

2. Amazon Advertising Performance (Last 12 Months)

Over the last 12 months, Amazon Ads generated $2.24M in sales on $272K in ad spend, delivering a ROAS of 8.24 and ACOS of 12.14%. As spend increased, efficiency stayed consistent, showing that ads were driving real demand—not covering up listing or Buy Box problems.

Once listings were cleaned up and unauthorized sellers were removed, ads consistently ran on brand-owned listings. Traffic stopped leaking to competitors, conversion rates stabilized, and every additional dollar in ad spend translated into profitable sales.

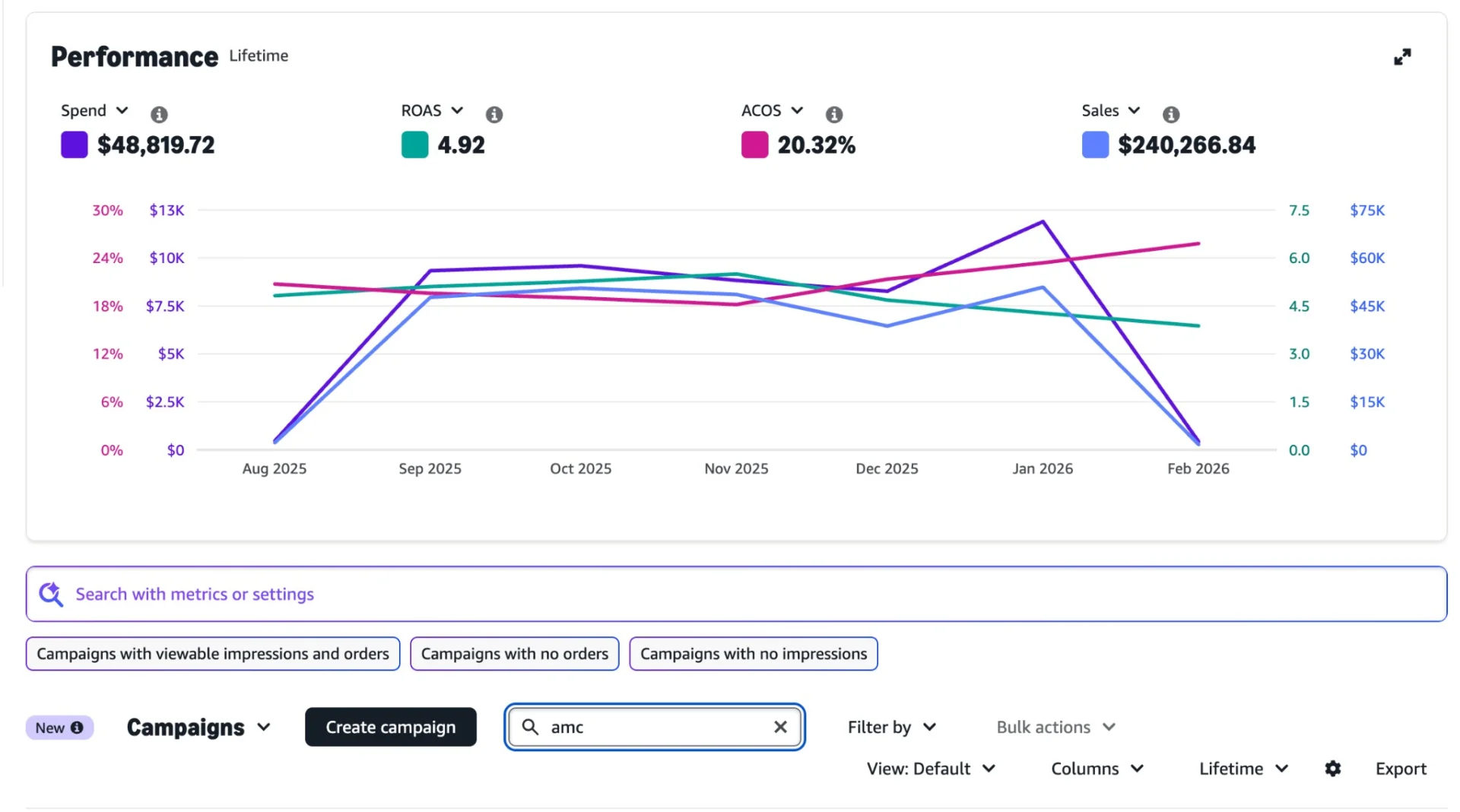

3. Amazon Marketing Cloud (AMC) Results

The audience-based approach defined in the AMC strategy translated into measurable performance once campaigns shifted from keyword-only targeting to behavior- and lifecycle-based audiences.

Across the measured period, AMC-driven campaigns generated $240,266 in ad-attributed sales on $48,819 in spend, delivering a ROAS of 4.92 with an ACOS of 20.32%.

Results reflected the impact of targeting high-value customers, missed-conversion audiences, repeat purchasers, and non–Subscribe & Save buyers, rather than expanding reach through broad keyword coverage. Spend scaled during peak periods while efficiency remained within a controlled range, indicating demand capture from qualified shoppers instead of low-intent traffic.

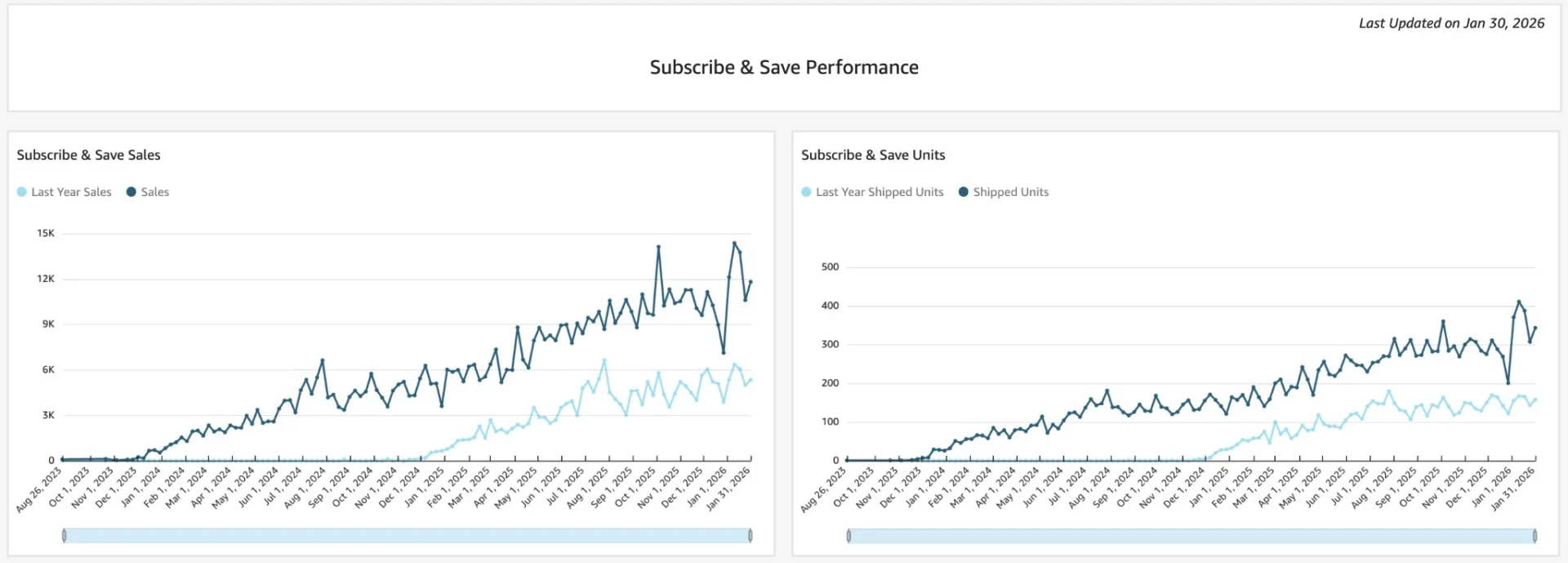

Subscribe & Save Results (Retention & LTV)

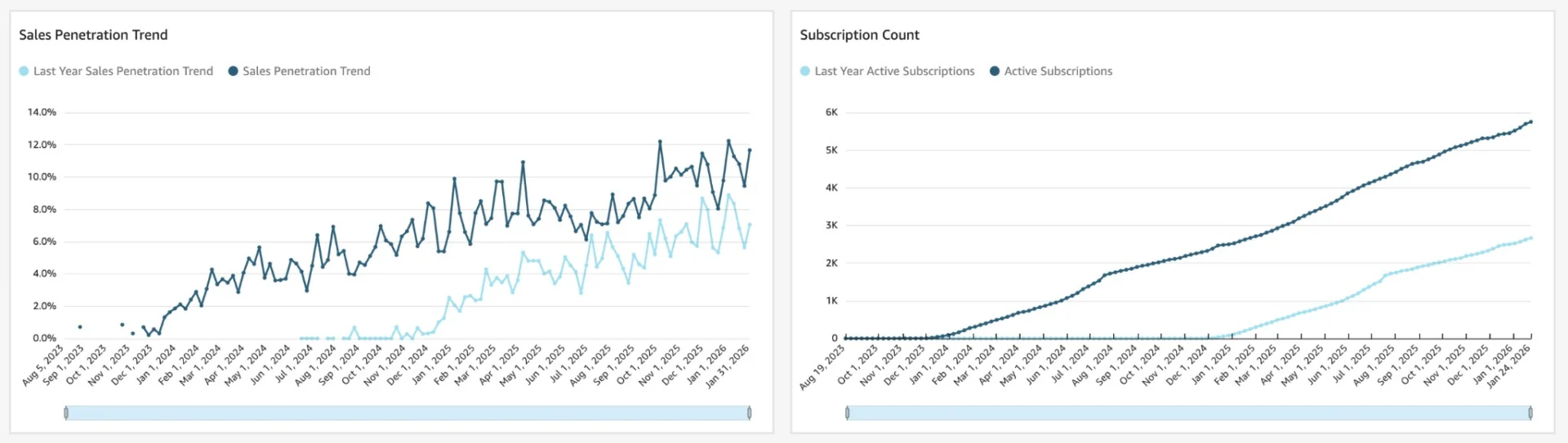

By identifying SKUs with strong reorder signals and enrolling them into Subscribe & Save with controlled discounts, monthly subscription revenue scaled to $10K–$14K, with 300–400+ units shipped per month, confirming sustained repeat demand without margin erosion.

The highest subscription growth was recorded during peak season, when aggressive first-order Subscribe & Save coupons were deployed to capture high-intent demand. These lead-in offers converted seasonal first-time buyers into long-term subscribers, allowing the business to capitalize on peak traffic while locking in future repeat orders beyond the promotional window.

As a result, Subscribe & Save penetration increased to ~10–12% of total sales, shifting a meaningful portion of revenue into recurring orders. Active subscriptions surpassed 5,000, more than doubling year over year, creating a growing base of predictable future demand.

FBA Reimbursement Recovery Results

From Jan–Dec 2025, total reimbursement recovery reached $151,878.53 across the portfolio, averaging ~$12.7K per month in recovered profit that would have otherwise remained unclaimed.

Recoveries were consistent throughout the year, with peak months in June ($24,728.29), August ($18,441.75), and September ($17,473.21). Even lower-volume months still produced meaningful recoveries, confirming this was a repeatable process rather than a one-time cleanup.

All reimbursements were handled manually by the internal team using in-house–built tracking tools, not third-party reimbursement software. This avoided the 20–25% recovery fees typically charged by external services, allowing 100% of recovered funds to flow directly back into net profit.

Conclusion

This case study shows how a multi-brand Amazon 3P business scaled 21 brand accounts profitably once control over listings, pricing, advertising, and operations was established.

With those controls in place:

- The portfolio generated $7.72M+ in Amazon revenue in 12 months from 240,474 units sold

- Amazon advertising produced $2.24M in sales on $272K spend at 12.14% ACOS, with efficiency holding as spend increased

- Amazon Marketing Cloud added $240K+ in sales by targeting repeat buyers and high-intent shoppers instead of broad keyword traffic

- Subscribe & Save scaled to $10K–$14K in monthly revenue, 300–400+ units per month, ~10–12% sales penetration, and 5,000+ active subscriptions

- $151,878.53 was recovered through FBA reimbursements using an internal process, with no third-party fees deducted

Growth shifted away from dependence on first-time purchases and increasing ad spend. More revenue came from repeat orders, subscriptions, and ads running on brand-owned listings with stable pricing.

For Amazon 3P sellers managing multiple brands, this shows that ads and retention start working only after listings are owned, pricing is stable, and daily operations are under control.

Ready to Scale Your Amazon Portfolio?

If you’re an Amazon brand owner, brand manager, or 3P seller facing unpredictable sales and reactive Amazon PPC management, it’s time to build a structured Amazon growth system.

Most Amazon sellers treat Amazon PPC, listing optimization, and customer data as separate functions. As a full-service Amazon marketing agency, AMZDUDES brings them together into a unified Amazon growth strategy.

We don’t just optimize campaigns or rewrite listings. We interpret Amazon data, identify structural gaps, and redesign how your brand is discovered, converted, and retained through Amazon advertising and organic growth.

What We Help You Achieve on Amazon

We help Amazon brands:

- ✔ Improve Amazon listing SEO and conversion rate to increase organic visibility

- ✔ Scale Amazon PPC campaigns with controlled ACOS and sustainable ROAS

- ✔ Acquire high-intent New-to-Brand customers Amazon can attribute and verify

- ✔ Increase Subscribe & Save adoption to build recurring revenue streams

- ✔ Leverage Amazon Marketing Cloud (AMC) to target and retarget high-intent shoppers

- ✔ Strengthen customer retention and lifetime value through repeat purchase strategies

Instead of relying on guesswork or short-term ad spikes, we apply the same Amazon growth framework used in this case study, designed for brands that want predictable, scalable, and profitable Amazon growth.

Book a Free Amazon Growth Strategy Call

Let’s review your Amazon listings, PPC campaigns, and customer data to identify growth opportunities and build a roadmap for sustainable scaling.